[ad_1]

One of many hottest cryptocurrencies prior to now few weeks has been Chainlink (LINK). In comparison with Bitcoin, which is up 20% yr so far, the asset just lately posted a 100% year-to-date achieve, rising to turn out to be the twelfth largest altcoin by market cap.

Many have appeared to LINK’s performance and adoption, with enterprise fund Parafi Capital writing in a latest MakerDAO discussion board publish:

“Given its marketcap, liquidity profile, and urge for food for hypothesis, we see worth in onboarding LINK into MakerDAO. LINK is valued at over $1 billion and can be one of the vital liquid ERC-20 tokens obtainable. The tokens are comparatively decentralized with no recognized “kill-switch” or blacklisting capabilities.”

But a prime dealer is fearing the highest asset is getting ready to bear a powerful reversal from the highs.

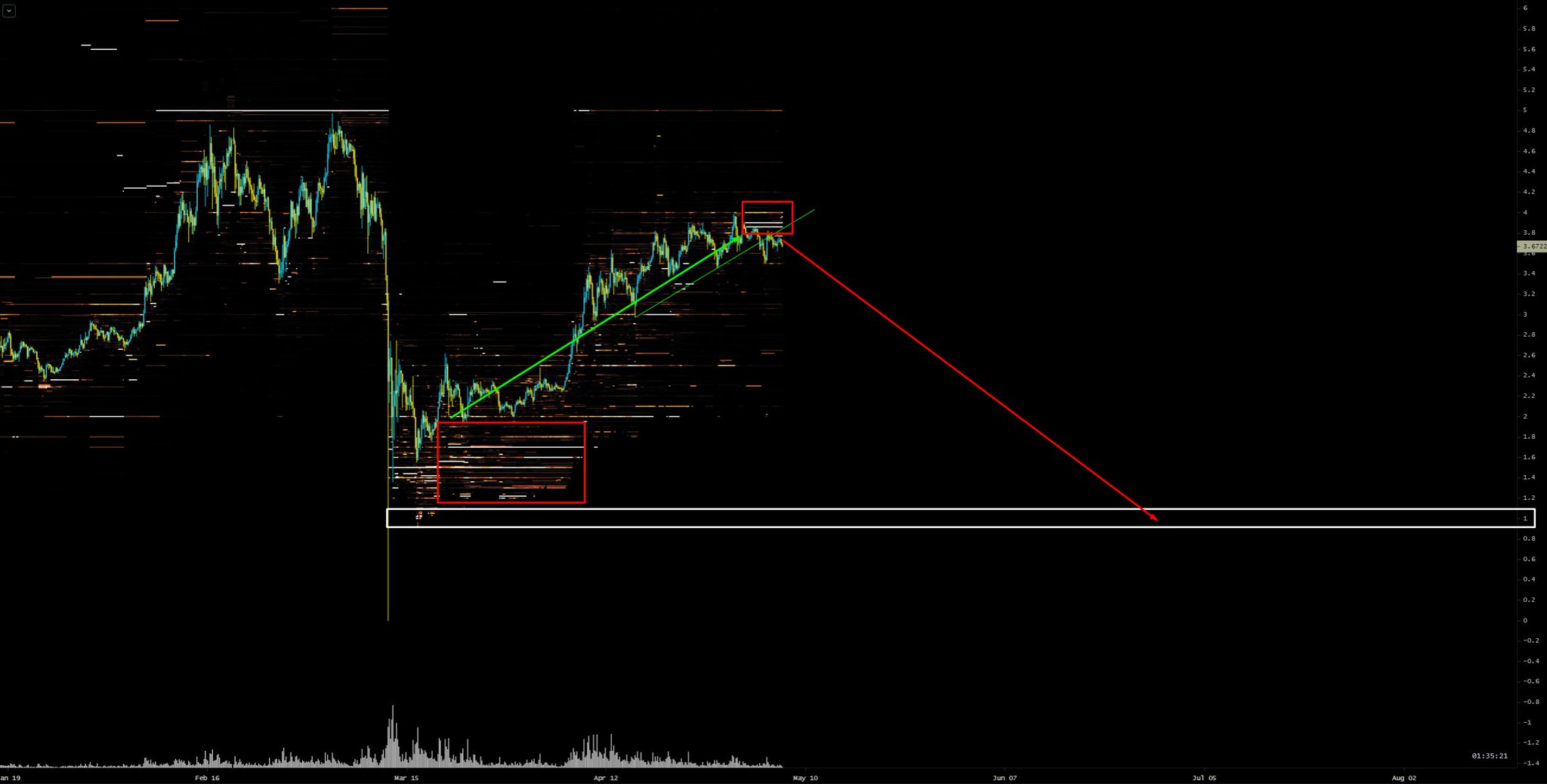

Chainlink Setting Up For Bearish Reversal

Chainlink is on the verge of present process a greater than 70% reversal in the direction of $0.98-$1.00, according to a top trader referencing the chart beneath. Backing this sentiment he appeared to the actual fact the altcoin broke beneath a key assist stage whereas failing to surmount heavy resistance round $4.00.

Chart from @CryptoCapo_

The analyst who made this prediction known as that Bitcoin would fall in the direction of the $3,000s earlier this yr when nobody thought it will occur. He additionally predicted XRP might backside round $0.11-$0.13, which it did.

Including to this, knowledge from blockchain analytics supplier IntoTheBlock indicated that all through segments of final week, there was a powerful bid-ask quantity imbalance. The location indicated that there was rather more promoting stress than bullish quantity, indicative of a distribution sample close to a market prime.

It’s Time for Bitcoin to Shine

The pinnacle of technical evaluation at crypto analysis agency Blockfyre argued that each one altcoins are poised to underperform. He cited the truth that Bitcoin dominance — the proportion of the crypto market made up of BTC — has began to development increased:

“A probably very painful scenario creating if dominance breaks out in the direction of the subsequent resistance. Every 1% rise in BTC.D roughly equates to a 6-12% drop in opposition to the BTC pairings for altcoins. Laborious to think about that it doesn’t matter what BTC does that alts dont see quite a lot of ache,” he wrote in reference to the chart beneath.

Chart from @Pentosh1 (Twitter)

In a separate evaluation, he wrote late final month that basically talking, the incoming volatility associated to the Bitcoin block reward halving will “rekt” altcoins, Chainlink presumably included.

He continued that from how he sees it, altcoins are all the time a “sport of musical chairs” as a result of they rally for causes not based mostly in fundamentals:

“The rationale the alt pumps are unconvincing is as a result of they’ve adopted the identical patterns. IEO’s, Interoperability, privateness cash shifting collectively. It’s coordinated because it has been the final Three years as a substitute of all ships rising collectively.”

Featured picture from Unsplash

[ad_2]

Source link