[ad_1]

An analyst has defined, utilizing completely different on-chain indicators, how Uniswap (UNI) could possibly be gearing up for a worth breakout.

Uniswap Metrics Might Level That A Rally Might Be Brewing Up

In a brand new post on X, analyst Ali has mentioned the result that UNI might face based mostly on some underlying metrics. The primary indicator of relevance right here is the variety of addresses carrying their tokens with a web quantity of unrealized loss.

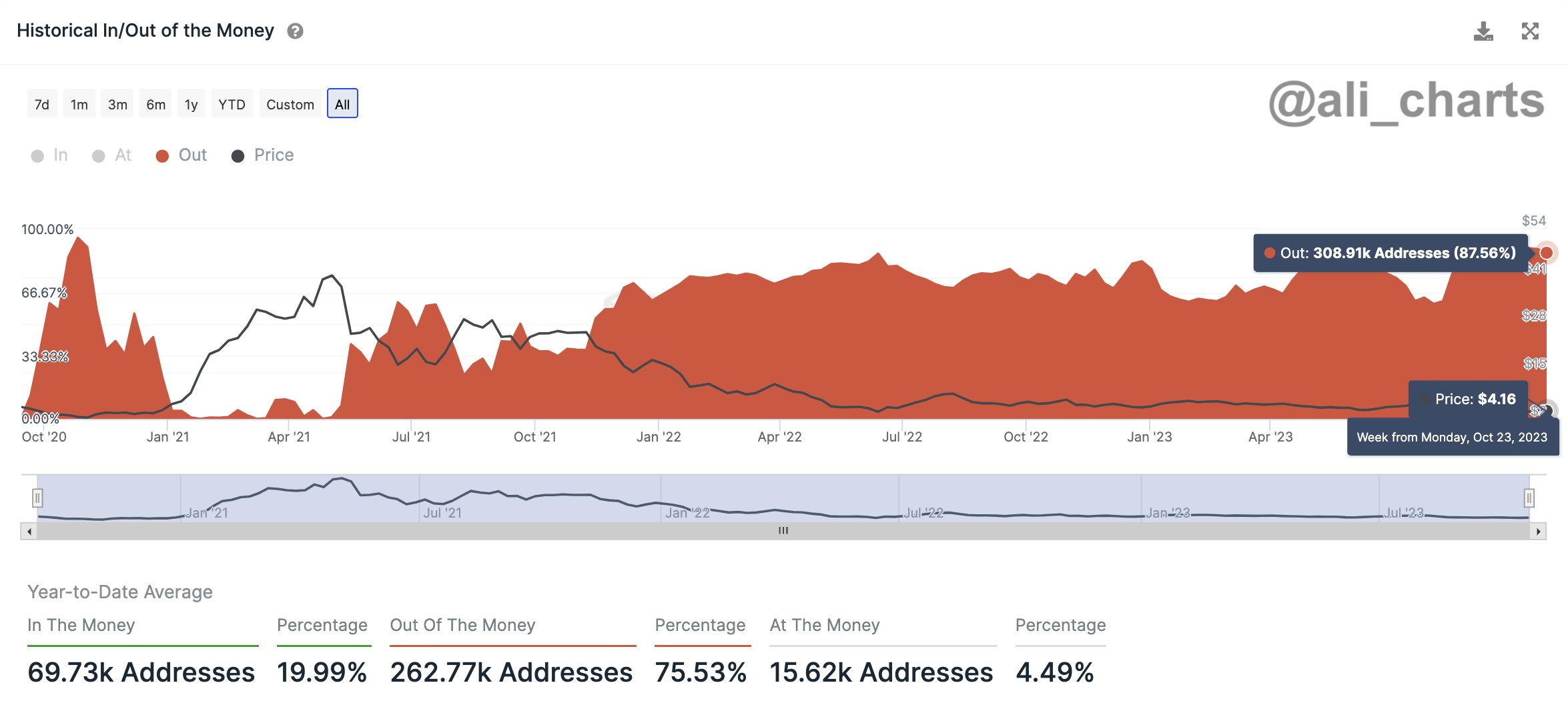

Here’s a chart that reveals the pattern on this Uniswap metric over the previous couple of years:

The worth of the metric appears to be at vital ranges in the mean time | Supply: @ali_charts on X

From the above graph, it’s seen that round 308,910 Uniswap addresses or traders are underwater proper now. That is equal to about 87.56% of the cryptocurrency’s total consumer base.

