[ad_1]

A senior analyst at RoboForex shares his insights into the long run eventualities for Bitcoin, Ethereum, Litecoin, XRP and Bitcoin Money worth motion.

Dmitriy Gurkovskiy, a senior analyst at international trade dealer RoboForex, supplies his imaginative and prescient of the doable tendencies in worth adjustments for Bitcoin in addition to for different main cryptos.

Bears proceed pushing costs of property to the draw back as they broke the closest assist ranges once more. Within the every day chart of Bitcoin, an excellent stage to rebound upwards from is $7335. Nonetheless, if bears break this stage as effectively, the instrument might check the closest native low at $6395.

Inside the given situation, it’s fascinating to look at Ethereum and Litecoin, as a result of they’ve higher probabilities to rebound upwards. Nonetheless, bulls should push costs a bit larger in order that they may return above key ranges. But when the present assist ranges are damaged, property might begin extra vital downtrends.

We mentioned earlier {that a} doable descending correction might present us with new ranges to open lengthy positions. Nonetheless, will probably be higher to search for confirmations on shorter timeframes, however they haven’t proven any indicators of latest progress of the cryptocurrency market to this point.

Bitcoin

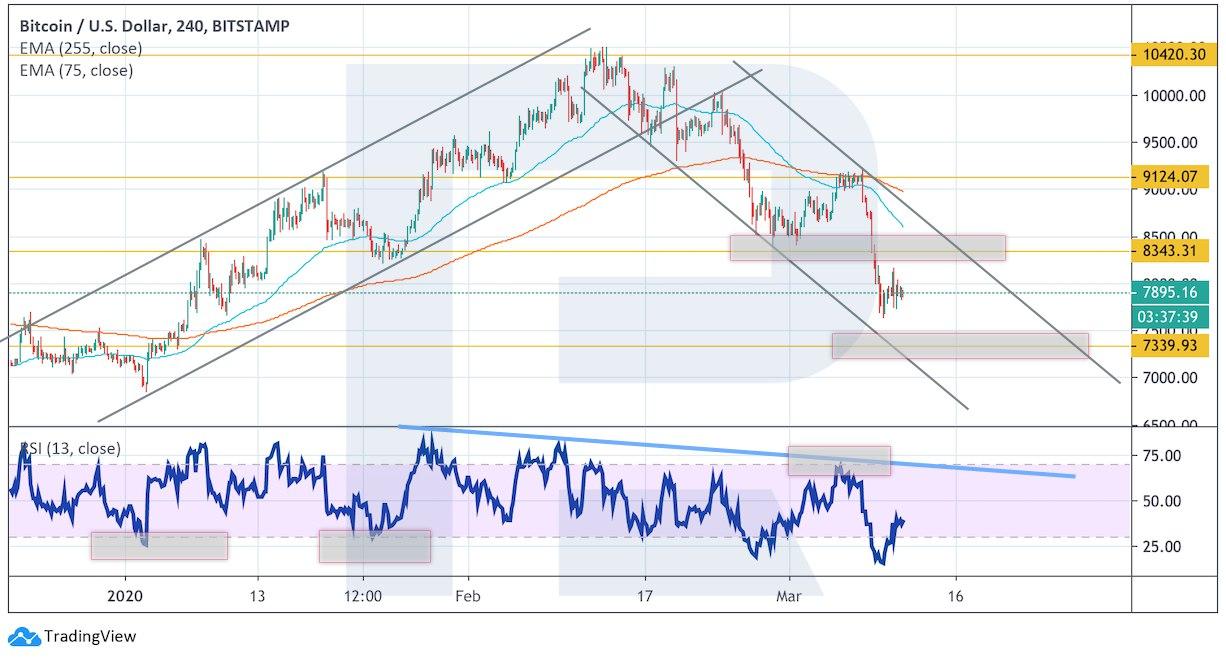

Within the every day chart, bears managed to interrupt one other assist stage. As we are able to see, even contemplating the present decline, the RSI hasn’t reached the trendline but, that’s why it’s too early to indicate a reversal. Furthermore, the worth has damaged the realm between Shifting Common to the draw back, thus indicating a big bearish strain. The mid-term buying and selling concept suggests anticipating an additional decline, a check of $7335, and a doable progress from this stage. Nonetheless, so long as the worth doesn’t break the native low and repair under $6075, one can anticipate one other rebound to the upside. An important sign right here shall be a affirmation from shorter timeframes.

