[ad_1]

On February 5, the Reginald Fowler’s case obtained an necessary replace relating to three financial institution accounts in Santander UK. The property held in them have been restrained.

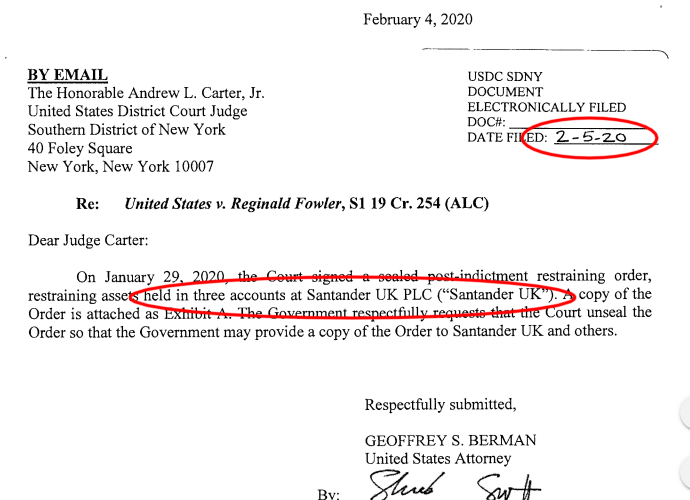

The U.S. Authorities has issued a sealed post-indictment restraining order. Within the doc added to the CourtListener on February 5, 2020, there may be an replace relating to the case in opposition to Crypto Capital Co. functionary Reginald Fowler, presumably working for Bitfinex. It seems that Reginald had some financial institution accounts associated to him within the UK. Due to the brand new doc, surprisingly gathered no consideration from the information retailers, three financial institution accounts will probably be seized.

In response to the doc, on 29 January 2020, the court docket has ordered to freeze cash held within the Santander UK accounts.

“The Authorities respectfully requests that the Court docket unseal the Order in order that the Authorities could present a duplicate of the Order to Santander UK and others.”

That cash presumably belongs to Fowler, who lately declined plea cope with the court docket. It seems to be like there are motives that go far past what the choose can think about relating to this deal. Fowler is accused of working a crypto-related shadow financial institution, but it surely looks as if there’s a ton of shady secrets and techniques to cover.

Reginald Fowler appears to have a lot of cash now going to the U.S. authorities’s brokers. The stockpile could act as proof in opposition to Fowler, the operational supervisor from the U.S. He was accused of cash laundering and fraud throughout an investigation associated to Bitfinex, Crypto Capital Co. and others. Crypto Capital is a shady banking group presumably stating behind the vast majority of the businesses on this house.

Choose any massive firm, and there’s a excessive chance it has connections with Bitfinex, Tether, iFinex, or Crypto Capital. Even your favourite crypto agency could have ties to the Crypto Capital cash.

The Bitfinex Cash Got here from Darkish Locations

The one drawback with Crypto Capital, after all of the drama, is that it has the roots. Some journalists did make clear the hidden USDT–BTC manipulations in 2017. As an illustration, the lawsuit by Roshe and Leibowitz refers to a scientific research made by College professor John Griffin.

It proves that Bitfinex was utilizing Tether to govern costs again in 2017. Then, Bitcoin was price virtually 20,000 on the finish of the 12 months. And the transaction mempool was bloated, with charges as much as $80 not working in any respect. Additionally, Polish authorities seized financial institution accounts belonging to Bitfinex. The financial institution was a wash mate for the Colombian drug cartels.

Bitcoin, Altcoins within the Hidden Pumping Zone

There are a lot of different particulars and the New York Lawyer is doing all that it takes to uncover the schemes. Bitfinex claims that they haven’t any relation to Crypto Capital’s operations. Nevertheless, they’ve monetary transactions with them, in addition to a set of damaged obligations. As an illustration, Bitfinex gave $850 million of buyers cash to Crypto Capital. Then, the CC consultant instructed Bitfinex that they misplaced the cash. Such a state of affairs is unbelievable by way of conventional banking and markets.

Exchanges pretend incoming volumes. A few of them conduct wash buying and selling. OTC merchants idiot one another. A number of the cash going off from DarkNet markets. All this mess finally ends up as bitcoins within the arms of institutional buyers, and your common mothers and dads. Quickly, there can be no approach of evading the ‘soiled’ cash. Have you ever seen the current wave of whale transactions? We will solely make guesses the place the market’s steam coming from.

Jeff Fawkes is a seasoned investment professional and a crypto analyst covering the blockchain space. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.

[ad_2]

Source link