[ad_1]

The cryptomarket is recovering after ending one other descending wave. Nonetheless, there are not any clear alerts for additional uptrend to date.

Dmitriy Gurkovskiy, a senior analyst at overseas alternate dealer RoboForex, gives his imaginative and prescient of the attainable tendencies in value modifications for Bitcoin in addition to for different main cryptos.

Bitcoin continues to be shifting beneath an vital space and solely a breakout of $10,400 could point out a brand new bullish rally. Ethereum is wanting fairly sturdy. Right here, the pair is as soon as once more shifting to check the resistance space regardless of bears’ makes an attempt to repair beneath $218 and full a Double Prime reversal sample. If the bullish strain continues and so they break $255, it could point out that the sideways motion is over and the asset could resume rising in direction of new highs. Each Litecoin and Bitcoin Money proceed shifting inside their respective long-term sideways channel, which neither bulls nor bears have been in a position to break. Nonetheless, it’s very important to do not forget that if such channels are lastly damaged, attainable targets could also be on the distance equal to those channel’s width. That’s why, after the property break their channels, they might begin sturdy actions within the path of a breakout.

Bitcoin

Within the every day chart, Bitcoin is testing the draw back border of a Triangle sample. There’s a potential for an extra decline in direction of $7,425 whereas finishing the sample. One other sign in favor of this concept will probably be a rebound from the resistance lien on the RSI: proper now, the indicator is testing this line. To verify this state of affairs, the worth should break the help space and repair beneath $8,695. Nonetheless, this state of affairs could now not be legitimate if the asset breaks $10,085. On this case, the Triangle sample will probably be canceled and the instrument could proceed buying and selling upwards to achieve $10,635. This motion could begin a string ascending tendency.

Picture: RoboForex / TradingView

As we are able to see within the H4 chart, BTC/USD is correcting throughout the channel; right here, the cryptocurrency has been shifting sideways because the finish of June. Often, if the market breaks such a channel, it strikes within the path of a breakout and covers the gap equal to the width of this motion. The closest resistance is at $9,510. The cryptocurrency is predicted to check the descending channel’s upside border after which resume falling with the primary goal at $8,835. A powerful sign in favor of this state of affairs will probably be a rebound from the resistance line on the RSI. To verify this state of affairs, the instrument should break the help space and repair beneath $8,835. On this case, the following draw back goal could also be at $8,250.

Picture: RoboForex / TradingView

Ethereum

ETH/USD is again to testing the descending channel’s upside border, which can point out a major bullish strain. Nonetheless, so long as the asset is shifting beneath $255, the “progress” state of affairs received’t be efficient. Proper after the pair breaks the descending channel, bulls could begin a brand new ascending tendency. The important thing buying and selling thought implies a rebound from the resistance line on the RSI, which will probably be a robust sign in favor of a rebound on the worth chart and an extra decline in direction of the help space at $218. After breaking it, the instrument could proceed falling to achieve the following one at $177.

Picture: RoboForex / TradingView

On shorter timeframes, the worth can also be shifting upwards and will take a look at the descending channel’s upside border within the nearest future. We must also be aware that bears have failed to interrupt the help space and repair beneath $218. If it occurs, the worth could go away the rising channel and begin a correct decline in direction of $196 and even deeper. A sign in favor of this state of affairs is a rebound from the resistance line on the RSI. As we are able to see, prior to now the worth did transfer downwards when the indicator was testing the road.

Picture: RoboForex / TradingView

Litecoin

Litecoin is again inside a Triangle sample, thus indicating a critical bullish strain. Furthermore, bears have failed to interrupt the help space and repair beneath $38. Nonetheless, in the intervening time, the RSI indicator is testing the resistance line and a profitable rebound from the road could trigger one other descending wave on the worth chart. Nonetheless, the bearish state of affairs could now not be legitimate if the asset breaks the resistance space and fixes above $51. After that, the instrument could proceed buying and selling upwards with the goal at $68.

