[ad_1]

Bitcoin worth modified again and again with bull runs or bearish strikes occurring after sure information about an financial or political occasion, authorities rules, hacks on crypto exchanges, amongst others. However let’s take a more in-depth take a look at every of those eventualities and the way the information about these occasions had impacted the costs of cryptocurrencies.

US-Iran Battle Spikes Bitcoin’s Value

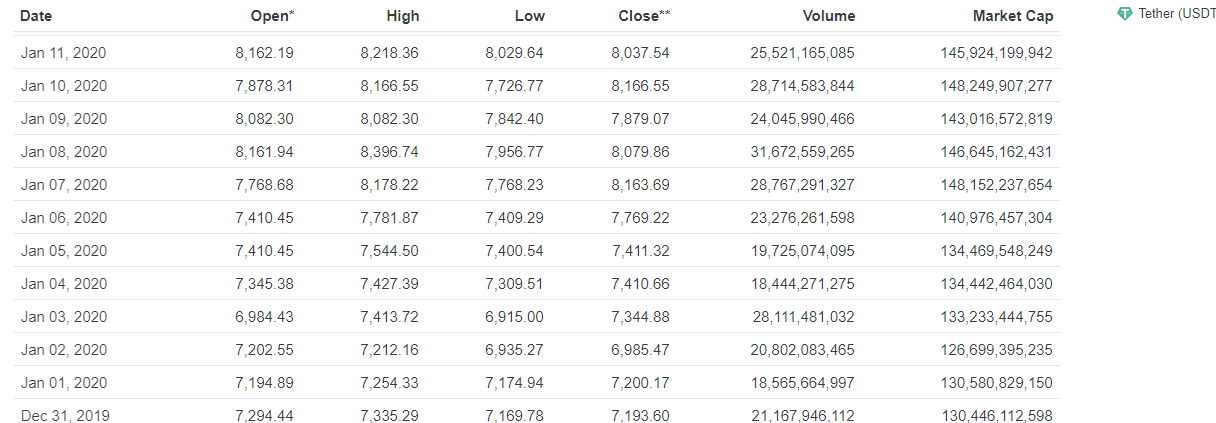

Tensions surrounding the US-Iran struggle influenced the costs of digital belongings. Bitcoin, as an example, surged by 5% after the U.S. killing of Iranian Normal Qassem Soleimani on January 3, 2020.

The main cryptocurrency additionally spiked on January 8, 2020, after Iran unleashed ballistic missiles at two American bases in Iraq in retaliation to Normal Soleimani’s assassination. Nevertheless, the market traded sideways when information surrounding the battle between each international locations started to wane.

Picture: Coinmarketcap

US-China Commerce Conflict Influences Bitcoin’s Value

As is the case with the US-Iran struggle, information that the US will improve tariffs on Chinese language import items impacted in the marketplace worth of Bitcoin. Bitcoin trades additionally surged by 284% between Might 19, 2019, and August 19, 2019, when the commerce struggle between each international locations was in full swing.

Once more, right here’s one other state of affairs that’s value noting. When the U.S. President, Donald Trump stated on July 12, 2019, that he’s not a fan of Bitcoin or different cryptocurrencies, the media went haywire and so did the worth of Bitcoin. Bitcoin recorded an 8% loss barely hours after the tweet.

Why Public Information Causes Leaps and Falls in Crypto Value

At this juncture, you might be curious to know why public information affect on crypto pricing. If that’s the case, listed below are some doable causes.

1. Panic Promote:

Public information may cause a wave of panic within the cryptocurrency house. Buyers who speculate that an occasion could negatively affect the costs of those belongings may dump them even earlier than the information makes the rounds. Many do that to reduce losses. Accordingly, an enormous sell-off throughout the crypto house will drive down the costs of those belongings. The identical applies to optimistic information rising, which will increase the purchase orders available in the market, thereby resulting in a rise in crypto costs.

