[ad_1]

Cryptocurrency markets have been climbing larger in worth as cash like BTC have gained over 19% over the past 90 days. Nevertheless, many different digital property have seen a lot bigger features and BTC dominance has been sliding downwards consecutively for the final 14 days.

Additionally Learn: Craig Wright’s $100B Theft Declare – BTC and BCH Used His Database With out Permission

BTC’s Ratio of Market Dominance Sinks to 60%

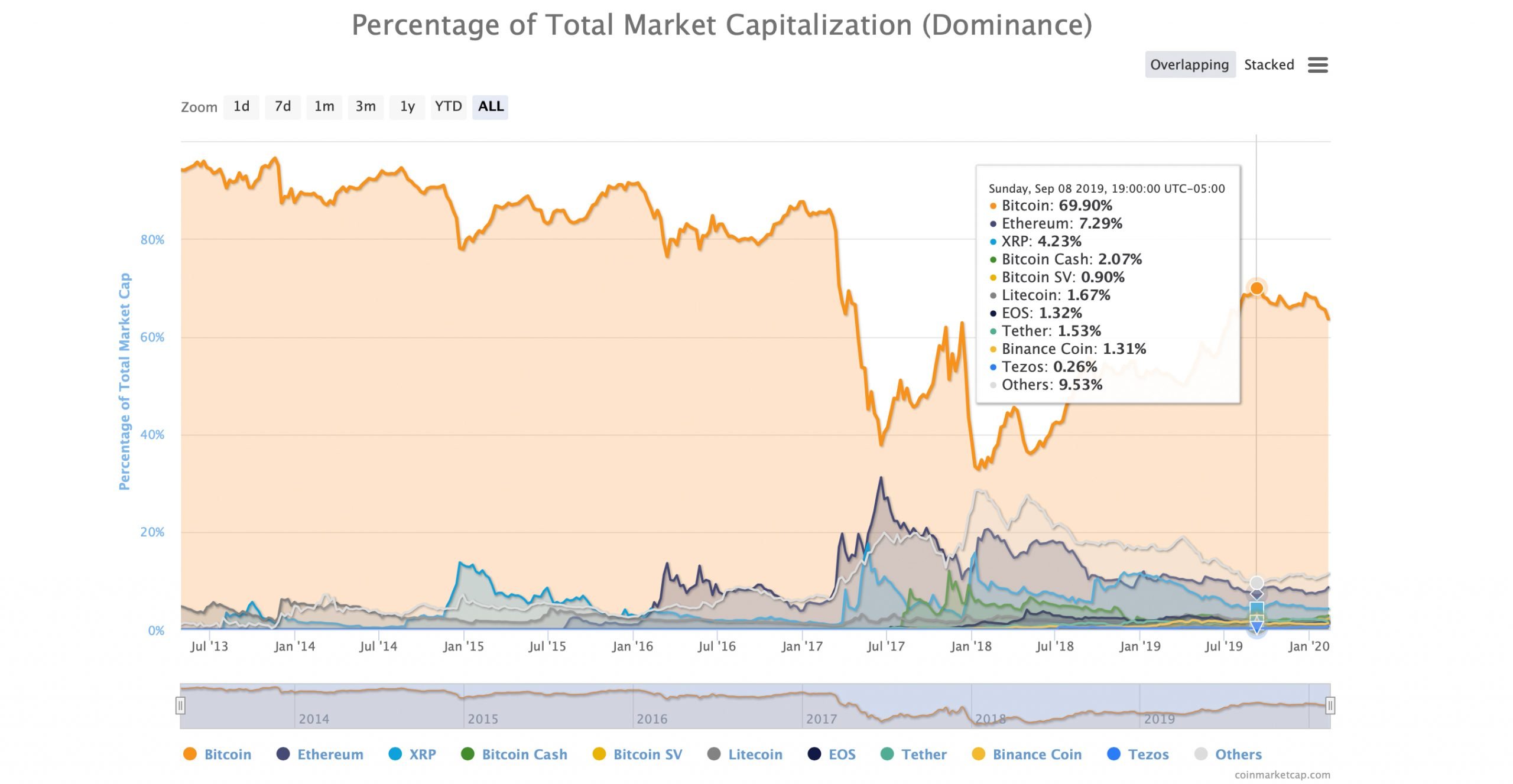

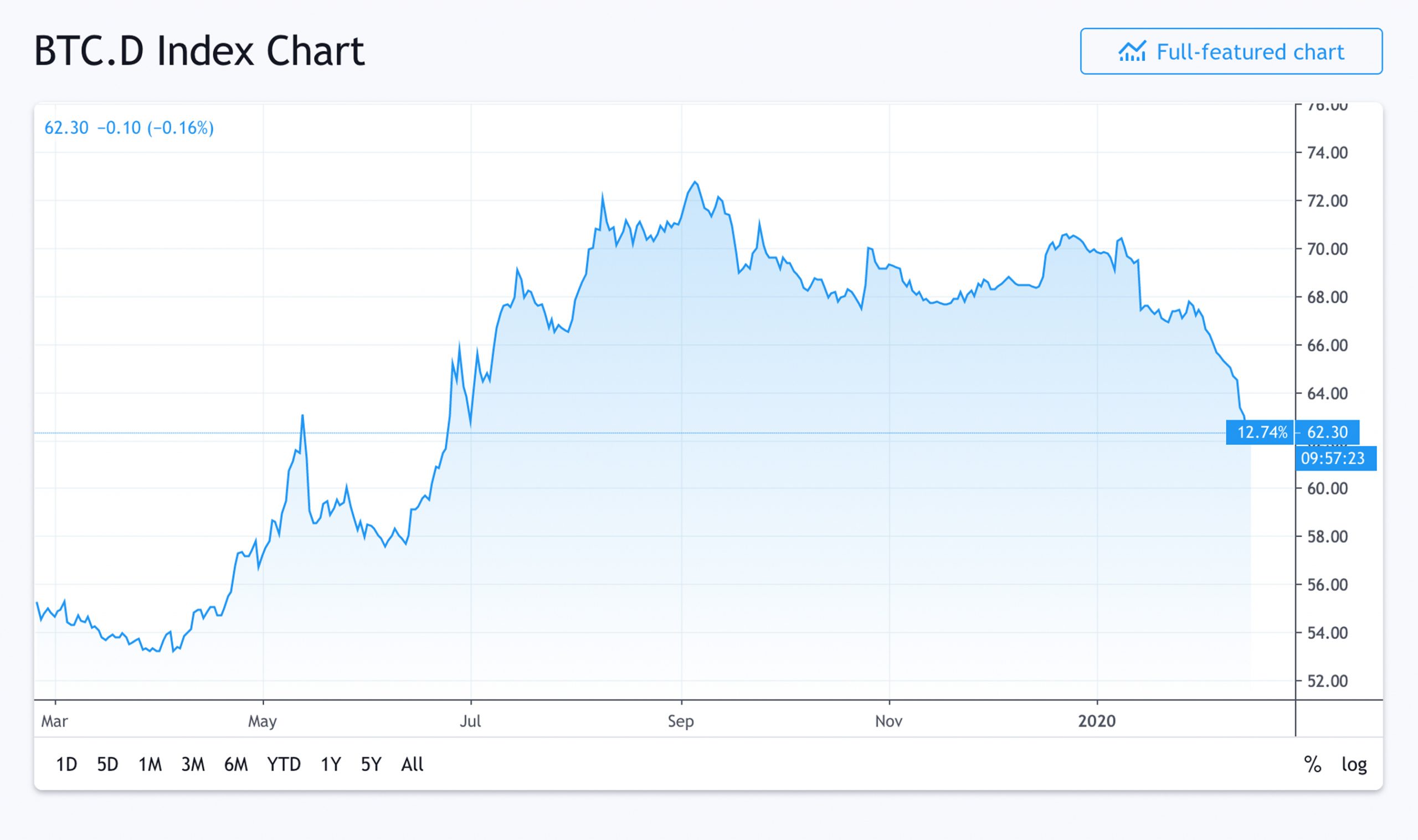

Throughout the previous few weeks, BTC dominance has dropped from a excessive of 70% to a low of 60%. The time period and metric BTC dominance is the ratio of BTC’s market capitalization versus all the opposite coin market caps. So the present market valuation of the complete cryptoconomy is round $305 billion and BTC captures 61% of that at the moment with a market valuation of round $186 billion. BTC has at all times been the world’s largest cryptocurrency by market capitalization and previous to February 2017, the asset captured greater than 80% of the complete cryptoconomy for eight years straight. Nevertheless, the video tweet beneath shared in 2018 exhibits how crypto dominance metrics can change drastically over time.

