[ad_1]

Coinspeaker

Crypto Value Evaluation February 19: BTC, ETH, LTC, XRP, BCH

Dmitriy Gurkovskiy, a senior analyst at international alternate dealer RoboForex, offers his imaginative and prescient of the potential tendencies in worth adjustments for Bitcoin in addition to for different main cryptos.

The consumers of cryptocurrency have but did not safe above the native resistance ranges. There’s a threat of a descending correction if the bulls don’t transfer the market even larger within the nearest future. Nonetheless, even such a correction will present conservative ranges for lengthy positions. As we will see, with a small decline, the market pushed off and the quotations begin rising, which signifies robust bullish strain. The XRP at the moment appears very weak. It has carried out a check of an necessary resistance stage on D1 and has fashioned a reversal sample on smaller timeframes. If the market doesn’t show a decline as soon as once more, and the sample might be canceled, we will be positive about additional development and the presence of influential consumers available on the market, who usually are not prepared for the smallest decline.

Bitcoin

On D1, the quotations have failed to interrupt out the resistance space but. On the similar time, the costs hold pushing off the center line of the Bollinger Bands indicator, which signifies bullish strain and the energy of the present ascending impulse. The important thing help stage is at $9195. A breakout of this space could provoke a severe descending correction with the purpose of $7785. As the primary buying and selling concept, we must always count on a check of the damaged border of the descending channel at $9195 and additional development of the costs. Full-scale improvement of the bullish pattern might be confirmed by a breakout of the resistance and securing above $11005. For now, the realm between $10500 and $11000 is a excessive threshold for the consumers.

Picture: Roboforex / TradingView

On H4, the quotations are additionally pushing off the resistance stage. The important thing help stage is at $9355. A breakout of this stage will signify the tip of the expansion and the start of a descending correction with the purpose of $8355. For now, the consumers’ strain stays robust: as w can see, the consumers pushed off the ascending help stage once more. So, one other check of the decrease border of the ascending channel close to $9355 shouldn’t be excluded, adopted by additional development.

