[ad_1]

Over the last week of November, the stablecoin financial system had crossed the $150 billion mark for the primary time with tether and usd coin dominating the pack. In a mere ten days, the stablecoin financial system gathered one other $11 billion in worth with origin greenback and terra usd swelling considerably over the last 30 days.

$11 Billion Added to the Fiat-Pegged Token Financial system

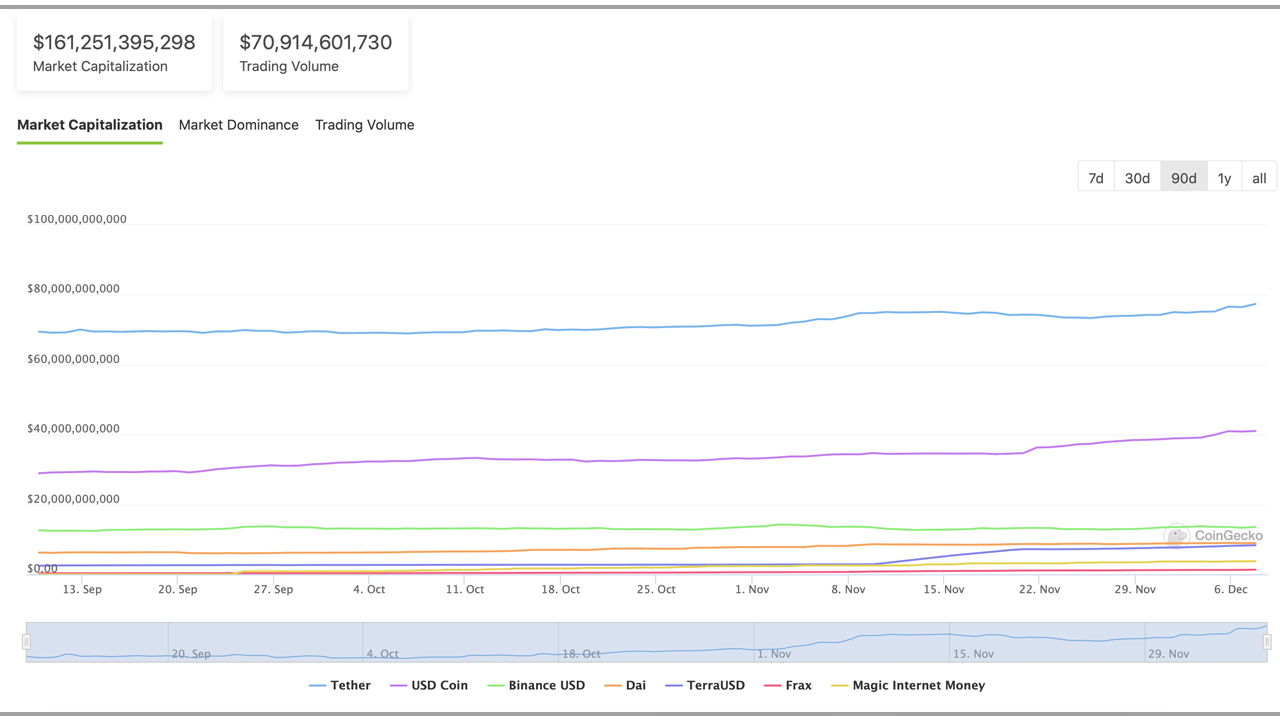

Stablecoins are positively a outstanding a part of the crypto business whether or not folks like them or not. In ten days’ time, the complete stablecoin financial system has grown 7.33% bigger from $150 billion to in the present day’s $161.2 billion.

Month after month, stablecoin markets have swelled, and the token tether (USDT) is the most important stablecoin by way of market valuation. Statistics point out that USDT has a market valuation of round $77.Three billion and its market cap grew 6.1% over the last month.

Usd coin (USDC) is the second-largest stablecoin in the present day with a market valuation of round $41 billion. USDC’s market cap grew by a large 19.5% over the last 30 days. The combination of USDT and USDC mixed is 4.75% of the complete crypto financial system.

By way of the stablecoin financial system alone, the 2 tokens USDT and USDC command 73.21% of the combination $161 billion in fiat-pegged tokens. Whereas tether captures a lot of the commerce quantity, USDC instructions the third-largest stablecoin commerce quantity beneath BUSD.

Terra and Origin Stablecoin Issuance Balloons Over the Final Month

Terra’s stablecoin UST has seen the most important improve within the high ten stablecoin markets over the last 30 days, with its market cap rising by 190%. A month in the past, Terra’s UST market cap was solely $2.88 billion.

The algorithmic stablecoin UST has a valuation of round $8.Three billion in the present day and $178 million in international commerce quantity. UST’s market capitalization is just under DAI’s $8.95 billion valuation. The Terra-issued algorithmic stablecoin can be above Abracadabra.cash’s magic web cash (MIM) and its $3.7 billion market.

The yield-earning stablecoin origin greenback (OUSD) issued by Origin Protocol (OGN) has risen a whopping 721% over the last 30 days. OUSD has an general market valuation of round $226.5 million and $2.7 million in commerce quantity. The stablecoin instructions the 15th largest dollar-pegged digital asset valuation in the present day.

Different stablecoins that noticed notable 30-day actions embody frax, pax greenback, and liquity usd. Along with fiat-pegged tokens tied to the worth of USD, a slew of stablecoins based mostly on totally different fiat currencies, just like the euro and Turkish lira, have seen vital 30-day development as effectively.

What do you consider the stablecoin financial system over the past ten days and UST and OUSD development this previous month? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Coingecko.com,

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link