[ad_1]

DeFi not solely attracts main expertise and curiosity but additionally massive sums of cash within the type of digital belongings. The variety of corporations on this sphere is continually rising however let’s take a look at probably the most distinguished of them.

There’s no time like the current to speak about DeFi.

Quick for “decentralized finance,” this buzzword merely refers to creating standard monetary providers (like loans or credit score) accessible by way of cryptocurrency and blockchain know-how. It’s a distinct segment throughout the cryptocurrency area of interest, however don’t let that counsel that it’s a standstill or unremarkable subject.

DeFi not solely attracts main expertise and curiosity but additionally massive sums of cash within the type of digital belongings like Bitcoin, Ethereum, and past. The place human technical capability meets our altering wants and expectations of monetary providers, DeFi is being born.

There are a selection of corporations making thrilling or significant strikes right here, however we’ve got picked ten of probably the most noteworthy in order that we’d study them extra carefully. Let’s get aware of these ten impactful corporations.

Airswap

It’s a decentralized buying and selling platform. Counting Joseph Lubin and Mike Novogratz amongst its advisory staff, Airswap gives the answer for merchants to execute transactions by way of sensible contracts with out the change retaining custody of these funds.

Decentralized exchanges are seeing more and more excessive demand in mild of quite a few profitable hacks in opposition to bigger centralized exchanges. A decentralized strategy like AirSwap is much less susceptible to hacks and theft, finally bettering the house’s repute and folks’s belief in it, facilitating adoption worldwide.

Equilibrium

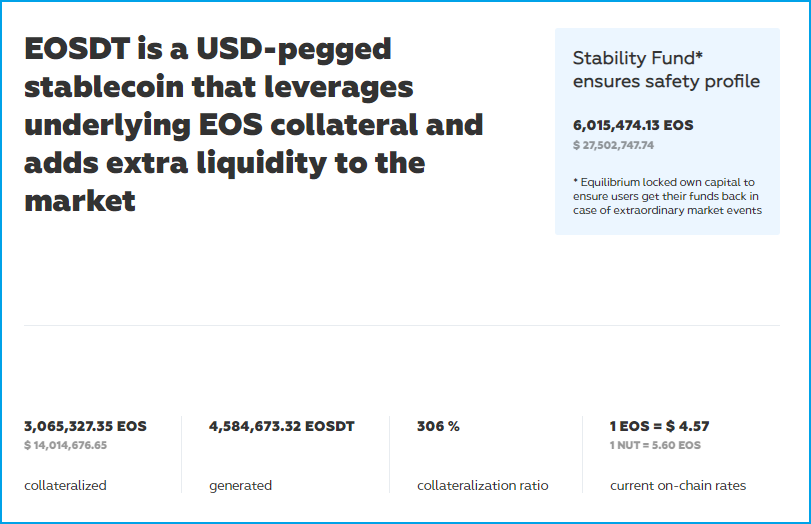

It’s a DeFi growth framework that comes with its personal stablecoins. Equilibrium is a multichain framework for crypto-backed stablecoins and DeFi merchandise.

Its first stablecoin product is EOSDT, pegged to USD and backed by EOS collateral. It’s arguably probably the most stable EOS stablecoin undertaking available on the market.

In December 2019, Equilibrium introduced the launch of a $17.5 million Stability Fund to as an insurance coverage coverage for EOSDT token holders, paying out robotically if the collateral backing the dollar-pegged token crashes by way of its collateralized flooring.

The staff actively helps DeFi philosophy and training: in November 2019, they held their first Crypto DeFi occasion in Singapore together with BlockShow.

