[ad_1]

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- ETH/USD tech evaluation

- Buterin: the Ethereum platform is powerful

- The ETH joined the Japanese crypto index

- The ETH might develop in worth on the coronavirus information however alas

On W1, the Ethereum worth doesn’t show any severe modifications in market moods but. The expansion that we are able to see doesn’t present any indicators of a reversal and thus is interpreted as a pullback earlier than one other decline. The closest essential purpose of the decline is the psychologically essential degree of $100.00, and after it’s damaged out, the market must go the fractal minimal of $80.86.

Additional descending is supported by the MACD and Stochastic values. The MACD strains have moved to the unfavourable space, whereas the Stochastic strains are aimed on the oversold space.

Photograph: Roboforex / TradingView

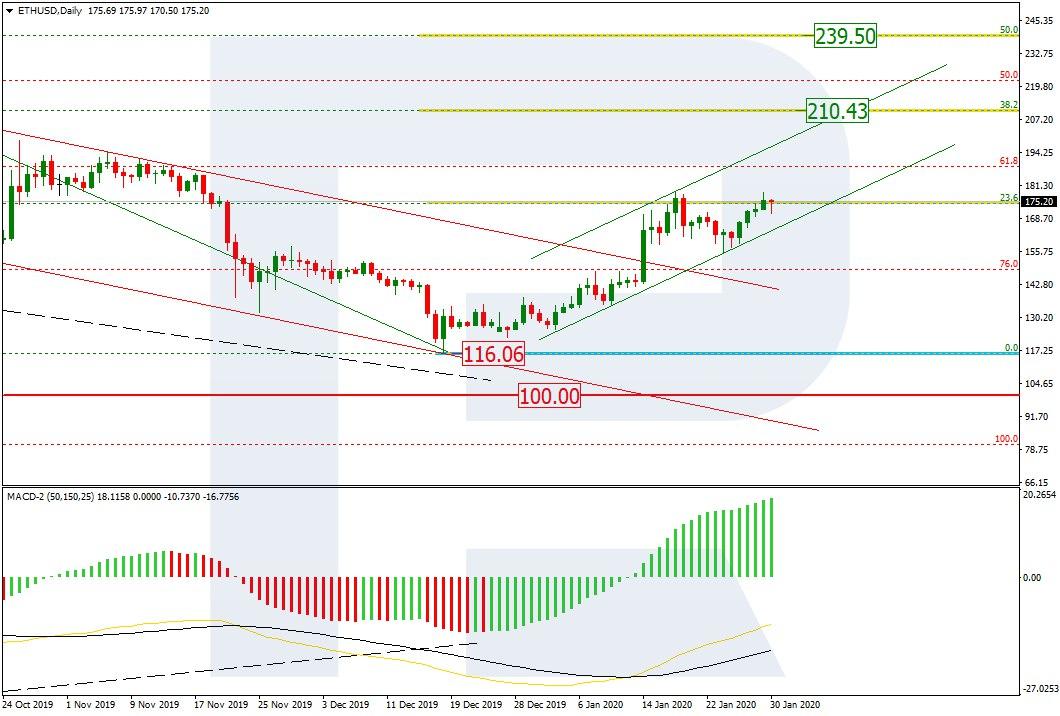

On D1, after a break of the downtrend and securing of the quotations above the earlier resistance line, a channel of development was fashioned. By now, the market has reached 23.6% Fibo, performing the correction state of affairs of the earlier downtrend. Additional goals of the expansion are at 38.2% ($210.43) and 50.0% ($239.50). The assist remains to be at $116.06.