Usually, the extra traders revenue, the upper the possibility of a selloff, as holders get tempted to comprehend their income. A excessive quantity of holders being in loss, then again, might indicate an exhaustion of sellers out there.

As there may be an excessive quantity of Uniswap addresses within the pink at the moment, the promoting stress might have already run out. Thus, the asset could also be unlikely to say no, no less than for now.

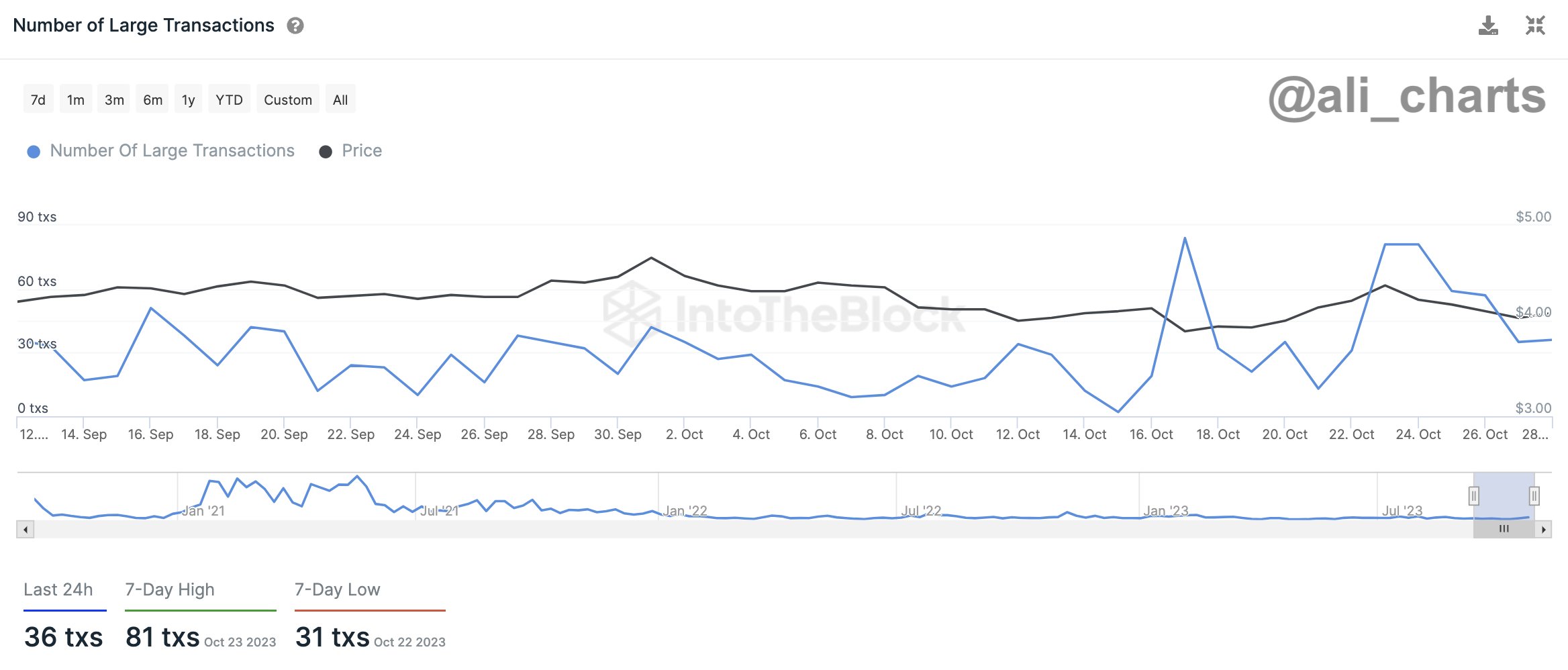

Whereas the market is at the moment overwhelmingly underwater, Ali notes that the variety of massive UNI transactions is selecting up.

Seems to be like the worth of the metric has been excessive in current days | Supply: @ali_charts on X

The “massive transactions” right here check with the transfers valued no less than $100,000. As solely the whales and institutional entities are able to shifting such massive quantities in single transactions, the variety of them can present hints about how lively these humongous holders at the moment are.

