[ad_1]

A senior analyst at RoboForex shares his insights into the long run eventualities for Bitcoin, Ethereum, Litecoin, EOS and Bitcoin Money worth motion.

Dmitriy Gurkovskiy, a senior analyst at overseas trade dealer RoboForex, offers his imaginative and prescient of the attainable tendencies in worth modifications for Bitcoin in addition to for different main cryptos.

The market of digital property retains rising confidently. As soon as once more, we are able to see the principle cash check the resistance ranges, nevertheless, the bears have but failed to impress any critical decline. That’s the reason the present ranges might be simply damaged out quickly. In the mean time, there are not any critical causes for a descending correction. Nevertheless, if the decline does occur, it’s going to solely present the patrons with conservative ranges. The stress from the bulls stays actually sturdy, and after a minimal decline the market restores shortly and rushes at new heights. An try of progress from the present ranges shouldn’t be excluded: with the patrons so aggressive, the market could quickly check the native highs.

Bitcoin

On D1, the quotations of the cryptocurrency are caught in one other resistance space. There’s a threat of a minor correction with a check of the damaged border of the descending channel at $9195. AS we see, the RSI values don’t go away the overbought space, which signifies stress from the patrons. Nevertheless, the event of a correction will give much more energy to the present ascending impulse. The potential for additional progress can even be supported by a check of the help line on the RSI. In the mean time of the correction, the costs can even check the Shifting Averages, which make provoke a bounce and additional progress. The MAs have already crossed in favor of the bullish development. The conservative space for a very good bounce is true between them. The subsequent goal of the expansion would be the space of $12400. Right here lies yet one more resistance degree. The situation, constructive for the bulls, could now not be legitimate if the costs fall and safe below $8355, wherein case we must always count on additional declining to $6875.

Photograph: Roboforex / TradingView

On H4, the costs are additionally rising. Right here, we are able to see fixed bounces off the MA, the costs eve fail to fall beneath the higher line. Such actions additionally point out the energy of the bulls. The RSI values are pushing off their resistance degree, which additionally signifies the presence of a very good ascending impulse. So long as the quotations re rising contained in the channel, additional progress ought to be anticipated. The primary signal of the tip of the expansion shall be a breakout of the decrease border of the channel and securing below $9195, wherein case we must always count on additional correction.

Photograph: Roboforex / TradingView

Ethereum

The ETH quotations continue to grow aggressively. By now, the costs have reached the higher border of the descending channel. There’s a threat of a correction to $225. As we are able to see, this space has already been a robust resistance degree. Thus, till the costs escape the channel, we must always count on an try of a descending correction, and after the escape – additional progress. The goal of the expansion could also be on the native excessive of $360. This situation shall be confirmed by securing above $260. The situation could also be canceled by a decline beneath $225, wherein case we must always count on additional descending correction to $155.

Photograph: Roboforex / TradingView

On the smaller timeframes of the Ethereum, the bulls are additionally aggressive. As we might even see, after a check of the help line on the RSI, the costs went additional up. The quotations are additionally pushing off the MAs – all these components point out a robust bullish development. The closest help space is at $225, the decrease border of the ascending channel lies right here as effectively. So, as the principle buying and selling thought, we must always count on a check of the border of the channel and additional progress with the primary goal at $287. The situation is likely to be canceled by a breakout of the decrease border of the channel and securing below $200, wherein case the goal of the decline shall be at $155.

Photograph: Roboforex / TradingView

Litecoin

The patrons have pushed the Litecoin to a brand new resistance degree. As we are able to see, with a breakout of this are, the following aim lies on the space of $100. Such aggressive progress shall be supported by a check of the ascending trendline on the RSI. The costs hold pushing confidently off the sign traces on the Ichimoku Kinko Hyo, which signifies a bullish impulse. The expansion shall be confirmed by a breakout of the higher border of the descending channel and securing above $90. The situation of progress could also be canceled by a really sturdy decline beneath $50. On this case, the decrease border of the Cloud shall be damaged, which would be the finish of the uptrend.

Photograph: Roboforex / TradingView

On H4, the costs hold transferring inside an ascending channel. The development stays slightly sturdy on smaller timeframes as effectively; the costs are above the cloud. The closest help degree is at $72. That’s the reason we must always not exclude a correction to this space earlier than additional progress. An extra sign supporting the expansion shall be a bounce off the help line on the RSI. The situation could now not be legitimate if the decrease border of the Cloud is damaged out, and the quotations safe below $72. In that case, we must always count on additional declining with the goal at $56.