Augur

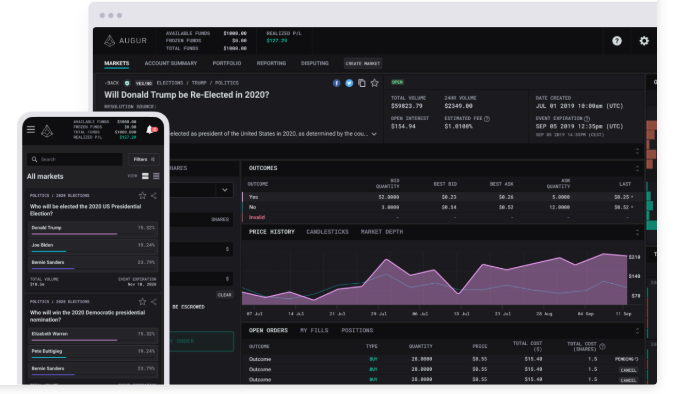

Augur is a decentralized prediction platform.

Whereas the first software for decentralized prediction is betting, the know-how behind Augur may also be utilized in finance, scientific analysis, governance, and extra. Its know-how can harness knowledge from the crowds in conditions that often depend on predictions by a small group of consultants.

MakerDAO

This undertaking is about producing stablecoins.

MakerDAO is the de facto title within the DeFi house, greatest identified for creating the protocol behind the DAI stablecoin. Positioning itself as a decentralized, unbiased forex, MakerDao provides some great benefits of digital cash with none related volatility due to superior mechanisms that keep worth stability.

The staff not too long ago launched some thrilling upgrades and new options. MakerDao is actively taking part in constructing the ecosystem, partnering up with a number of gamers throughout the DeFi house.

Compound Finance

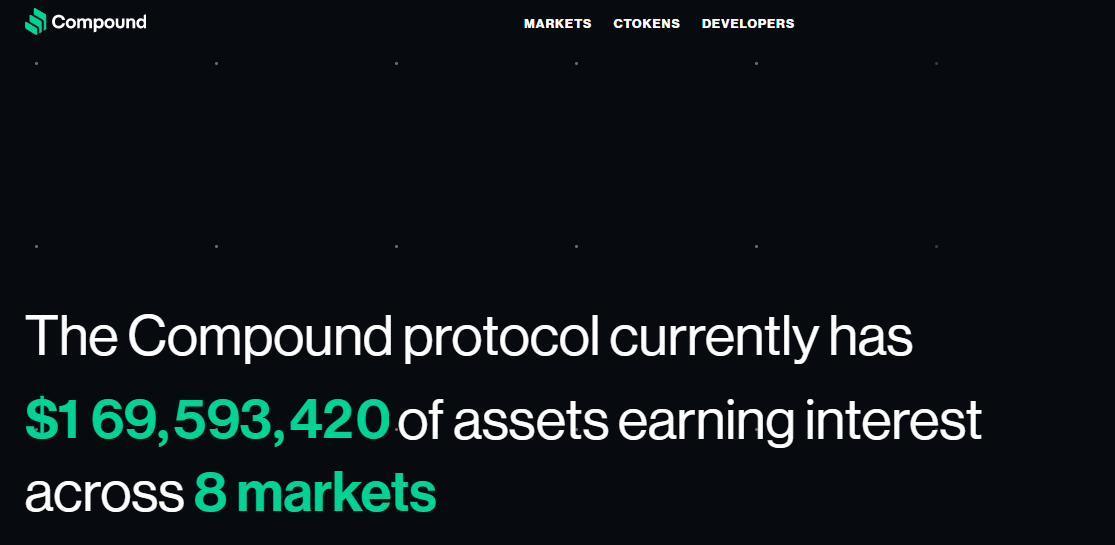

It’s a decentralized lending platform.

Compound Finance is likely one of the most actively used merchandise within the house that allows decentralized peer-to-peer lending and borrowing for digital belongings. Theirs is an alternate answer to the issue of taking out costly loans from a financial institution, or letting banks benefit from your deposits to mortgage different folks cash at excessive rates of interest.

Debtors and lenders don’t have to barter with one another or anybody else. They as a substitute provide or borrow digital belongings straight from the protocol. Asset suppliers earn rates of interest instantly and get the chance to commerce the time worth of digital belongings.

