[ad_1]

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- BTC/USD tech evaluation

- BTC miners earned $5 billion in 2019

- Within the Bitcoin community, a $1.1 billion transaction happened

On W1, the Bitcoin quotations return to the beforehand damaged resistance degree of 50.0% Fibo. Such a pullback ought to be interpreted as short-term, meant only for testing the positions taken from above. Within the mid-term, the quotations are rising to the resistance line of lengthy scale at $11500.00.

On the similar time, the Stochastic and MACD are trying down, which implies bearish prevalence. The goals of the decline are as earlier than: 76.0% ($5700.00) Fibo and the fractal minimal of $3121.90.

Photograph: Roboforex / TradingView

On D1, the Bitcoin value is declining to the beforehand damaged resistance degree of the short-term channel of development. This example means the start of testing and the steady improvement of the start correction. The principle aim of testing is the assist space close to $7800.00. After a pullback testing, there might observe an impulse of development to the short-term aim on the degree of $9800.00.

Photograph: Roboforex / TradingView

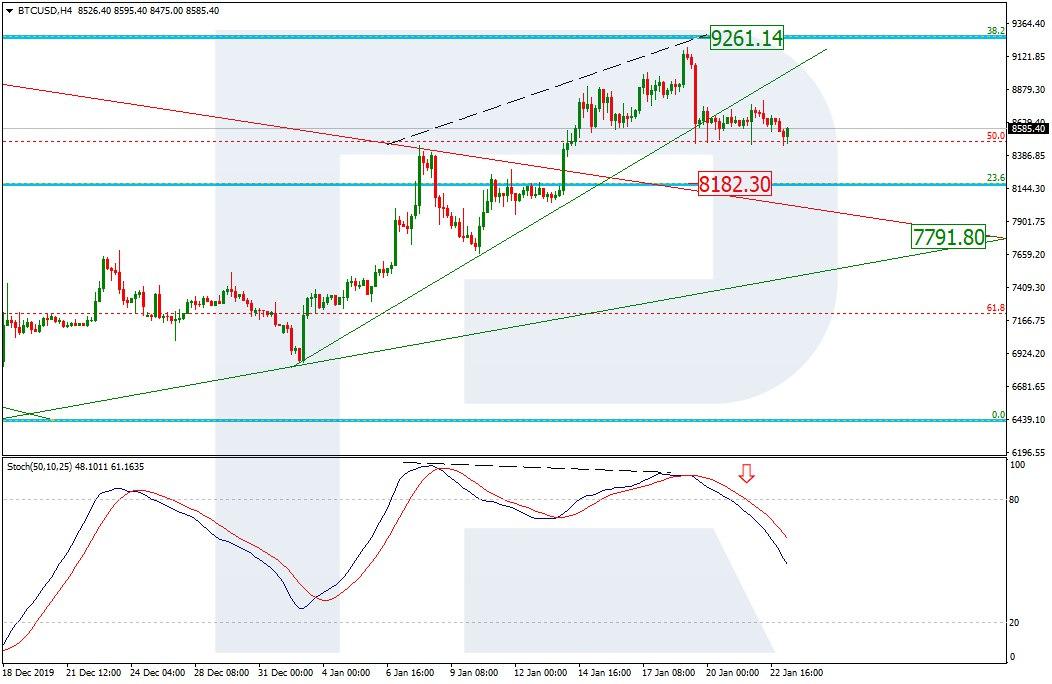

On H4, there’s a correction part after a wave of development and divergence on the Stochastic. The quotations are declining to the assist degree 23.6% ($8182.30) Fibo however the correction might lengthen to $7791.80.

Photograph: Roboforex / TradingView

Final yr, the Bitcoin miners earned some $5 billion, mining the cryptocurrency. Round $4.89 billion from this sum was rewards for mined blocks. Till Could 2020, the reward will stay with out change as 12.5 BTC per every block. Later, after the halving, the sum will lower two occasions to six.25 BTC per block.

As commissions for mining, a minimum of $146 million was acquired in 2019.

Concurrently, we will see that the revenue from mining is reducing easily. Say, in 2018 BTC miners earned $5.26 billion. In 2017, quite the opposite, the revenue was decrease, amounting to $3.19 billion.

In the course of January 2020, within the Bitcoin community there was carried out a transaction amounting to 124,946 BTC, or $1.1 billion. The identify of the transh proprietor stays unknown. Available on the market, they are saying that the fee for such a transaction was not more than $83.

It’s famous that the transaction could possibly be defined by easy transferring of cash from one pockets to a different. Final yr, such operations happened, first they appeared to be an try of hacking sure accounts and wallets, however later the model was rejected.

That is the attraction and the robust aspect of crypto transactions, as they are saying on the platform — it’s nearly unattainable to trace the volumes of finance.

Disclaimer: Any predictions contained herein are based mostly on the authors’ specific opinion. This evaluation shall not be handled as buying and selling recommendation. RoboForex shall not be held responsible for the outcomes of the trades arising from relying upon buying and selling suggestions and opinions contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European on-line overseas change foreign exchange dealer.

[ad_2]

Source link