Photograph: Roboforex / TradingView

EOS

On D1, the EOS quotations have escaped the descending channel. The MAs have crossed, confirming additional progress. Te subsequent goal of the expansion stands out as the space of $6.70. The closest help is at $4.15. As a mid-term buying and selling thought, we could count on a minor correction with a check of the damaged border of the descending channel close to $4.35. From there, we would count on additional progress. This motion shall be supported by a check of the descending trendline on the RSI. The situation could also be canceled by a decline beneath $4.05, wherein case we must always count on a decline to $2.35.

Photograph: Roboforex / TradingView

On the smaller timeframes, the RSI values are squeezed inside a Triangle sample. A breakout of such a construction upwards will ship the quotations even greater, with the potential goal at $6.70. The expansion could now not occur if the decrease border of the ascending channel is damaged out, and the quotations safe below $4.45. On this case, there’s a threat of a robust descending correction. Nevertheless, whereas the costs stay inside an ascending channel, we must always count on additional progress.

Photograph: Roboforex / TradingView

Bitcoin Money

The patrons try to safe above the higher border of the descending channel. Within the case of profitable progress to the extent of $520, we must always count on additional progress above $750. This situation can be confirmed by a bounce off the help line on the RSI. The situation could now not be legitimate if the quotations fall beneath $375, which can imply a breakout o the decrease border of the ascending channel and additional correction to $230.

Photograph: Roboforex / TradingView

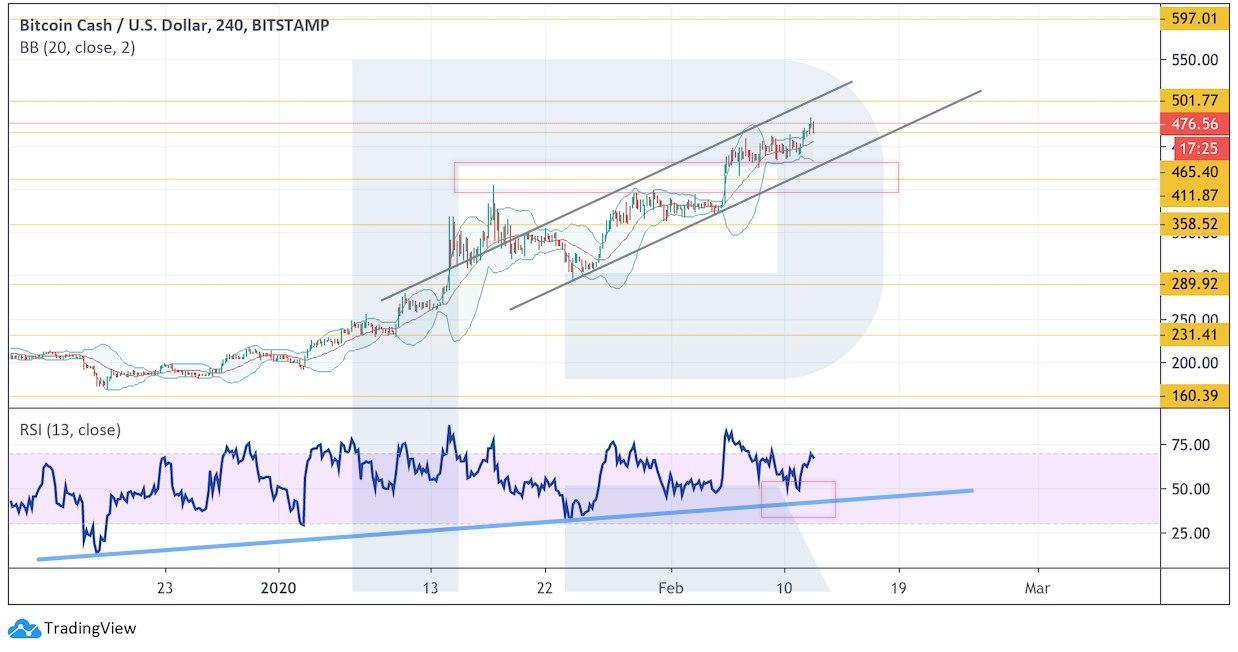

On H4, the quotations hold transferring up contained in the channel. The present construction of the value motion is symmetrical, that means additional progress with the goal at $595. A robust sign supporting the event of the ascending impulse shall be one other bounce off the trendline on the RSI. The thought shall be confirmed by a breakout of the resistance space and securing above $500. The constructive situation could also be canceled by falling and a breakout of $465, which can imply an escape from the ascending channel and additional declining.

Photograph: Roboforex / TradingView

Disclaimer: Any predictions contained herein are primarily based on the authors’ explicit opinion. This evaluation shall not be handled as buying and selling recommendation. RoboForex shall not be held responsible for the outcomes of the trades arising from relying upon buying and selling suggestions and critiques contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.

[ad_2]

Source link