[ad_1]

The Japanese yen is up 3.42% in opposition to the U.S. greenback on Tuesday because the Financial institution of Japan shocked the world by deciding to permit the benchmark rate of interest to rise to 0.5% from 0.25%. The Japanese central financial institution was one of many solely banks worldwide to carry off on elevating benchmark rates of interest, as policymakers have saved the federal government bond yield charge near zero since 2016.

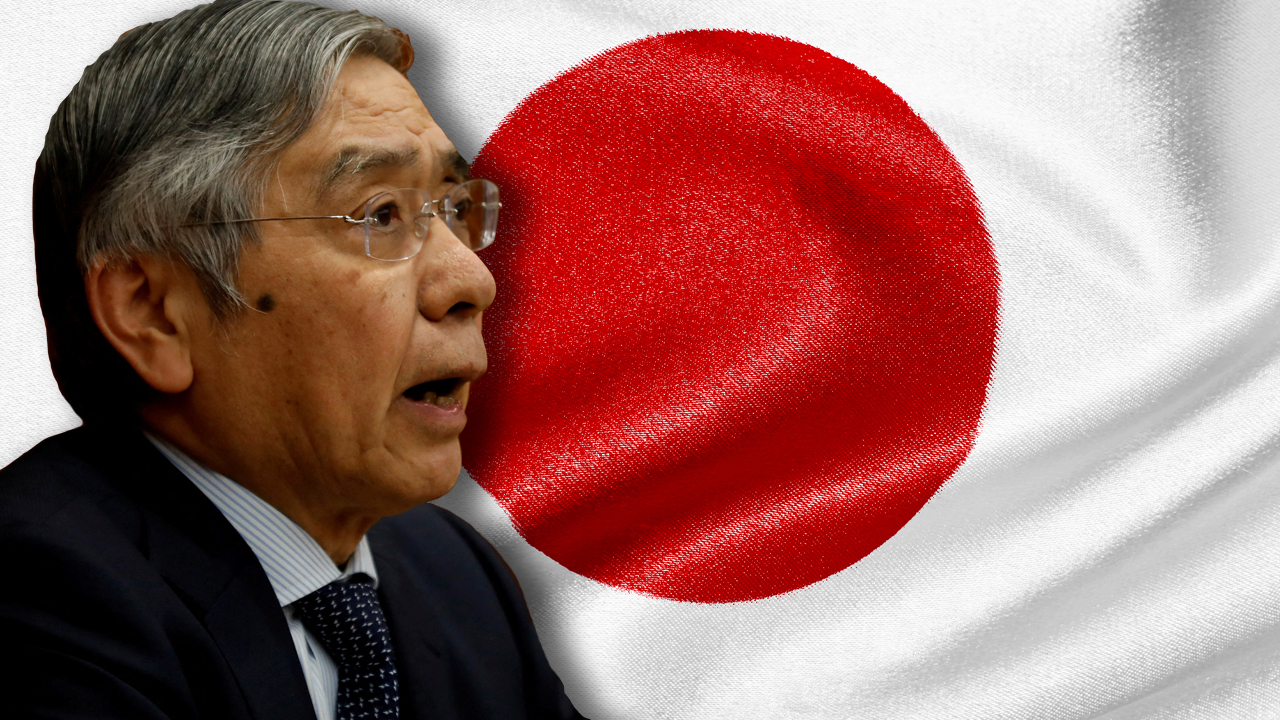

Japanese Central Financial institution Lifts Charges for the First Time in 6 Years

Over the last two months, there’s been a whole lot of dialogue surrounding the Financial institution of Japan’s (BOJ) governor, Haruhiko Kuroda, because the BOJ chief might be changed quickly by a successor. Kuroda, nevertheless, shocked world markets on Dec. 20, when he detailed that the BOJ would permit Japan’s 10-year bond yields to extend to 0.5% from the earlier higher restrict of 0.25%.

The transfer follows the yield curve management mechanism the Japanese central financial institution launched in Sept. 2016. The BOJ defined on Tuesday that the change goals to “enhance market functioning and encourage a smoother formation of all the yield curve, whereas sustaining accommodative monetary situations.”

Representatives from Mizuho Financial institution advised CNBC in an interview that the transfer mirrored the assumption that there might be a hawkish pivot from the BOJ going ahead. Nonetheless, these hawkish bets might not come to fruition the monetary establishment elaborated on Tuesday. “Widespread wager doesn’t imply that’s the coverage actuality or the supposed coverage notion,” Mizuho Financial institution added.

Gold bug and economist Peter Schiff is betting that the BOJ will elevate charges once more. “The Financial institution of Japan blinked and pivoted in the other way,” Schiff tweeted. “After artificially holding the 10-year JGB yield at .25%, the BOJ simply raised the goal charge to .5%. Extra hikes are coming. Within the U.S. this implies the greenback and asset costs will fall and inflation will rise.” Hedge fund supervisor James Lavish said the BOJ has tried to make one final objective.

“At this level, the Financial institution of Japan has pulled the goalie and is hoping for a last-second tying objective,” Lavish tweeted. “Perhaps get to additional time. Perhaps in some way pull it out. Besides they’re down 5-1. The sport is over, they usually simply don’t comprehend it but.”

At 8:41 a.m. (ET), the Japanese yen was up 3.42% in opposition to the U.S. greenback over the last 24 hours and 4% larger during the last 5 days. 30-day statistics point out the yen has gained 5.73% in opposition to the dollar as effectively. Six-month metrics present the yen is up 1.81% and year-to-date the yen is down 13.25% in opposition to the greenback.

What do you concentrate on the BOJ determination to permit charges to rise to 0.5% from 0.25% on Tuesday? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link