[ad_1]

At this time, on Thursday, April 16th, the Ethereum value is rising steeply. The coin is usually buying and selling at 169.70 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Ethereum value is rising right this moment: tech evaluation.

- The worth of all belongings within the ETH community has turn into equal to the BTC.

- Customers will be capable to test the origin of the cryptocurrency.

On W1 of the Ethereum, we see that the correctional section after a speedy decline was too “modest”. A brand new wave of descending dynamics didn’t turn into huge both. The market now rests throughout the borders of a channel between $80.86 and $260.00 USD. The descending strains of the MACD and Stochastic point out bearish predominance. Nevertheless, if the bulls handle to interrupt away the resistance stage close to $260.00 USD, the correctional section will prolong to 23.6% ($398.00 USD) and 38.2% ($593.00 USD) Fibo.

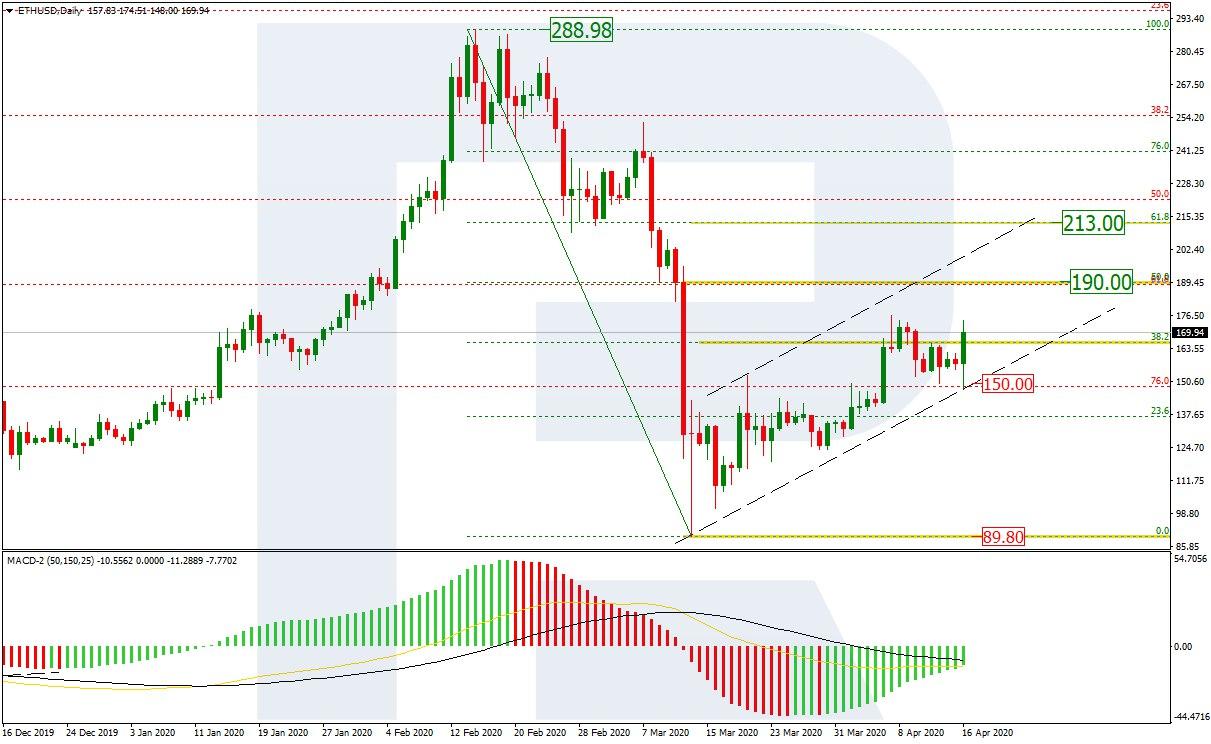

Photograph: Roboforex / TradingView

On D1, ETH/USD additionally demonstrates an uptrend as a mid-term correction. The quotations are shifting inside a secure channel and testing 38.2% Fibo for the second time. The following objectives of the expansion are 50.0% ($190.00 USD) and 61.8% ($213.00 USD). The dynamics of the MACD strains stay descending, therefore a breakaway of the help close to $150.00 USD might turn into the start of a brand new wave of declining to the low of $89.80 USD.

Photograph: Roboforex / TradingView

On H4, the quotations escaped a short-term descending channel upwards. The momentum of progress is aimed toward overcoming the native low; then the psychologically vital stage of $200.00 USD could also be approached. Further affirmation of the upcoming progress might be a Gold Cross on the Stochastic.

Photograph: Roboforex / TradingView

The combination sum of the belongings transferred intraday within the ETH community has turn into equal to that of the BTC, amounting to 1.5 billion USD. That is defined by traders’ excessive demand for stablecoins. The parity with the BTC implies that the demand for various cryptocurrencies within the first quarter of 2020 will stay excessive, after which the alignment of forces might change.

About 80% of the transactions within the Ethereum community contain USTD, USDS, and TUSD. Prevailing of cryptocurrencies with a hard and fast fee is defined by greater traders’ demand for them within the case of transferring capital.

As the newest information goes, within the Ethereum survey service Etherscan, chances are you’ll now test the origin of the cryptocurrency. For this, a perform known as “ETHProtect: is used; the investor might gather the info on the cryptocurrency historical past – whether or not it has been observed in some frauds, fishing, or different illegal actions. In lots of instances, this info is not going to be extraordinarily helpful for the consumer however in the event you purchase giant sums, it would undoubtedly not hurt you. For instance, frequent hacking of crypto exchanges has created an unlawful move of digital cash, and the brand new perform will let the place your cash has come from. Nevertheless, it stays unclear what to do with this information subsequent.

Disclaimer: Any predictions contained herein are primarily based on the authors’ specific opinion. This evaluation shall not be handled as buying and selling recommendation. RoboForex shall not be held responsible for the outcomes of the trades arising from relying upon buying and selling suggestions and critiques contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European on-line international alternate foreign exchange dealer.

[ad_2]

Source link