[ad_1]

The stablecoins market is predicted to considerably develop amid the mainstream adoption of Bitcoin and different digital belongings globally.

The rise of the Tether (USDT) stablecoin has been undisputed for a number of years. The Tether (USDT) stablecoin runs on greater than 10 blockchains together with Ethereum, Binance Sensible Chain, Polygon, and Tron, amongst others. On the Ethereum community, Tether (USDT) has greater than $36 billion in provide with about 4.three million holders. The Tron community holds an unlimited quantity of Tether (USDT) with about $46 billion. On the Solana blockchain, Tether (USDT) has a complete provide of about $1.eight billion.

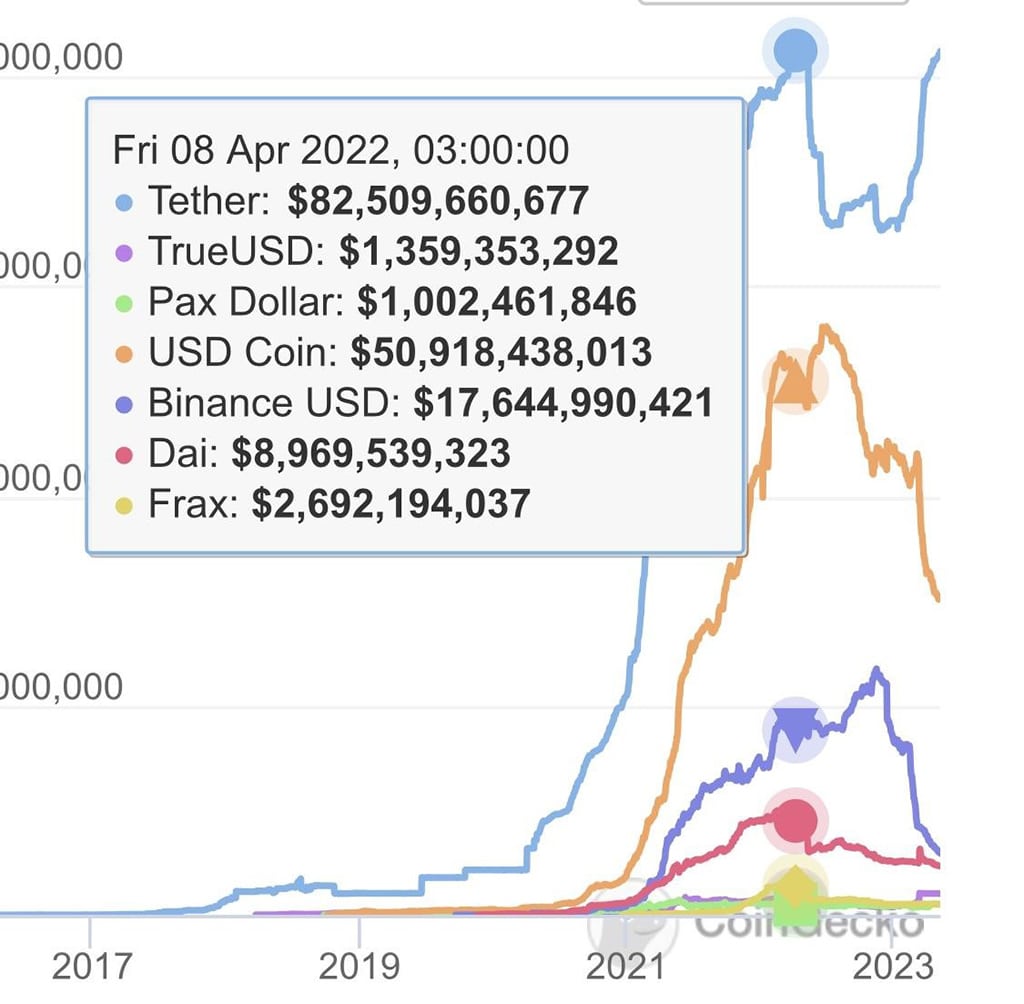

In complete, the Tether (USDT) has a complete provide of greater than $82 billion, thus holding the highest US dollar-backed stablecoins. Notably, Tether (USDT) has the very best every day traded quantity within the digital asset business with about $25.57 billion, in comparison with Bitcoin at $16.5 billion.

Banking Disaster Lifts Tether (USDT)

Amid america banking disaster, which has seen greater than three regional banks succumb to fintech and large valued banks, traders are extra conscious of self-custody by means of stablecoins. In response to the newest combination knowledge from CoinGecko, the Tether USDT market valuation has reclaimed ATH achieved proper earlier than final yr’s crypto capitulation.

Notably, Tether USDT bottomed out at a market capitalization of about $65 billion throughout the FTX and Alameda Analysis implosion late final yr. With the de-pegging of Circle’s USDC throughout the collapse of Silvergate Capital, Tether USDT’s valuation climbed exponentially so far.

The narrative that Bitcoin is a greater hedge in opposition to inflation than every other market equities has elevated the adoption of Tether stablecoins.

“The banking disaster is fuelling ‘hyper-bitcoinisation’ – the inevitable endgame that the greenback will probably be nugatory,” stated Anders Kvamme Jensen, Oslo-based founding father of the AKJ world brokerage and digital asset specialist.

King of the Stablecoin Market

The stablecoins market cap is about $130,788,346,187, with Tether controlling greater than half. In response to combination knowledge from Binance-backed CoinMarketCap, solely Tether (USDT) has seen its market valuation improve YTD within the high three stablecoins. The second largest stablecoin, USDC by Circle has been on a decline for the reason that Silvergate Capital saga.

Equally, Binance-backed BUSD has considerably shrunk for the reason that issuer ceased issuing new cash following the SEC prices.

Picture: CoinGecko

Greater Image

The stablecoins market is predicted to considerably develop amid the mainstream adoption of Bitcoin and different digital belongings globally. Furthermore, there are extra crypto-friendly markets – together with the EU, Hong Kong, UK, El Salvador, and UAE, amongst others – than there have been just a few years in the past.

Consequently, Tether (USDT) is predicted to develop exponentially within the coming years. Moreover, the corporate has launched extra stablecoins denominated in different world currencies together with the Euro.

subsequent

Let’s discuss crypto, Metaverse, NFTs, CeDeFi, and Shares, and give attention to multi-chain as the way forward for blockchain expertise.

Allow us to all WIN!

[ad_2]

Source link