Picture: Roboforex / TradingView

Ethereum

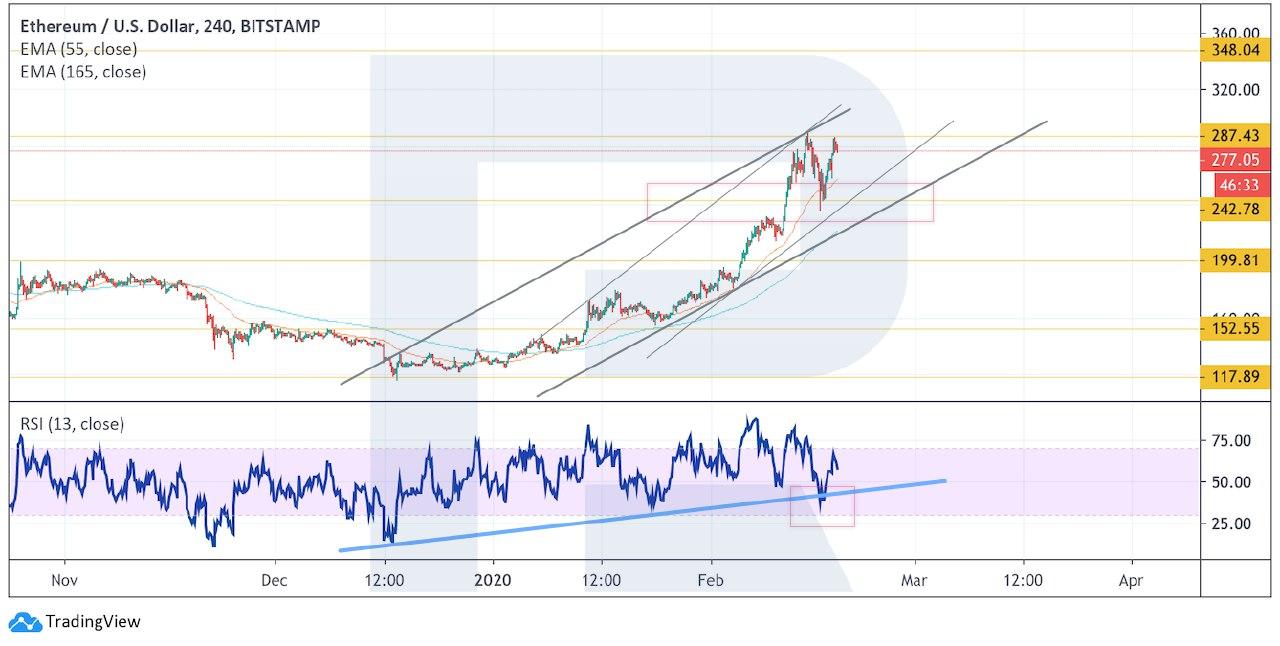

The Ethereum quotations hold going up and are at the moment testing the resistance space close to $285. As we will see, the costs have escaped the descending channel, and additional development with the purpose of $385 is very possible. A robust sign confirming this motion might be a check of the damaged trendline on the RSI. The Transferring Averages are additionally revealing the presence of a bullish impulse. The state of affairs could also be canceled by a decline and a breakout of $245, which is able to signify falling to $200. The expansion might be confirmed by securing above $295.

Picture: Roboforex / TradingView

On smaller timeframes, the costs bounced off the MAs for the second time, revealing robust strain from the consumers. The expansion can also be supported by a bounce off the trendline on the RSI. The state of affairs could also be canceled by a breakout of the decrease border of the ascending channel and securing below $242, through which case we must always count on a reversal Double High sample to kind and the quotations decline to $200 and $155, executing the sample.

Picture: Roboforex / TradingView

Litecoin

On D1, the consumers once more managed to impress a bounce off the sign strains of the Ichimoku indicator, demonstrating the energy of the bulls. Nonetheless, the costs have but did not rise above the higher border of the descending channel. Such a breakout could be a powerful sign of additional development with the primary purpose at $125. The state of affairs will not be legitimate if the quotations decline and get away the extent of $50. Such a transfer will provoke a breakout of the decrease border of the Ichimoku Cloud and additional decline to $35.

Picture: Roboforex / TradingView

On H4, the costs have additionally managed to push off the decrease border of the ascending channel. The important thing help stage is at $65. So long as the costs are above it, shifting contained in the channel, we must always count on additional development with the purpose of $102. An extra sign confirming the expansion is one other bounce off the help line on the RSI. If the decrease border of the channel is damaged out and the quotations safe below $65, we must always count on a correction with the objective of $50.

Picture: Roboforex / TradingView

XRP

On D1, the quotations have failed to interrupt out the resistance space. At present, there’s a threat of declining to $0.2185. This state of affairs is supported by a bounce off the trendline on the RSI. Conversely, it is going to be canceled by a breakout of $0.35, through which case we must always count on development to $0.40. The decline might be confirmed by securing below $0.2685.

Picture: Roboforex / TradingView

On H4, a reversal Head and Shoulders sample is prone to kind. The completion of the sample might be confirmed by a breakout of the neck and securing below $0.2655. One other sign confirming the decline might be a check of the resistance line on the RSI. The destructive state of affairs could also be canceled by robust development and a breakout of $0.35, through which case the reversal sample won’t be accomplished and development will resume.

Picture: Roboforex / TradingView

Bitcoin Money

The consumers have did not safe above the higher border of the descending channel. At present, there’s a good likelihood to see the event of the descending correction to $410 after which – to $290. As we will see, the help line on the RSI additionally lies decrease, so it is likely to be examined earlier than the start of a brand new wave of development. The expansion might be confirmed by a breakout of $500, which is able to imply an escape from the descending channel and additional development to $600.

Picture: Roboforex / TradingView

On H4, the costs have bounced off the decrease border of the descending channel. They may attempt to go on rising to the extent of $500. One other sign supporting such a motion might be a bounce off the help line on the RSI. The thought might be confirmed by a breakout of the higher MA and securing above $465. The expansion could also be canceled by a breakout of $405, which is able to imply additional falling to $290 and full-scale improvement of a descending correction, as indicated on the D1.

Picture: Roboforex / TradingView

Crypto Value Evaluation February 19: BTC, ETH, LTC, XRP, BCH

[ad_2]

Source link