[ad_1]

The FED rate of interest will obtain a cut-off even supposing Jerome H. Powell was beforehand in opposition to that. Donald Trump and Steven Mnuchin ship the phrases of help. The U.S. is filled with coronavirus fears.

Because of the coronavirus assault, the U.S. Federal Reserve (FED) decides to take 50 foundation factors off the rate of interest. After the information, Bitcoin value went up, later exhibiting once more that the pattern just isn’t shifting in a optimistic course. It doesn’t matter what, Bitcoin is within the loosen up zone under $9000. The shares have skilled comparable bump, after which the bullish pattern has drowned in volatility recreation.

The specialists have began claiming that charge cuts will bump up the crypto market. Nevertheless, it seems that the info from the previous suggests the other.

FED Cuts Charges, Jerome H. Powell Sad

Beforehand, honorable Jerome H. Powell has stated that he’ll oppose the thought of White Home to chop the FED charge in 2020. However now, when the U.S. dive in coronavirus preparations, it’s essential to urgently stimulate the economic system. Per Jerome:

“The magnitude and persistence of the general impact on the U.S. economic system stay extremely unsure and the scenario stays a fluid one. In opposition to this background, the committee judged that the dangers to the U.S. outlook have modified materially. In response, we have now eased the stance of financial coverage to supply some extra help to the economic system.

The coronavirus poses evolving dangers to financial exercise. In gentle of those dangers and in help of attaining its most employment and value stability objectives, the Federal Open Market Committee determined in the present day to decrease the goal vary for the federal funds charge.”

The present goal vary is 1-1,25%, whereas the FED claims that the dangers from the virus are rising. Proper after the information, Bitcoin’s value went as much as $8,880 after which went again to $8,700 degree. Charles McGarraugh who works at Blockchain.com as Head of Markets, claims that the second must be bullish as a result of the greenback will lose power.

Certainly, a hefty of weak fiat currencies worldwide already obtained a lift after the FED’s revelations. Nevertheless, once we take a look at the crypto market, it appears fairly quiet. The grand rally just isn’t occurring, and the Bitcoin halving looks like the one large volatility probability up to now.

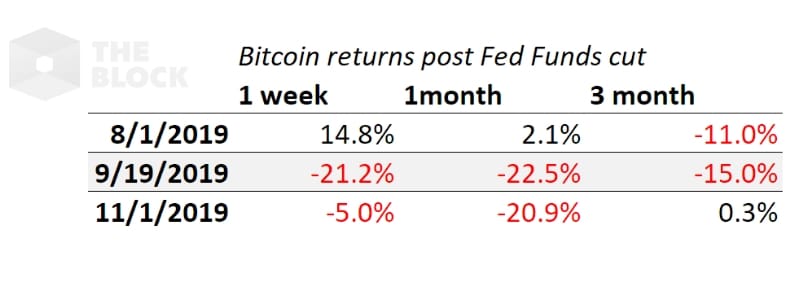

The speed cuts prior to now have decreased the worth of Bitcoin. Let’s take a look at the earlier three charge cuts, occurred in August, September, November 2019.

Picture: The Block

Bitcoin value went down from -5% to -20% in a single to 3 months, as we see. So, what’s in it for Bitcoin? Nothing good, as a result of the coronavirus will rush to destroy any economic system it likes. It received’t choose the edges like right here’s the great libertarians and right here’s the unhealthy authorities. No, it’s going to make the nation a worse place, if we take a look at Italy or China. Individuals throughout the planet begin the panic, shares rise and fall, and uncertainty makes buyers promote shares.

The lower turns into the primary one for the reason that notorious base charge reduce in 2008.

Jeff Fawkes is a seasoned investment professional and a crypto analyst covering the blockchain space. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.

[ad_2]

Source link