[ad_1]

On Thursday, March fifth, the Bitcoin (BTC) began rising after the current fall. The coin is presently buying and selling at $9,081.94.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- BTC/USD tech evaluation: Bitcoin value has began rising.

- On Binance DEX, the BTC has fallen to 100 USD.

- Germany has acknowledged the BTC as a monetary instrument.

On W1, the quotations are testing the help space at 50.0% Fibo in relation to the earlier uptrend. Development to the principle resistance space and the extent 11500.00 USD is just not excluded. Nevertheless, on the MACD and Stochastic, the dynamics are descending, which signifies the potential of a decline to the goal ranges: 76.0% (5700.00 USD) and the low at 3121.90 USD.

Picture: Roboforex / TradingView

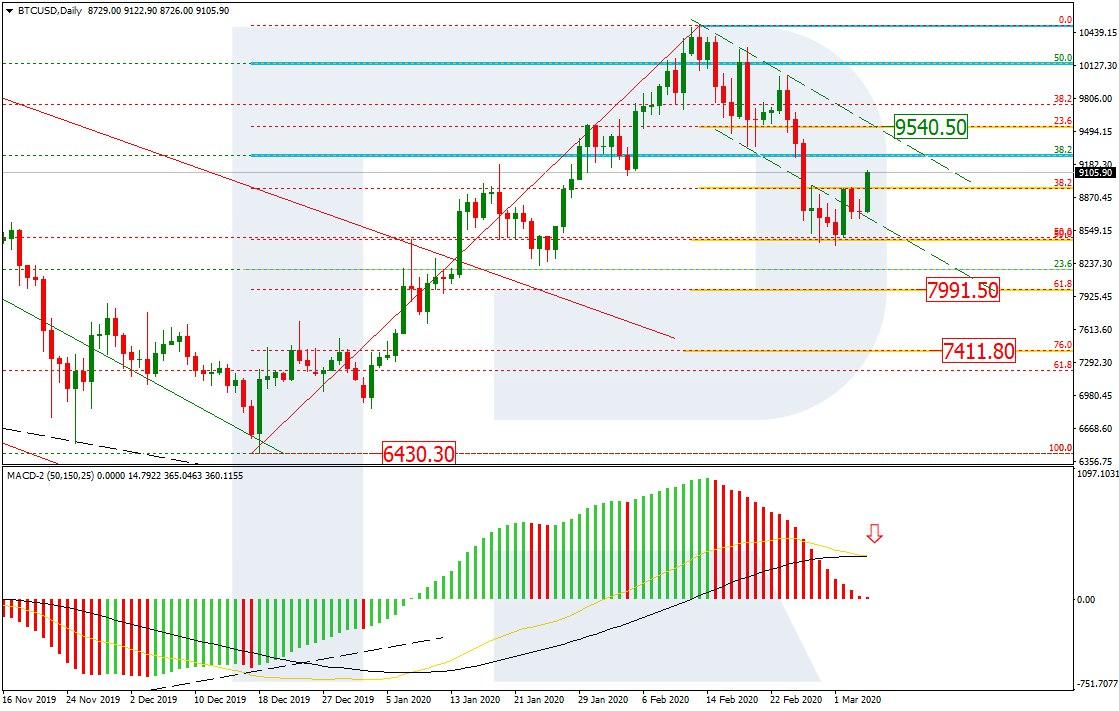

On D1, the quotations are returning contained in the earlier descending channel after a breakout of its decrease border and a check of 50.0% of the correction. The present progress is aiming on the resistance line and 9540.50 USD. On the similar time, on the MACD, there’s a Black Cross getting ready to type. This may occasionally imply that the expansion is short-term and the decline will proceed to 61.8% (7991.50 USD) and 76.0% (7411.80 USD) Fibo and the fractal minimal of 6430.30 USD.

Picture: Roboforex / TradingView

On H4, there may be an ascending correction occurring. The state of affairs of additional progress is supported by the ascending dynamics of the Stochastic. On this timeframe, the purpose for rising Bitcoin value is 9674.20 USD.

Picture: Roboforex / TradingView

This week, the BTC price has fallen to 100 USD – however solely on one alternate, Binance DEX. The falling occurred within the pair with the USDS; the decline of the BTC amounted to 98%. Later, the difficulty was defined by the technical upkeep of the principle platform as properly. Aside from this cause, the alternate and the speed might be influenced by low liquidity.

For the primary time, German authorities let themselves name the BTC a monetary instrument. The Federal Monetary Supervisory Authority (BaFin) outlined the standing of the cryptocurrency as a monetary instrument, referring to the truth that a number of establishments have the identical definition of the BTC. Therefore, the cryptocurrency could also be used as a method of fee and alternate, transferred, traded, and saved in digital type.

Within the BaFin assertion, additionally it is talked about that the cryptocurrency is a digital worth not issued by any state or Central financial institution and never essentially linked to any foreign money. Concurrently, the BTC doesn’t have the standing of a foreign money or a monetary means however is accepted for funds and different operations.

The choice of the German authorities will need to have grow to be the results of the requests from 40 main German banks for the permission to make operations with the BTC. In truth, the banks even have the so-called EU fifth directive, by which monetary entities might perform operations with digital cash offered that they keep away from cash laundering and financing suspicious actions of frauds and terrorists (Anti-Cash Laundering, or AML coverage).

Disclaimer: Any predictions contained herein are primarily based on the authors’ specific opinion. This evaluation shall not be handled as buying and selling recommendation. RoboForex shall not be held responsible for the outcomes of the trades arising from relying upon buying and selling suggestions and evaluations contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European on-line international alternate foreign exchange dealer.

[ad_2]

Source link