Picture: RoboForex / TradingView

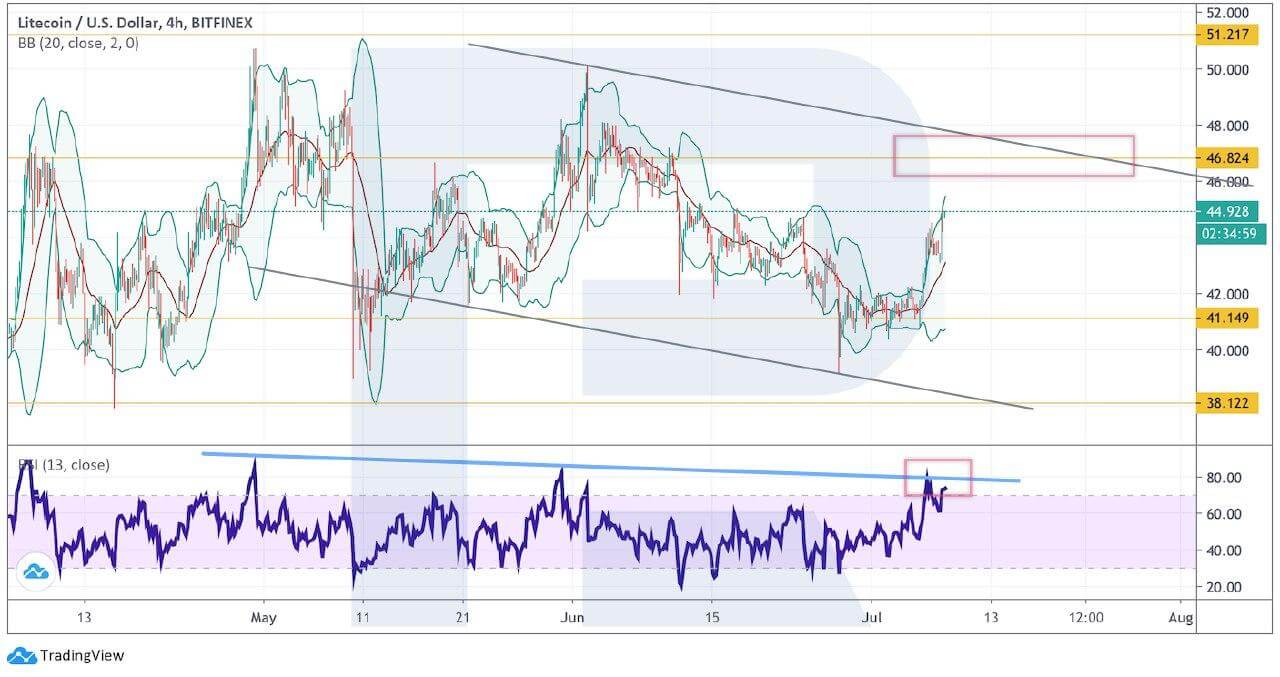

As we are able to see within the H4 chart, LTC/USD is rising whereas forming a “5-0” bearish sample. Later, the pair is predicted to proceed rising and take a look at the sample’s upside border at $46.80. after this motion is full, the cryptoasset could resume falling with the goal at $38. A powerful sign in favor of an extra decline will probably be one other rebound from the resistance line on the RSI. Nonetheless, the bearish state of affairs could also be canceled if the market breaks the descending channel’s upside border and fixes above $48. On this case, the instrument could proceed buying and selling upwards to achieve $51 and even break it.

Picture: RoboForex / TradingView

Bitcoin Money

As we are able to see within the every day chart, the scenario is sort of much like Litecoin: the asset has failed to interrupt the help space and cease its long-running sideways channel. Nonetheless, the RSI indicator is presently testing the resistance line, that’s why one shouldn’t exclude a brand new decline proper from the present ranges. Nonetheless, this bearish state of affairs could now not be legitimate if the pair continues rising to interrupt the resistance space and repair above $280. After that, the instrument could proceed buying and selling upwards to achieve $356.

Picture: RoboForex / TradingView

Within the H4 chart, Bitcoin Money is rising in direction of the descending channel’s upside border. One ought to anticipate the worth to check $250, rebound from it, after which begin a brand new decline in direction of $204. One other sign in favor of this concept will probably be a rebound from the resistance line on the RSI. Nonetheless, this state of affairs could also be canceled if the market breaks the descending channel’s upside border and fixes above $260. On this case, the asset could proceed buying and selling upwards to achieve $280 and even break it.

