[ad_1]

Alphabet Inc. reveals unimaginable earnings in the course of the total market melancholy. Google Cloud and YouTube are making a superb contribution to the entire income. Alphabet (GOOGL) inventory could attain new highs.

Whereas the regulators promise new threats that may apply extra hurt to small companies than to Google itself, the large continues making big earnings. The long-awaited YouTube income report can be a giant deal to concern. Seems to be like, the extra troubles Google has, the extra options they generate to manage.

Most of the market traders are so positive about Google they even want the Alphabet (GOOGL) inventory worth to fall. Louis Stevens, SeekingAlpha analyst, famous:

“The selloff and stagnation in worth is the perfect factor that might occur to Alphabet for long-term traders. In actual fact, I would love the Alphabet’s share worth to stagnate extra usually.”

Prior to now, the corporate used to dump the shares after the earnings report. Wall Avenue makes up some purpose like that shares had ‘hidden’ market troubles, and the grand sell-off begins. However in 2020, there’s a software for longtime traders that might assist them to reverse the state of affairs. That software is known as The Buyback.

Throughout January, Alphabet Licensed a Buyback

The corporate has determined to withdraw the shares equaling $12,5 billion, a mysteriously identical quantity that’s Bitcoin‘s block reward (12,5 BTC per the block in present community state). The Alphabet additionally acquired inspiration to unlock $25 billion for traders in earnings in July 2019.

Right this moment, for the corporate it’s even higher if the sell-off begins. The 20 billion stay below the authorization for this system of inventory repurchasing look helpful in a longterm sense. Per the charts revealed on Google’s web site, they’ve been shopping for again the shares each month over the last three months. The Alphabet (GOOGL) inventory worth was rising laborious, and Google has 20 billion extra to proceed supporting its traders.

Per the paperwork, Google Cloud is now the first revenue supply producing a 52% progress in income in comparison with YouTube’s 35.8% advert income for a similar interval. Nonetheless, YouTube introduced in $15,15 billion in earnings, whereas Google Cloud solely acquired $8,91 billion.

The Google Report Exhibits YouTube and Cloud Knowledge

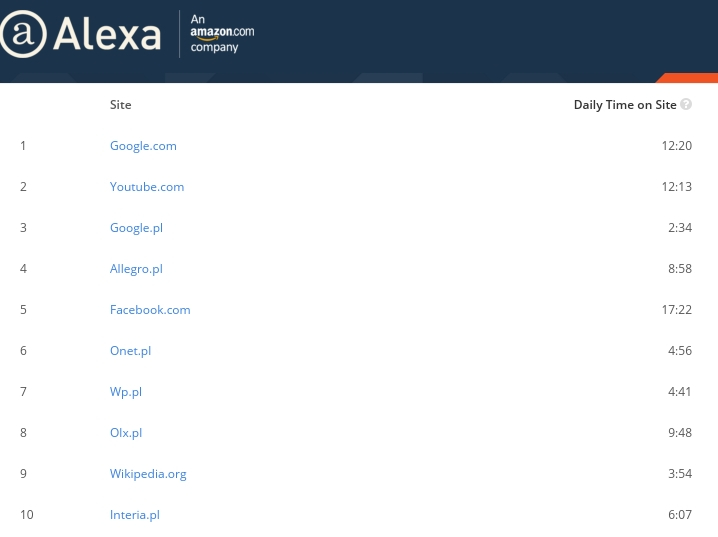

Social Media and YouTube are two main sources of knowledge for a lot of creating nations and youth. Based on the stats, Poland, Norway, Japan, Germany have YouTube of their TOP 10 nationwide web site rating. For example, guests from Poland are spending not less than 12 minutes on YouTube web site day by day.

Picture: Alexa

Poland is the uncommon nation when it comes to finance – they use each Euro and Zloty as currencies throughout the nation, thus securing the independence from the European Central Financial institution. The video content material boasts reputation as a result of it might train extra in comparison with books or traditional articles with photos. Additionally, the voice of the channel’s writer normally provides private context and credibility to the data offered inside a video.

Alphabet reveals the info for 3 years, which is separating Cloud income from the YT one. From the stats, we will presume that Google is aiming at longterm earnings, desires to safe the earnings within the subsequent ten years by way of YouTube. The web site already has 2 billion confirmed registrations, which implies not less than 1,1-1,5 billion of actual customers as individuals don’t usually create an excessive amount of of the YT channels.

Google’s CEO Sundar Pichai claims the corporate has extra space to develop:

“On the query round YouTube, I do assume there’s a number of alternatives forward… I feel there’s extra room — considerably extra room over the mid- to long-term on monetization ranges. And so I feel we see that as a giant alternative and are investing for it.”

Up to now, YouTube had no rivals apart from Vimeo with its custom-made subscription plans and the cryptocurrency-related decentralized internet hosting initiatives, just like the LibreVideos one which is freed from cost. As per Netflix and Hulu, their content material just isn’t user-generated. Which implies no particular, odd audiences and no pace of adoption to sizzling traits.

Jeff Fawkes is a seasoned investment professional and a crypto analyst covering the blockchain space. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.

[ad_2]

Source link