Dharma

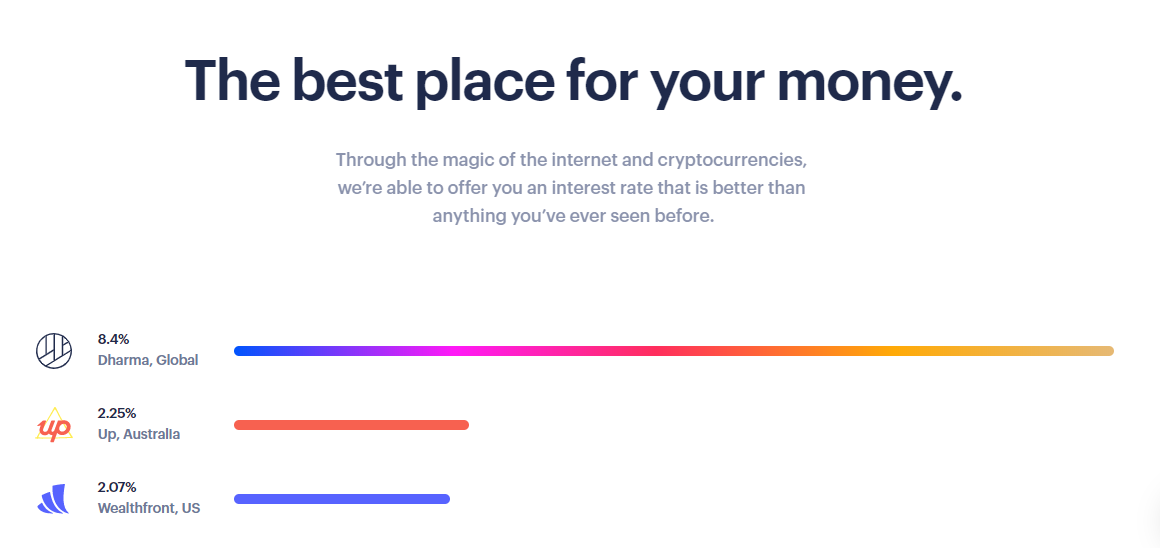

Dharma is a decentralized lending and remittance platform.

It permits for the creation and buying and selling of tokenized lending merchandise of any sort, from common client loans to company bonds.

Initially offering fastened rates of interest for fastened durations, Dharma introduced it will make these parameters versatile and wouldn’t require customers to lock up their funds. Dharma launched the brand new product — stablecoin financial savings accounts ‚ and a partnership with Compound Finance, one other vital participant in decentralized lending.

Harbor

Harbor is a digital securities platform. Bridging conventional capital markets along with the potential of blockchain know-how, Harbor gives corporations with a variety of providers: issuing asset-backed digital securities, cap desk administration, streamlined digital dividends distributions, and extra.

To make sure full regulatory compliance, Harbor leads its monetary actions from its FINRA-registered broker-dealer and SEC-registered switch agent subsidiaries. The corporate has made a powerful entry into the worldwide economic system: in November 2020 Harbor introduced that iCap Fairness is utilizing its platform to “improve the liquidity in 4 actual property funds managing over $100M in belongings.”

Notable buyers in Harbor embrace Andreessen Horowitz and Pantera Capital.

MetaMask

MetaMask makes wallets and lets customers make Ethereum transactions utilizing common internet browsers.

The service bridges the hole between industry-specific interfaces and the web sites everyone seems to be accustomed to utilizing every day. This accelerates the adoption of digital belongings.

0x

0x is a decentralized change protocol that enables for the event of scalable decentralized buying and selling infrastructure. Mainly: customers can construct their very own crypto exchanges on high of it.

Having obtained a diploma in Intercultural Communication, Julia continued her studies taking a Master’s degree in Economics and Management. Becoming captured by innovative technologies, Julia turned passionate about exploring emerging techs believing in their ability to transform all spheres of our life.

[ad_2]

Source link