[ad_1]

A latest Gallup Ballot reveals a major decline within the proportion of Individuals favoring actual property as their most well-liked long-term funding, regardless of its continued recognition. Conversely, the Gallup survey signifies that the notion of long-term investments in gold has skilled an nearly twofold enhance in comparison with the earlier 12 months’s ballot on the identical subject.

Gallup Ballot Reveals Choice for Actual Property and Crypto Slides, Whereas Bias Towards Gold Practically Doubles

Gallup, Inc., the analytics and advisory firm headquartered in Washington, D.C., lately unveiled its newest Gallup Ballot on long-term investments on Might 11, 2023. With a historical past courting again to 1935, Gallup has been conducting public opinion polls worldwide.

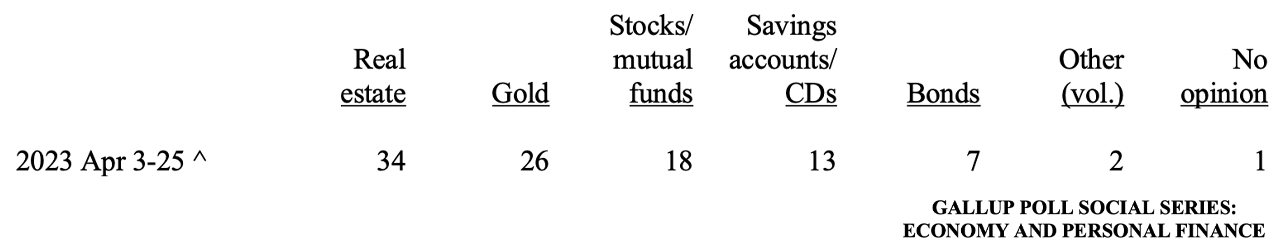

The ballot, performed from April three to April 25, 2023, delves into numerous funding choices equivalent to actual property, gold, shares, bonds, and crypto property. The outcomes had been derived from phone interviews held throughout the identical interval, involving a randomly chosen pattern of 1,013 adults aged 18 and above residing in the US.

Gallup’s newest ballot revealed that actual property emerged because the favored long-term funding, however the attract of this asset has skilled a major decline amongst Individuals. The share of respondents favoring actual property plummeted from 45% final 12 months to a present determine of 35%.

Lydia Saad, the creator of the Gallup Ballot report, highlighted that this present proportion aligns with the standard choice fee noticed between 2016 and 2020, “earlier than housing costs skyrocketed throughout the pandemic.” Saad additional defined that the housing market’s enchantment has waned over the previous 12 months, as increased rates of interest have subdued investor enthusiasm.

Whereas the notion of U.S. inventory indices has largely remained stagnant in comparison with the earlier 12 months, there was a slight dip from 24% in 2022 to the present 18%. Then again, the enchantment of gold as a long-term funding has skilled a noteworthy surge since final 12 months.

Gold has soared from 15% to 26%, surpassing shares and claiming the place because the second most favored long-term funding, in accordance with Gallup’s respondents. “At the moment’s choice for shares is on the low finish of the 17% to 27% vary of Individuals selecting it since 2011,” Saad detailed.

In accordance with the Gallup Ballot creator, within the earlier 12 months, 8% of surveyed Individuals favored crypto property as their most well-liked long-term funding. Nevertheless, the enchantment of selecting cryptocurrency for long-term investments has dwindled to 4%. Saad attributed this decline to the FTX contagion and the worth hunch skilled by bitcoin (BTC) in 2022, which have dampened enthusiasm for crypto property.

The survey additionally highlighted an attention-grabbing development: when cryptocurrencies had been included as an choice within the ballot, individuals had been much less inclined to pick out shares, however their choice for shares elevated when crypto property weren’t among the many decisions. Whereas crypto property outperformed bonds as a long-term funding choice final 12 months, bonds garnered a rating of seven% within the newest ballot.

What are your ideas on the shifting panorama of long-term funding decisions revealed by the Gallup Ballot? Share your insights and tell us which funding choices intrigue you essentially the most within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link