Picture: RoboForex / TradingView

XRP

Within the every day chart, XRP is recovering slightly aggressively. The RSI indicator hasn’t reached the resistance line but however could rebound from it sooner or later, thus forcing a brand new decline of the worth. One ought to anticipate the pair to proceed the bullish correction after which take a look at 0.2160. This take a look at could lead to a brand new descending motion. Nonetheless, this state of affairs could now not be legitimate if the instrument breaks $0.22. On this case, a Head & Shoulders reversal sample, which continues to be efficient proper now, could also be canceled and the asset could proceed buying and selling upwards.

Picture: RoboForex / TradingView

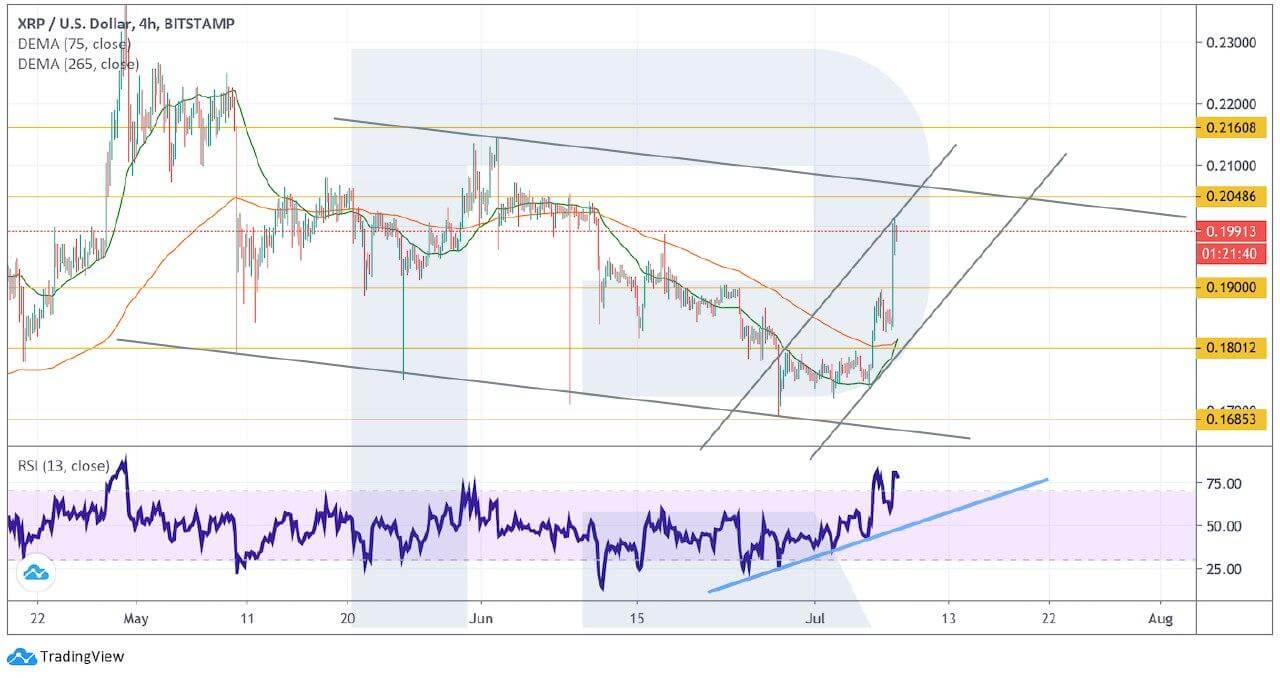

Shorter timeframes present a robust bullish impulse, that’s why a sign to promote could also be a breakout of the ascending trendline on the RSI. On this case, the worth might also break the rising channel’s draw back border. The closest draw back goal could also be at $0.1685. Nonetheless, this state of affairs could also be canceled if the instrument breaks $0.2050. After that, the asset could go away the descending channel and proceed buying and selling upwards to achieve $0.2160 and even increased.

Picture: RoboForex / TradingView

Disclaimer: Any predictions contained herein are based mostly on the authors’ specific opinion. This evaluation shall not be handled as buying and selling recommendation. RoboForex shall not be held accountable for the outcomes of the trades arising from relying upon buying and selling suggestions and opinions contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European on-line overseas alternate foreign exchange dealer.

[ad_2]

Source link