[ad_1]

Though all altcoins are usually not but rallying in tandem, some prime crypto property have been outperforming as of late.

Working example: CoinMarketCap knowledge as of the time of this text’s writing, XRP — the third-largest cryptocurrency by market capitalization — is up 10% previously 24 hours, outpacing Bitcoin’s comparatively delicate 0.5% achieve.

This rally in a number of the main altcoins is unlikely to proceed, with crypto companies observing a transparent slowdown in on-chain exercise for cash like Cardano, Bitcoin Money, and Chainlink.

Sorry Bulls: Prime Crypto Belongings See On-Chain Exercise Gradual

Over the previous few weeks, altcoins throughout the board have seen spectacular rallies as Bitcoin has stagnated within the high-$6,000s and $7,000s.

Among the many altcoins which have outperformed embrace Cardano, Chainlink, and Tezos. Whereas Bitcoin tacked on 15%, the cryptocurrencies talked about, all multi-billion-dollar property, have skilled positive factors of 45% to 65%.

Many of those strikes had been predicated on basic developments pertaining to the initiatives, however on-chain and market knowledge exhibits that the possibility of a drop is rising.

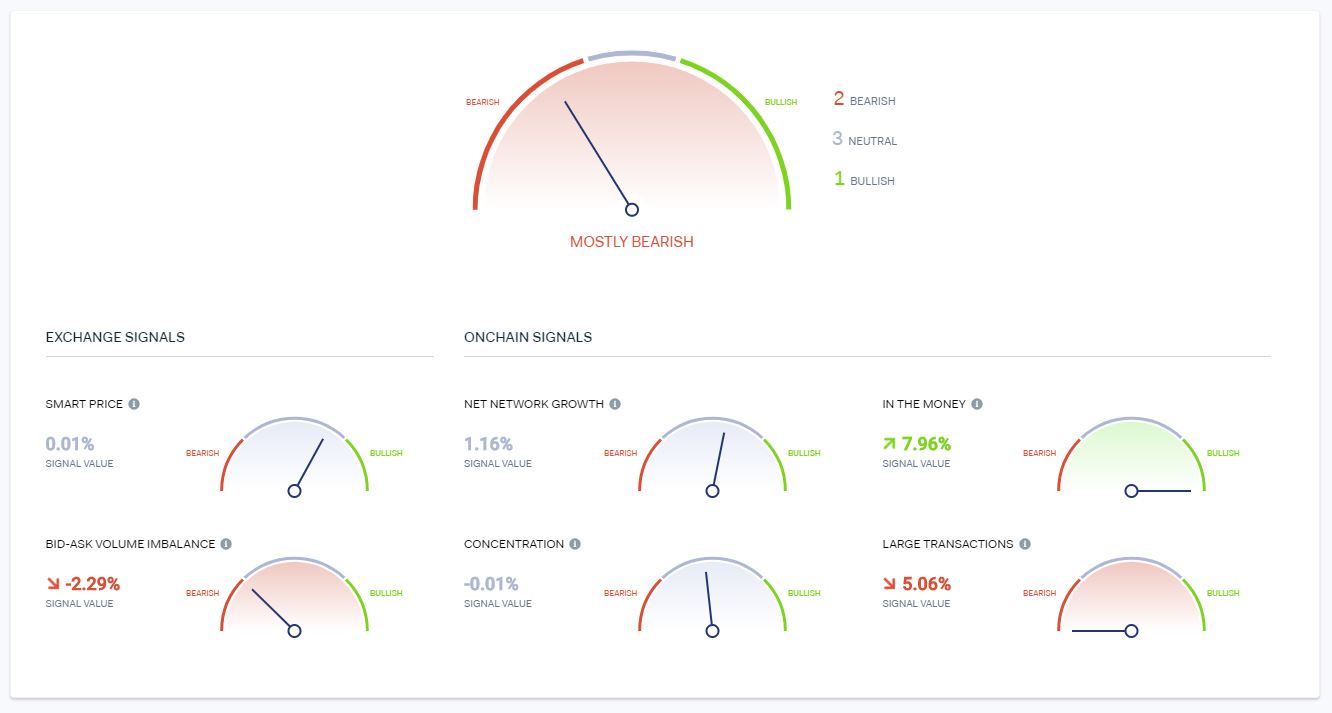

IntoTheBlock — a blockchain intelligence agency — discovered that a variety of its proprietary indicators are “principally bearish” for some main crypto property.

Under is the agency’s dashboard for Cardano as of April 28th.

It signifies that the “Giant Transactions” — which tracks multi-million-dollar transactions on the blockchain” — and “Bid-Ask Quantity Imbalance” — the skew of a market’s order books — counsel bearish worth motion is on the horizon, whereas a lot of the different indicators are principally trending impartial.

Knowledge from IntoTheBlock

Related tendencies have been noticed for Bitcoin Money and Chainlink, which each registered as “principally bearish” by IntoTheBlock.

All Altcoins May Drop, Analyst Fears

It’s vital to notice that the abovementioned indicators solely counsel {that a} short-term altcoin correction is imminent, however some worry that this underperformance may very well be a longer-term pattern for the crypto market as a complete.

An analyst at crypto analysis agency Blockfyre just lately remarked that he intends on lowering his publicity to altcoins as a result of he believes Bitcoin’s block reward discount will trigger volatility that ends in altcoins “getting rekt.”

The analyst continued that from how he sees it, altcoins are all the time a “recreation of musical chairs” as the explanations they’re rallying, Pentoshi defined, are all “purple flags,” not basic developments:

“The rationale the alt pumps are unconvincing is as a result of they’ve adopted the identical patterns. IEO’s, Interoperability, privateness cash transferring collectively. It’s coordinated because it has been the final three years as a substitute of all ships rising collectively.”

This skepticism has been echoed by others pointing to how the basic narratives within the crypto business are all targeted on Bitcoin — a bellwether for the remainder of the business, particularly in such unsure macroeconomic and geopolitical occasions.

Photograph by nikko macaspac on Unsplash

[ad_2]

Source link