[ad_1]

As we speak, on April ninth, BTC worth began to develop once more however now it’s barely falling. Nevertheless, Bobby Lee believes that Bitcoin should renew its all-time peak by the top of this yr and proceed to 25,000 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

Bitcoin is mostly buying and selling at round 7260 USD at this time. The gross sales of the final two days have been localized, and the market is clearly making its thoughts concerning the subsequent step.

- Tech evaluation of Bitcoin worth adjustments.

- The BTC price will rise to 25,000 USD. – Bobby Lee

- Miners’ earnings has decreased by 25%.

On W1, the Bitcoin is growing correctional development after a wave of declining. The downtrend, in addition to the overall market temper, stays bearish. The goal of the principle pattern is the fractal low of 3121.90 USD. The resistance degree is 8500.00 USD. The declining dynamics of the MACD and Stochastic affirm additional lower.

Photograph: Roboforex / TradingView

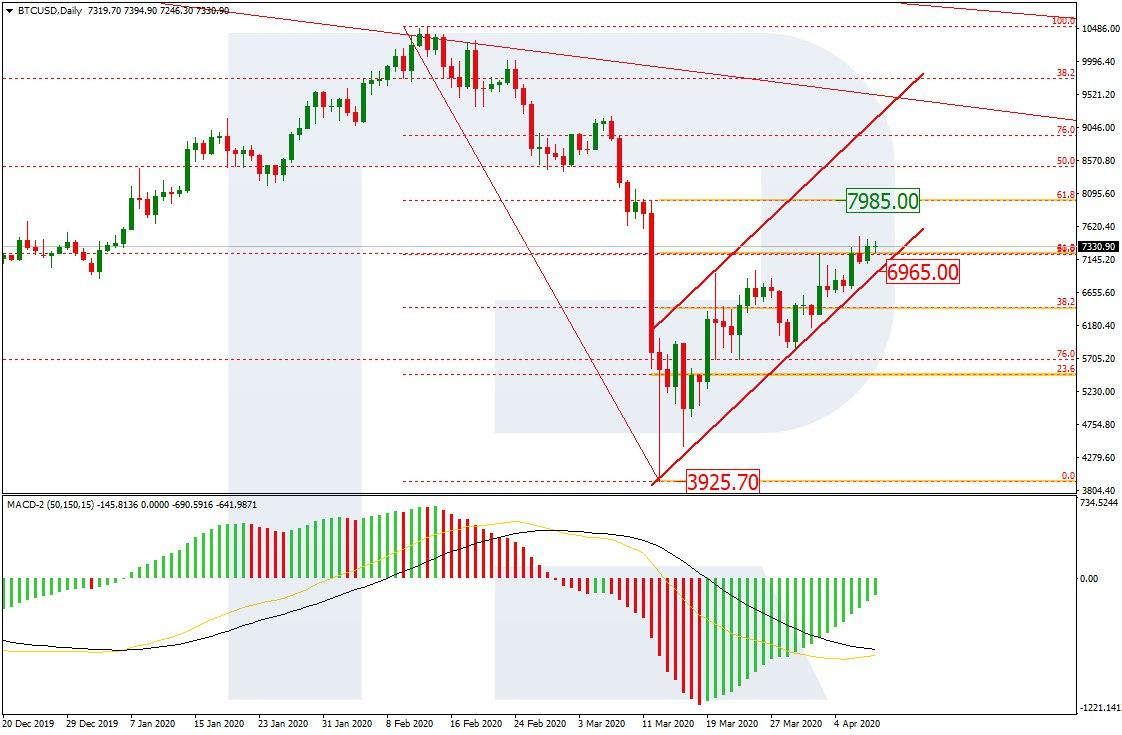

On D1, the correctional uptrend has considerably slowed down upon reaching 50.0% Fibo. The subsequent goal of the expansion is 61.8% (7985.00 USD). A breakaway of the present help degree of 6965.00 USD will sign a decline to the low of 3925.70 USD; the MACD traces aimed downwards forecast additional declining.

