[ad_1]

Through the previous 9 weeks, Solana recorded a complete influx of about $0.7 million whereas all digital asset funding merchandise noticed an outflow of about $342 million prior to now seven weeks.

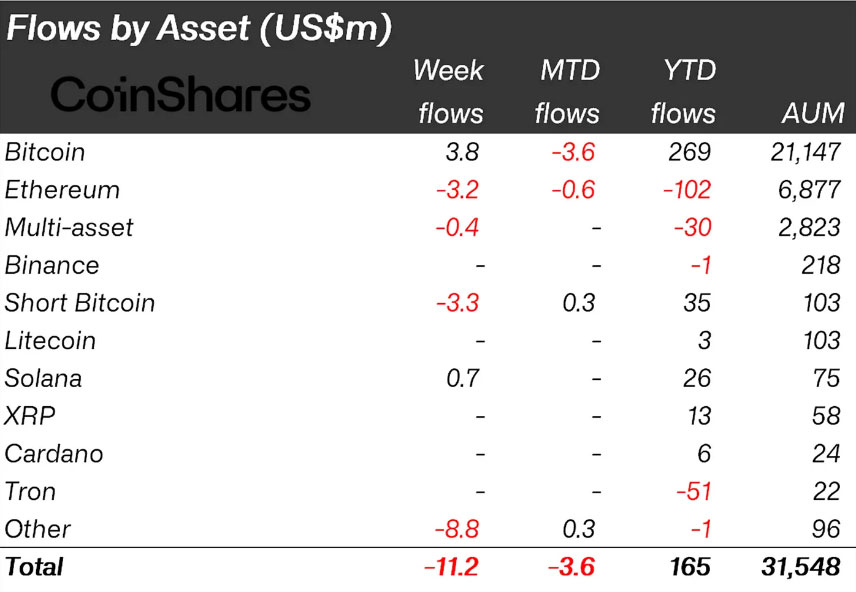

One of many main sensible contract blockchains and DeFi ecosystems with over $305 million in whole worth locked (TVL), Solana (SOL), has been a favourite amongst most traders. In accordance with a weekly report on digital asset fund flows by CoinShares, Solana was the one high coin to file inflows prior to now weeks. Exactly, the report highlighted that Solana posted a complete fund inflows of about $0.7 million prior to now 9 weeks. Alternatively, Polygon (MATIC), and Ethereum (ETH) posted a fund outflow of about $8.6 million and $3.2 million respectively.

In whole, the digital asset fund flows recorded an outflow of about $11.2 million, with the entire outflows prior to now seven weeks totaling about $342 million. CoinShares highlighted that buying and selling quantity for digital property fund flows remained comparatively increased than common, totaling about $2.Eight billion.

Photograph: CoinShares Weblog / Medium

Notably, most altcoins recorded outflows prior to now weeks amid regulatory considerations and ETF uncertainty in the US. Nonetheless, Solana continued to draw extra traders for the reason that calendar flipped in January.

“Whereas Solana noticed inflows for the ninth consecutive week totaling US$0.7m, the YTD inflows of US$26m recommend it’s the most cherished altcoin amongst traders at current,” CoinShares famous.

Can Solana Keep Momentum Amongst Traders Forward?

The Solana (SOL) ecosystem has been vibrant with decentralized monetary (DeFi) platforms, which has considerably helped its common day by day traded quantity stay excessive. In accordance with the most recent crypto value oracles, Solana had a complete market capitalization of about $7.Eight billion and a 24-hour traded quantity of roughly $253 million.

Nonetheless, the Solana ecosystem continues to be feeling the results of the FTX and Alameda Analysis collapse late final 12 months. Over the weekend, on-chain analysts noticed FTX-related wallets transferring SPL tokens via a Wormhole bridge to the Ethereum community, therefore sparking fears of attainable liquidation. Furthermore, FTX held over $1 billion in Solana and its associated cash, therefore including attainable liquidation strain as the present administration seeks to make collectors complete once more. Notably, Solana’s value continues to be buying and selling beneath the pre-FTX ranges, at round $19.24 on Tuesday.

In a bid to take care of its future development prospects, the Solana ecosystem has continued to construct technical infrastructure to assist onboard mainstream customers. Moreover, Solana has a Web3-oriented smartphone dubbed Saga cellular meant to assist customers entry the DeFi protocols safely and relaxed.

Nevertheless, the Solana community has to proceed engaged on bettering its decentralization in a bid to keep away from the common scrutiny of attainable missteps of the securities legal guidelines.

subsequent

Let’s speak crypto, Metaverse, NFTs, CeDeFi, and Shares, and deal with multi-chain as the way forward for blockchain know-how.

Allow us to all WIN!

[ad_2]

Source link