[ad_1]

Knowledge of an on-chain indicator suggests nearly all of the altcoins have now dropped into the historic “hazard zone,” an indication that may very well be bearish.

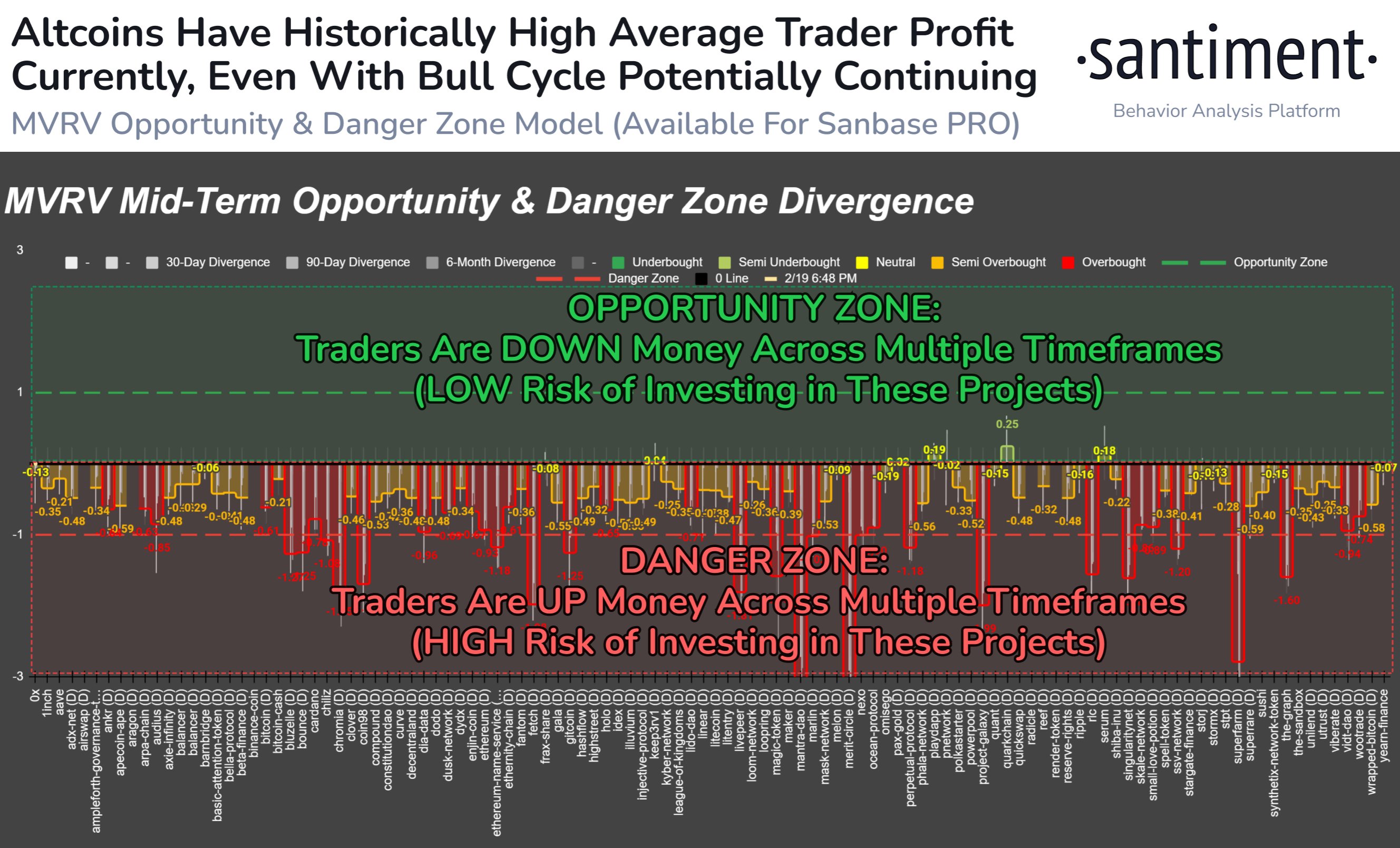

Altcoins Could Be Overbought At present As Dealer Earnings Have Shot Up

In a brand new post on X, the on-chain analytics agency Santiment has mentioned how the altcoins as a complete have been observing excessive earnings not too long ago based mostly on the MVRV ratio.

The “Market Worth to Realized Worth (MVRV) ratio” is an indicator that retains observe of the ratio between the market cap and realized cap for any given cryptocurrency.

The “realized cap” right here refers to a capitalization mannequin that assumes the actual worth of any token in circulation will not be the present spot worth of the asset, however reasonably the worth at which it was final moved on the blockchain.

Because the earlier transaction for any token was probably the purpose at which it final modified palms, this earlier worth would function its present value foundation. As such, the realized worth basically accounts for the price foundation of each investor out there.

Because the MVRV ratio compares the market cap of an asset (that’s, the overall worth the traders are holding proper now) with its realized cap (the worth that the holders as a complete put into the coin), it will probably inform us concerning the profitability ratio for the typical investor of the cryptocurrency.

Traditionally, the traders holding giant quantities of earnings (that’s, a excessive MVRV ratio) have been a sign that the asset is overheated, whereas the traders being in losses have instructed an underbought standing. Primarily based on this historic sample, Santiment has outlined “alternative” and “hazard” zones for the market.

The chart under exhibits a measure of the divergence of the MVRV ratio for various timeframes and for varied altcoins:

The worth of the metric appears to have been destructive for all of those altcoins | Supply: Santiment on X

In response to Santiment’s mannequin, the MVRV ratio diverging to the -1 mark (from its regular 0% worth) suggests the asset in query is contained in the hazard zone the place merchants carry excessive earnings. From the graph, it’s seen that many of the altcoins are inside this area proper now.

“Outdoors of some lagging altcoins, the overwhelming majority of crypto tasks have generated earnings for the typical pockets on a mid to long run timescale,” explains Santiment. “Which means that our mannequin is indicating a good bit of ‘overbought’ indicators.”

Much like the hazard zone however reverse to it’s the alternative zone, the place the indicator’s divergence reaches the 1 degree. On this zone, few traders are carrying excessive earnings, so cash inside this zone might current a ripe alternative for accumulation. At present, although, no asset is current on this area.

“This definitely doesn’t imply that cryptocurrency is on the verge of a large correction,” says the analytics agency. “However based mostly on historical past, the extremely respected MVRV metric is revealing there’s a increased threat than common in shopping for or opening new positions whereas markets are within the midst of a 4+ month surge.”

ETH Worth

Ethereum has seen a decoupling from Bitcoin not too long ago because the coin has registered a recent surge above the $2,900 mark, whereas the unique cryptocurrency has slumped sideways.

Appears like the value of the asset has surged not too long ago | Supply: ETHUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link