Photograph: Roboforex / TradingView

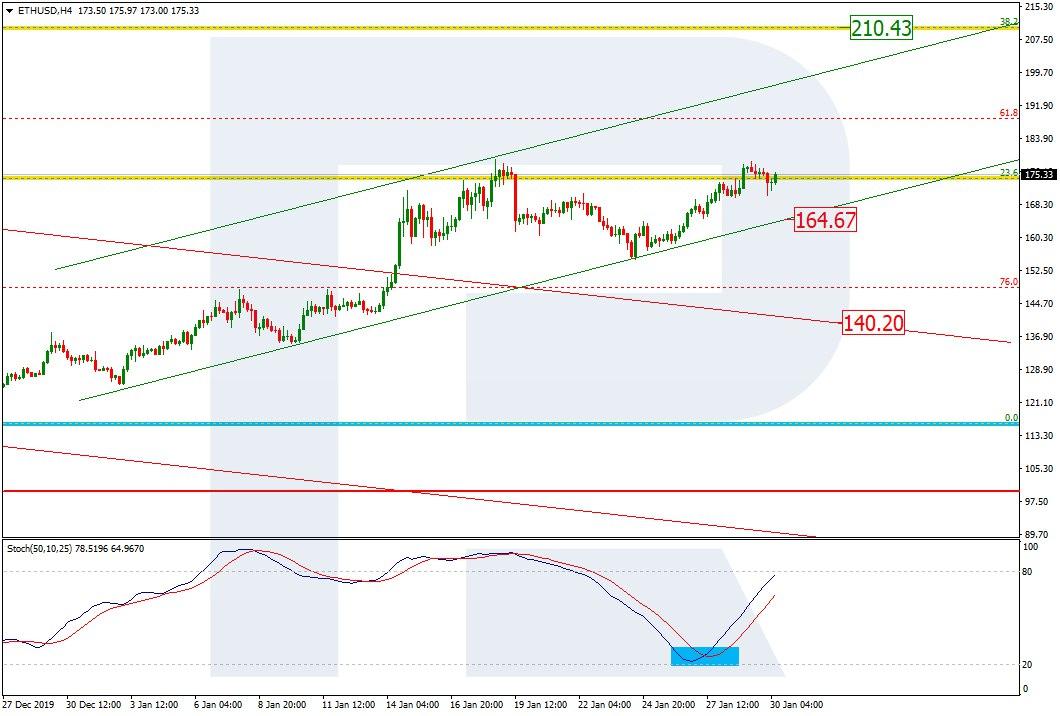

On H4, we may even see the event of an uptrend inside a steady channel. After a Gold Cross on the Stochastic, the quotations are creating an impulse of development to the native excessive and the extent of $210.43. The assist is at $164.67. A breakout of this degree shall be a begin for testing the resistance line, damaged earlier, and its fixing because the assist line round $140.20.

Photograph: Roboforex / TradingView

The Ethereum creator Vitalik Buterin considers his platform as robust as by no means earlier than. That is what he answered to a query on Twitter. Earlier, it was mentioned that the Ethereum is shedding its energy and sources, and the customers puzzled if the system will ever recuperate its earlier power.

This isn’t the primary time Buterin solutions nothing particular to constructive critics. Nevertheless, there may be nonetheless hope for switching to the two.Zero ecosystem, the place the Proof-of-Stake algorithm would be the base. This might breathe some contemporary air into the Ethereum and appeal to new customers to the platform.

Nomura Analysis Institute in partnership with Intelligence Unit fashioned a brand new product supplied by the greenback and yen. On the base of the index, there are 5 cryptocurrencies, together with the ETH. Based on the corporate’s message, the index offers traders information for orientating on the institutional degree. Later, it could assist the standing of cryptocurrencies.

It’s supposed that the index shall be rebalanced every month.

The crypto world reacts positively on what is going on in the actual cash sector when the traders began escaping dangers after the activization of the information concerning the coronavirus spreading from China. At this second, the BTC was on time to develop whereas for the ETH, the state of affairs was not excellent. Its fee might develop extra robustly if the token was extra well-liked available on the market.

Disclaimer: Any predictions contained herein are primarily based on the authors’ specific opinion. This evaluation shall not be handled as buying and selling recommendation. RoboForex shall not be held accountable for the outcomes of the trades arising from relying upon buying and selling suggestions and critiques contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European on-line international alternate foreign exchange dealer.

[ad_2]

Source link