2. Buyers’ Mindset:

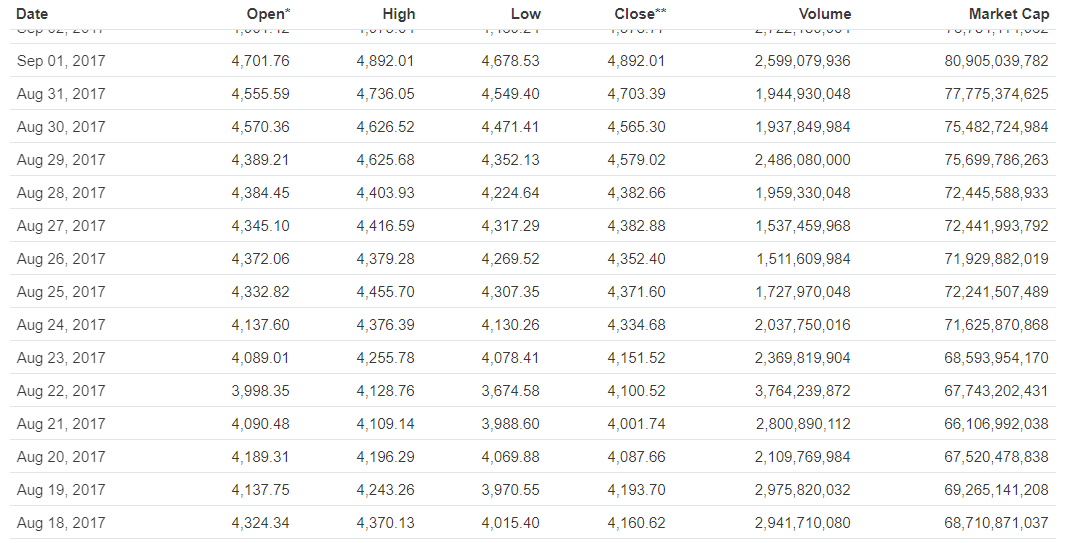

Most traders monitor the most recent occasions to determine the place the market is headed. An occasion is the case of Japan which acknowledged Bitcoin as a authorized forex in April 2017. The information brought on Bitcoin to spike over $1,000, buying and selling as excessive as $4,000 by August of the identical 12 months.

Picture: Coinmarketcap

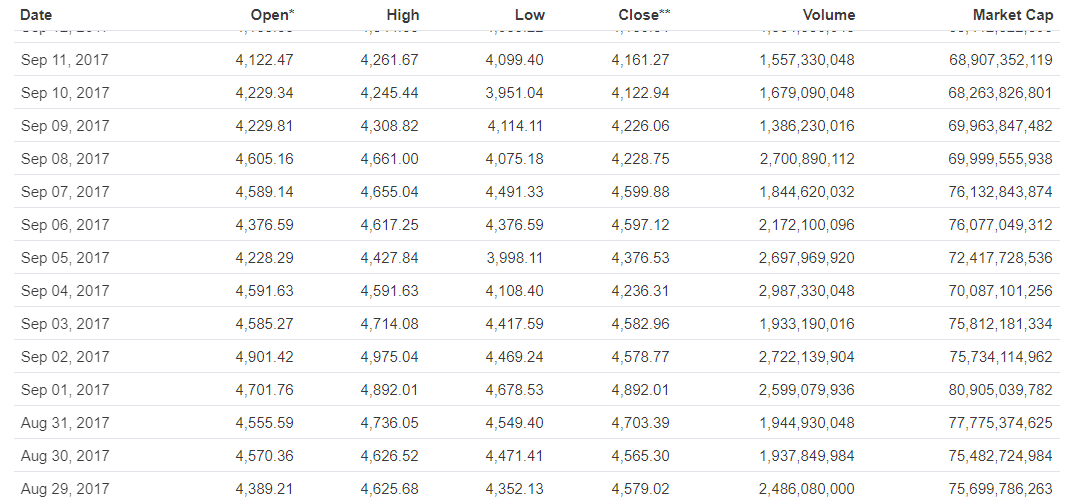

When China banned ICOs and the information started to flow into on September 3, 2017, Bitcoin fell from the day’s excessive of about $4,400 to $3,900.

Picture: Coinmarketcap

This clearly reveals how far the media goes to affect an investor’s resolution. Ought to they dump the crypto asset they’ve amassed and watch for a greater shopping for alternative, or experience the present wave?

3. Protected Haven:

Within the face of financial uncertainty, Bitcoin is used as a secure haven. As an illustration, the worth of Bitcoin surged whereas the Yuan and inventory markets declined throughout the US-China commerce uncertainty. There have been reviews of accelerating curiosity in Bitcoin by Iranians because of the conflicts between the U.S. and Iran. It’s value noting that the surge has occurred within the face of problem in accessing the web in Iran.

Conclusion

The costs of cryptocurrencies could also be pushed by provide and demand, nevertheless, public information additionally performs an important half, positively or negatively, in relation to crypto costs. That mentioned, it doesn’t come as a shock that crypto merchants are at all times updated with the most recent traits to determine a forthcoming pump or dip available in the market.

Please try newest information, professional feedback and business insights from Coinspeaker’s contributors.

[ad_2]

Source link