The truth that these traders have instantly began making a comparatively excessive variety of transfers lately might point out that they’re within the asset at its present worth stage. “They might be investing or positioning themselves earlier than Uniswap breaks out,” explains the analyst.

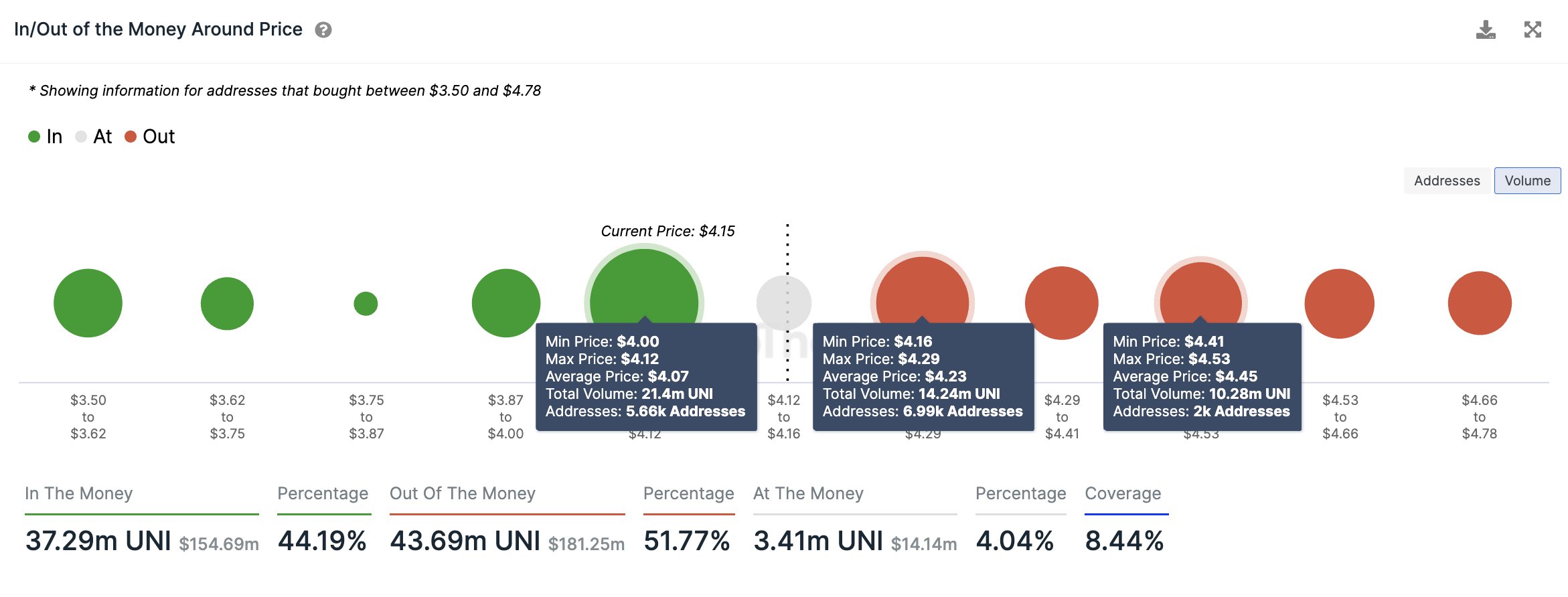

Ali has additionally identified how the present UNI costs have a robust on-chain help wall under them.

The varied help and resistance ranges of the coin on the premise of on-chain knowledge | Supply: @ali_charts on X

In on-chain evaluation, help and resistance ranges are outlined based mostly on what number of addresses/traders purchased at them. As is seen within the chart, the vary just under the present UNI costs is filled with holders, implying that ought to the asset retests them, it might really feel shopping for stress.

“Regardless that Uniswap constructed a key help flooring at $4, there are 2 provide partitions it wants to beat to sign a bullish breakout,” says Ali. “One is at $4.23, the place 7,000 addresses purchased 14.24 million UNI, and the opposite is at $4.45, the place 2,000 addresses maintain 10.28 million UNI.”

UNI Value

Uniswap has been consolidating across the $Four stage for some time now, unable to seek out upward breaks.

UNI has been shifting sideways in the previous couple of weeks | Supply: UNIUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com

[ad_2]

Source link