[ad_1]

After SEC’s motion on Binance, Bitcoin and the broader crypto market tanked immediately. Altcoins face heavy correction to the tune of 7-8% with Binance BNB struggling probably the most.

The submitting of the lawsuit by the US SEC towards crypto large Binance despatched shockwaves throughout all the cryptocurrency market on Monday, June 5. Over the past 24 hours, Bitcoin (BTC) and the broader cryptocurrency market have corrected by over 4%.

As of press time, the Bitcoin (BTC) value is down by 4% and is presently buying and selling at $25,778 with its market cap dropping beneath $500 billion. With the current transfer, Bitcoin has misplaced its most essential assist of $26,300, and this might additional drag the BTC value all the best way to $23,000.

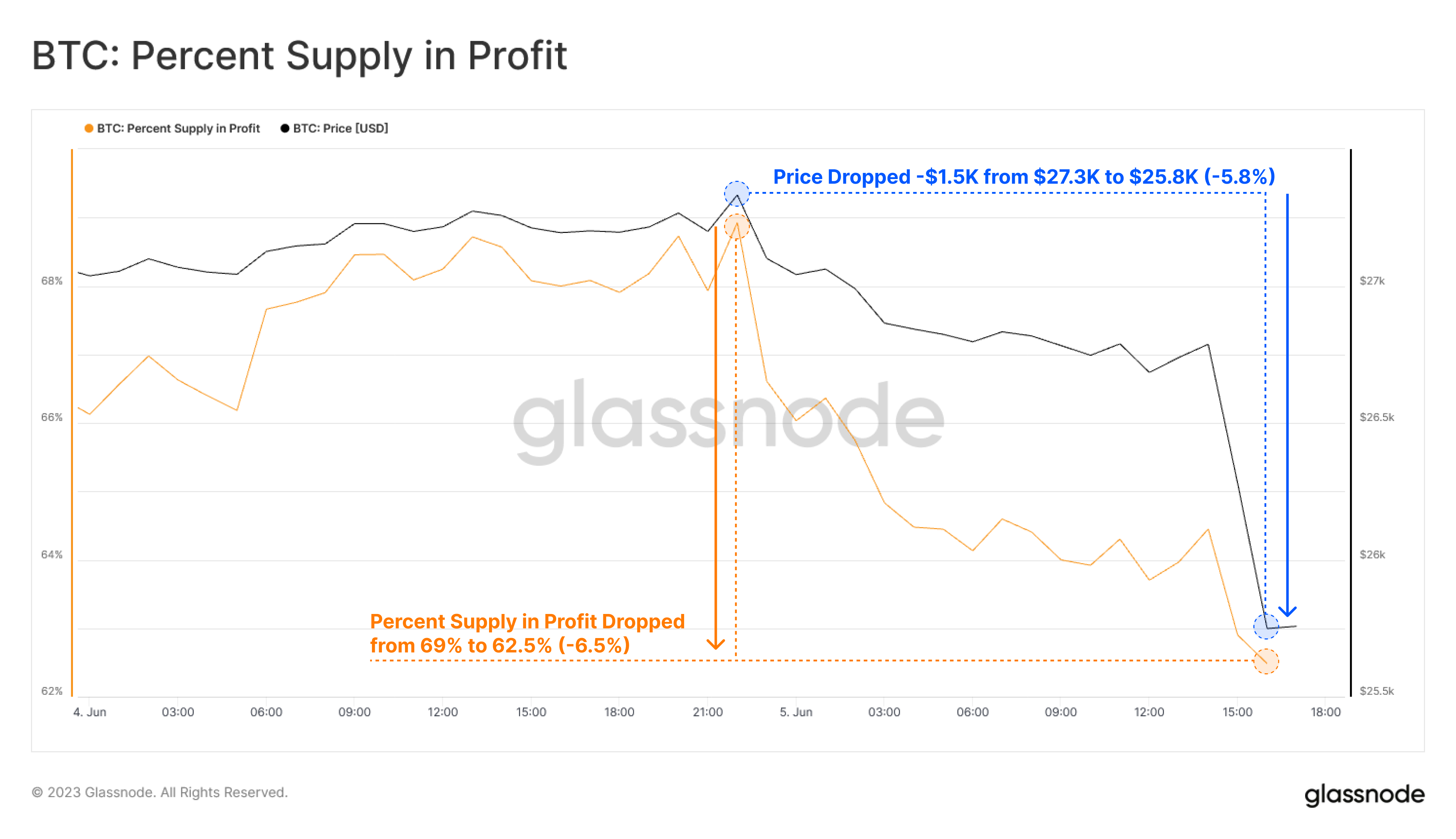

On-chain knowledge supplier Glassnode additional wrote:

“The current Bitcoin transfer downwards from $27.3K to $25.8K (-5.8%) has brought on the p.c provide in revenue to say no from 69% to 62.5% (-6.5%), plunging an extra 1.26M cash into loss.”

-

Picture: Glassnode

- After a powerful begin to the 12 months 2023, the world’s largest crypto cryptocurrency has come beneath promoting strain over the previous few weeks. It has already corrected by greater than 15% from its 2023 excessive of over $30,000.

Additionally, the US boosting its debt ceiling hasn’t helped Bitcoin traders a lot as they wait on the sidelines for the following FOMC assembly subsequent week on June 14. In its current report, on-chain knowledge supplier Glassnode wrote:

“As an more and more hostile regulatory surroundings is established within the US, capital seems to be flowing out, and eastward within the digital asset sector. A lot of this hints to a typically risk-off surroundings, with the remaining capital concentrating within the extra liquid majors, and a rising choice for Stablecoin capital.”

Altcoins Face Larger Correction

Together with Bitcoin, the altcoins have entered a deeper correction. In its lawsuit, the SEC has named altcoins like Binance BNB, Cardano’s ADA, Solana’s SOL, Polygon’s MATIC, Filecoin’s FIL and Algorand’s ALGO, for violating the securities legal guidelines by buying and selling on the Binance crypto trade.

The Binance BNB coin has confronted probably the most correction and is down by 9% within the final 24 hours. All of the above-mentioned altcoins have additionally corrected within the vary between 5-9% every.

On-chain knowledge from Dune analytics reveals that crypto trade Binance witnessed internet outflows of an enormous $635 million following the SEC’s lawsuit. It is going to be attention-grabbing to see how robust can Binance continues to remain towards the regulatory headwinds.

Binance and its chief CZ have obtained large assist from trade leaders. Cardano chief Charles Hoskinson has requested trade gamers to unite towards the authoritarianism of the SEC and different regulatory our bodies.

The entire market capitalization for #Crypto remains to be sustaining on the 200-Week MA and 200-Week EMA.

So long as that holds, and on condition that the ultimate celebration, #Binance, is receiving an assault, we is also reaching the low of this correction. pic.twitter.com/gAY7fig2ns

— Michaël van de Poppe (@CryptoMichNL) June 6, 2023

Nevertheless, traders needn’t panic instantly. In style crypto dealer and analyst Michael Van de Poppe famous that the crypto market remains to be sustaining above the 200-week transferring common (WMA).

subsequent

Bhushan is a FinTech fanatic and holds a very good aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in the direction of the brand new rising Blockchain Know-how and Cryptocurrency markets. He’s repeatedly in a studying course of and retains himself motivated by sharing his acquired data. In free time he reads thriller fictions novels and generally discover his culinary abilities.

[ad_2]

Source link