Picture: Roboforex / TradingView

As we are able to see within the H4 chart, the worth has rebounded from Shifting Averages, which point out a mid-term bearish impulse. The RSI can also be rebounding from the descending trendline. All these components taken collectively verify continued strain from bears, that’s why the worth might but simply check the assist space at $7335 within the nearest future. The rising tendency might resume solely after the asset breaks the descending channel’s upside border and fixes above $8500. In the meantime, bearish strain stays relatively robust.

Picture: Roboforex / TradingView

Ethereum

As for Ethereum, bulls managed to maintain the worth between Shifting Averages, which signifies that it could try and rebound from these ranges to the upside. Additionally, right here we are able to see an necessary assist stage near $190. Nonetheless, the RSI hasn’t dropped decrease than 30 but, to allow them to’t verify the “new-growth” situation. Along with that, we shouldn’t exclude the opportunity of a extra severe check of the assist space and a rebound with the primary goal at $240. Nonetheless, this situation might longer be legitimate if the instrument breaks the channel’s draw back border and fixes under $150. On this case, the draw back goal shall be $115.

Picture: Roboforex / TradingView

On shorter timeframes, there’s a excessive potential for the formation of a Wedge reversal sample. Nonetheless, the draw back goal space continues to be the assist stage between $195-180. After testing this space, the worth might try and reverse. To substantiate this situation, the worth should break the Wedge’s upside border and repair above $215. Nonetheless, this situation could also be canceled if the pair breaks the sample’s draw back border. On this case, the asset might enhance its decline and attain $115 in a short time.

Picture: Roboforex / TradingView

Litecoin

Within the every day chart, Litecoin is transferring very near the draw back border of a “5-0” ascending sample. It’s essential for bulls to place the worth again contained in the rising channel within the nearest future and attempt to get better in the direction of $65. A superb sign to verify a rebound to the upside is a check of the assist space on the worth chart, however the RSI hasn’t reached the trendline but. One other sign to verify a brand new progress is a breakout of the medium line of Bollinger Bands: right here we are able to see a breakout of the indicator’s draw back border, which signifies a powerful bearish strain. If bulls fail to get again contained in the channel, the draw back goal could also be at $35.

Picture: Roboforex / TradingView

As we are able to see within the H4 chart, the worth continues falling contained in the descending channel. In the meanwhile, there’s a risk of correction in the direction of the resistance stage at $56 and additional decline with the expected goal at $35. This situation could also be confirmed by a rebound from the resistance line on the RSI. Nonetheless, the unfavourable situation could also be canceled if the worth breaks the descending channel’s upside border and fixes above $60. On this case, the instrument might end the descending impulse and begin a correct rising motion.

Picture: Roboforex / TradingView

XRP

Within the every day chart, XRP continues falling; it’s transferring under Ichimoku Kinko Hyo Cloud, thus indicating a bearish tendency. Additionally, right here we are able to see the rising channel’s draw back border and the worth might rebound upwards to check the resistance stage near $0.26. nevertheless, to renew the ascending tendency, bulls should push the worth larger than $0.31. On this case, the instrument might break the channel’s upside border and attempt to attain $0.37.