Photograph: Roboforex / TradingView

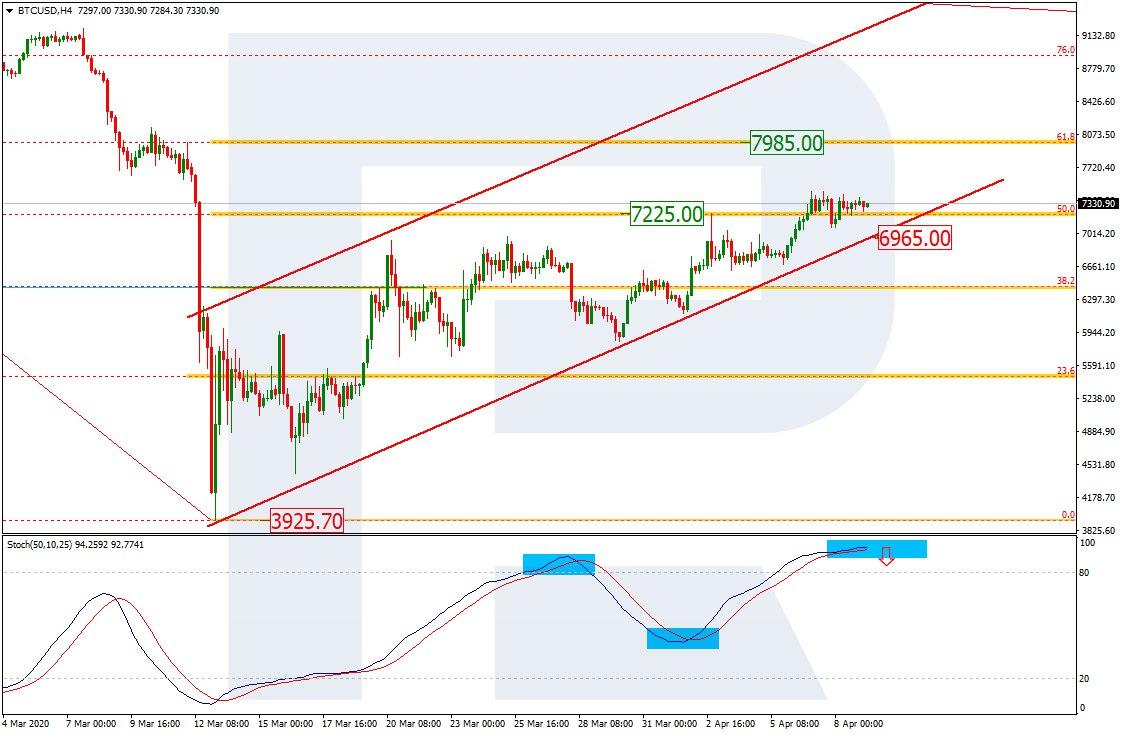

On H4, the ascending is offered in additional element, the quotations are transferring alongside the help line. Nevertheless, the Stochastic within the overbought space, making ready a Black Cross, appears alarming. This sign, mixed with a breakaway of the help line, will imply the top of the correctional section.

Photograph: Roboforex / TradingView

Based on the top of Bitcoin Basis Bobby Lee, the BTC worth should renew its all-time peak by the top of this yr and proceed to 25,000 USD. As the important thing issue of the expansion, Lee suggests the halving. This can be first such response on a lower of the reward for mining.

Lee states that the halving will increase the BTC price. Furthermore, he doesn’t exclude the likelihood that the value of the main cryptocurrency might rise because of an influx of traders, dissatisfied by primary property and seeing a possible of security in cryptocurrencies.

In March, customers mining cryptocurrencies earned 380.1 million USD on the BTC. That is 25% lower than they managed to earn in February. The supply talked about that the cash mined may very well be bought straight away, whereas their worth fashioned primarily based on the closing worth of the each day candlestick.

In 2019, the general miners’ revenue was estimated at 5 billion USD. That yr, probably the most profitable month was July, when miners earned about 650 million USD.

Disclaimer: Any predictions contained herein are primarily based on the authors’ specific opinion. This evaluation shall not be handled as buying and selling recommendation. RoboForex shall not be held responsible for the outcomes of the trades arising from relying upon buying and selling suggestions and opinions contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European on-line international alternate foreign exchange dealer.

[ad_2]

Source link