The evolution of the altcoin market share and BTC dominance #cryptocurrency #cryptosec #Crypto #cryptotwitter #altcoins #cryptotrader #cryptotrading #blockchain #btc #eth #bch #eos #ltc #xrp #bitfinex #cryptoexchange #binance #bitmex #crypto #cryptocurrencynews#cryptotrading pic.twitter.com/1IcerX7BHC

— Cryptosec (@vivasatori) September 15, 2018

After February 26, 2017, BTC dominance slid from 85% to a low of 40% one month later. On the similar time, Ethereum (ETH) spiked to an all-time excessive of 31% of the cryptoconomy’s total valuation and XRP was at 17%. Quite a few individuals imagine that BTC’s rising community charges and clogged backlog (mempool) of transactions in 2017 and 2018 attributed to the decline. Alongside this, many crypto proponents and merchants referred to the time as “alt season,” through which quite a lot of different digital property scale back BTC’s share of the complete coin market cap.

After BTC dropped to a low of 40%, the dominance metric slid even decrease in January 2018 as BTC dominance was round 33%. Since then, the digital forex has regained plenty of market cap dominance and BTC had risen to shut to 70% on September 8, 2019. Nevertheless, after the leap to 70%, BTC’s share of the cryptoconomy has been sliding as soon as once more. From September’s excessive of 70%, BTC dominance has dropped all the way down to 60% on February 15, 2020, dropping roughly 10%. The sliding metric has been resulting from different digital property which have achieved much better percentage-wise so far as features are involved. As an example, over the past 90 days, BTC has gained 19%, however ETH jumped 52%, XRP 26%, BCH 82%, and BSV rose by 185% in that point interval. BTC dominance has slid consecutively for the final 14 days straight to its present low and solely at the moment has it began to rise once more barely. It’s been one of many longest downward slides for BTC dominance since September 2018.

Are Market Valuations and Dominance Essential Metrics?

Though BTC dominance is a metric utilized by crypto market value aggregation web sites, many proponents don’t imagine the information displays any actual worth. Market caps solely replicate the present price of each coin circulating in real-time and a few individuals assume the information might be skewed. Even supposing a variety of crypto proponents imagine market caps and dominance are insufficient worth metrics and don’t essentially replicate the challenge’s actual price, these metrics are utilized by nearly all of crypto fans. Within the early days, after property like namecoin, ripple, litecoin, and mastercoin appeared, the web site coinmarketcap.com was developed and the general public had been capable of examine cash based mostly on market valuations. There’s now a fantastic number of coin market cap aggregation web sites that present comparable information and supply different statistics too like commerce volumes.

Regardless of some believing that market cap lists should not a superb reflection of actual worth, people discover the information essential. As talked about above, traders imagine there are vital causes for BTC dominance declines, whether or not it was the community stress or alt season that prompted the decline from 85% to 33%. Market caps and dominance metrics present traders the extent of threat concerned as small-caps, mid-caps, and large-caps see various kinds of actions.

Historically, mid to small market caps are way more risky than larger-cap cryptocurrencies they usually can spike in value and drop in worth in a short time. Folks view market valuation and dominance as a reliability metric as a result of giant caps often current much less threat to traders. Smaller crypto market caps present traders with high-risk buying and selling conditions which might be good or dangerous relying on how the person is buying and selling.

The truth that BTC misplaced 61% of the dominance it commanded over the complete cryptoconomy between February 2017 and January 2018 is a metric of nice significance to plenty of crypto fans. When BTC’s dominance climbed from 33% again to 70%, some maximalists and hardcore BTC supporters stated that “altcoins had been dying.” Though ever since this, altcoin values have been outperforming BTC by an extended shot. Lesser recognized cash are additionally outpacing many cash within the high 20. BCH and ETH’s rise over the past 90 days did outperform BTC, however cash like presearch (PRE 2,641%), cryptaur (CPT 1,351%), htmlcoin (HTML 333%), vetri (VLD 322%), and Digixdao (DGD 308%) did even higher.

The place do you see the cryptocurrency markets heading from right here? Tell us what you concentrate on this topic within the feedback part beneath.

Disclaimer: Value articles and market updates are supposed for informational functions solely and shouldn’t be thought-about as buying and selling recommendation. Neither Bitcoin.com nor the writer is answerable for any losses or features, as the last word resolution to conduct a commerce is made by the reader. All the time keep in mind that solely these in possession of the non-public keys are accountable for the “cash.” Cryptocurrency costs referenced on this article had been recorded on February 15, 2020, at 9:30 a.m. ET.

Photographs by way of Shutterstock, Buying and selling View, Bitcoin.com Markets, Twitter, coinmarketcap.com, Truthful Use, Pixabay, and Wiki Commons.

Need to create your individual safe chilly storage paper pockets? Test our instruments part. You can even benefit from the simplest way to purchase Bitcoin on-line with us. Obtain your free Bitcoin pockets and head to our Buy Bitcoin web page the place you’ll be able to purchase BCH and BTC securely.

[ad_2]

Source link