Picture: Roboforex / TradingView

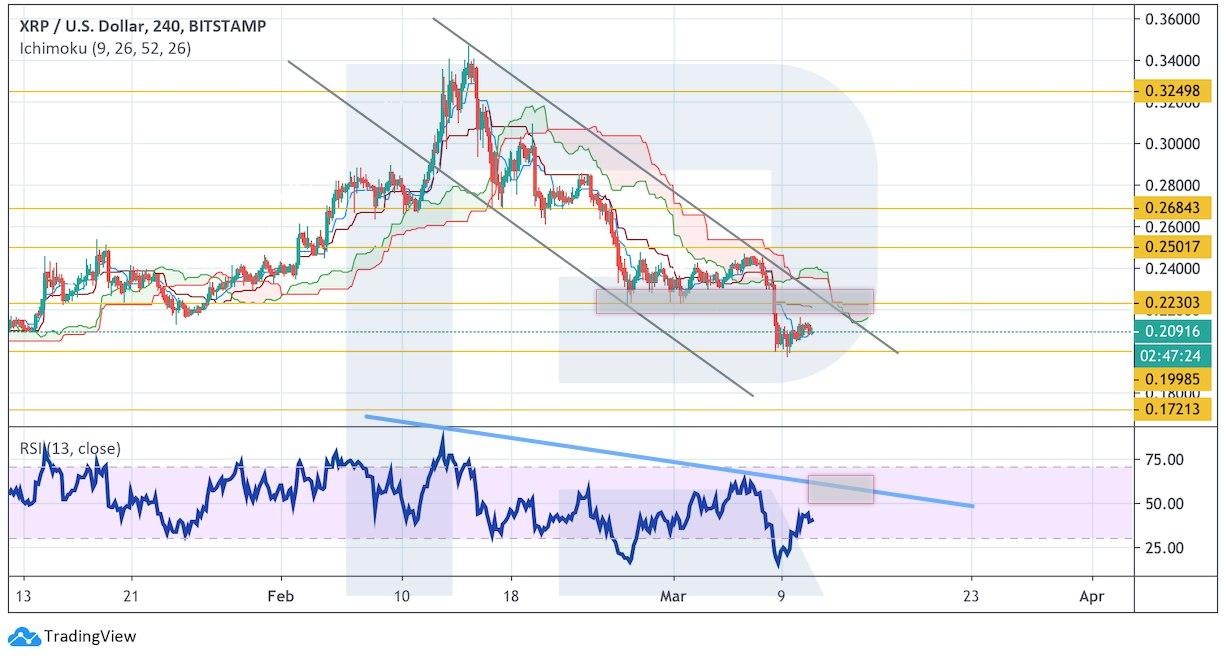

As we are able to see within the H4 chart, XRP can also be transferring under the cloud however bulls have been in a position to keep above the assist stage. The short-term buying and selling concept suggests anticipating a check of the descending channel’s upside border at $0.22 and additional decline with the goal at $0.17. One other sign to verify this situation is a rebound from the resistance line on the RSI. Nonetheless, this situation might not be legitimate if the instrument breaks the cloud’s upside border and fixes above $0.24. on this case, the asset might break the descending channel and proceed buying and selling upwards.

Picture: Roboforex / TradingView

Bitcoin Money

Bears proceed placing strain on the asset; they’ve damaged one other assist space and nearly reached the rising channel’s draw back border. The RSI additionally hasn’t reached the assist stage but, that’s why we might anticipate additional decline in the direction of $230, a rebound from this stage, and new progress. Nonetheless, this situation might not be legitimate if the worth breaks the channel’s draw back border and fixes under $160.

Picture: Roboforex / TradingView

Within the H4 chart, the worth can also be falling contained in the descending channel. The mid-term buying and selling concept suggests anticipating an ascending correction and a check of the resistance stage near $295. After that, the instrument might resume falling with the expected goal at $160. A check of the resistance on the RSI will verify this situation. Nonetheless, this situation shall be canceled if the worth skyrockets to interrupt the channel’s upside border and fixes above $325.

Picture: Roboforex / TradingView

Disclaimer: Any predictions contained herein are primarily based on the authors’ explicit opinion. This evaluation shall not be handled as buying and selling recommendation. RoboForex shall not be held responsible for the outcomes of the trades arising from relying upon buying and selling suggestions and evaluations contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European on-line international trade foreign exchange dealer.

[ad_2]

Source link