[ad_1]

Tron’s USDD stablecoin fell under $0.97 at this time, and founder Justin Solar has tried to reassure customers by saying that he’s “deploying extra capital” to defend the peg.

Tron’s USDD Stablecoin Depegs To Lowest Worth Since June 2022

Tron’s Decentralized USD (USDD), which had already been combating its peg this final month because it stayed under $1, has noticed additional destabilization at this time because it touched lows not seen since June.

Under is a chart that reveals the development within the stablecoin’s worth (in opposition to USD) over the past 24 hours:

Appears like the worth of the coin has jumped again up following the decline | Supply: USDDUSD on TradingView

Because the above graph reveals, USDD declined to as little as under $0.97 earlier within the day, however has since seen some restoration to round $0.977.

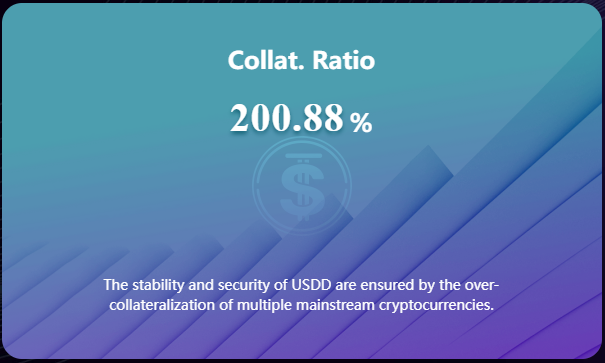

Justin Solar, the founding father of TRON, has come forth and tried to reassure customers by declaring that the stablecoin is secured by a collateral ratio of greater than 200%.

Moreover, Solar additionally knowledgeable customers that he’s “deploying extra capital” to defend the peg.

Deploying extra capital – regular lads https://t.co/55pra5wQMi https://t.co/CexyaBy2hx

— H.E. Justin Solar🌞🇬🇩🇩🇲🔥 (@justinsuntron) December 12, 2022

Earlier than the Tron founder added these additional deposits, the collateral ratio of the stablecoin was round 200.71%. Now, the crypto has grow to be even additional overcollateralized because the ratio has improved to 200.88%.

The overcollateralization of the decentralized USD stablecoin | Supply: USDD.io

Whereas USDD appears to have stopped from additional depegging for now, it’s nonetheless unclear whether or not the coin will have the ability to regain $1 anytime quickly.

Because the collapse of the crypto change FTX, the stablecoin hasn’t been in a position to stabilize its peg. Different stables additionally noticed turbulence from the crash, however the depegging was solely momentary of their case, as they have been again up shortly sufficient.

Decentralized USD is a stablecoin issued by the TRON DAO reserve, and is collateralized by the group utilizing a number of property like Bitcoin, Tron, and USDT.

The crypto’s mannequin is much like Terra USD (UST), a stablecoin that misplaced its peg and collapsed again in Might of this 12 months (an occasion that might kick off a market-wide crash).

After USDD slipped additional away from its $1 peg at this time, there have been speculations within the crypto group on whether or not the stablecoin is heading in the direction of the same destiny to UST.

If USDD does certainly find yourself following the trail of UST, the domino impact in the marketplace from its collapse is unlikely to be on the identical degree as Terra USD’s, provided that the market cap of USDD is presently nowhere close to what UST was simply earlier than it went down.

[ad_2]

Source link