[ad_1]

On-chain knowledge exhibits that cash from GBTC has been flowing into the newly launched spot Bitcoin ETFs amid very low price constructions.

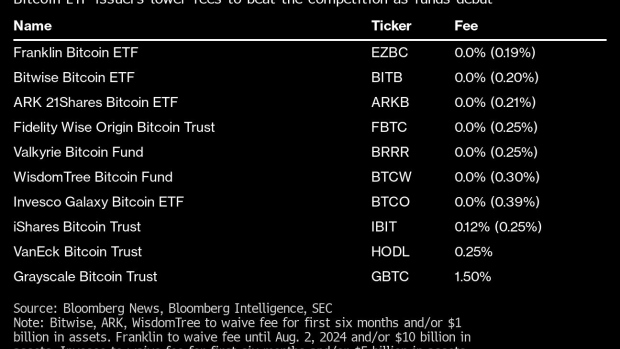

In an unique interview with Bloomberg Tv from Davos on Wednesday, January 17, Grayscale Investments Chief Govt Officer Michael Sonnenshein defended the 1.5% administration price charged for the Grayscale Bitcoin Belief (GBTC). This price is presently the very best amongst spot Bitcoin ETFs out there. Sonnenshein justified the price, citing the corporate’s important dimension, excessive liquidity, and confirmed observe file.

“As an investor, if you find yourself selecting amongst these merchandise, charges are a consideration, the asset supervisor, the issuer behind it are a consideration, however so must be dimension, liquidity and that observe file,” said Sonnenshein in the course of the interview.

The cryptocurrency market has not too long ago witnessed the launch of 9 rival exchange-traded funds, a few of that are attracting buyers with incentives resembling zero charges. Nonetheless, Grayscale’s Bitcoin Belief has skilled roughly $1.2 billion in outflows since its conversion to an ETF following regulatory approval final week, in accordance with knowledge compiled by Bloomberg Intelligence. In distinction, excluding Grayscale’s Bitcoin Belief, all different spot Bitcoin ETFs have recorded round $1.9 billion in web inflows.

VanEck’s not too long ago launched spot Bitcoin ETF boasts a administration price that stands because the second-highest among the many newest ETF choices. Nonetheless, it’s considerably cheaper compared to GBTC, with a price set at 0.25%. However, BlackRock’s iShares spot Bitcoin ETF, witnessing the very best inflows amongst all Bitcoin ETFs since its current market debut, options an preliminary price of 0.12%. This introductory price is prone to enhance to 0.25% after 12 months for accounts holding lower than $5 billion in property.

-

- Picture: Bloomberg

- GBTC Outflows Transferring Into Bitcoin ETFs

The Grayscale Bitcoin Belief (GBTC) has witnessed notable outflows within the wake of the current launch of spot Bitcoin ETFs. These ETFs current a extra regulated and safe technique of holding Bitcoins. Market analysts counsel that almost all of the outflows from GBTC have resulted in substantial inflows into the ETFs.

Bloomberg strategist James Seyffart has noticed a major switch of funds from Grayscale Bitcoin Belief ($GBTC) to rival ETFs, underscoring the potential significance of this development. Seyffart estimates a considerable outflow of round $594 million from $GBTC, totaling $1.173 billion in outflows.

Assuming the information is right it backs up one thing i wrote about yesterday. A variety of these $GBTC outflows are probably discovering a house in competing ETFs https://t.co/Bj8HZAOkXa pic.twitter.com/qcVBnbdnX5

— James Seyffart (@JSeyff) January 17, 2024

In the future after the approval of spot Bitcoin ETFs by the US Securities and Trade Fee, Grayscale Investments filed for a coated name ETF. In line with the N-1A kind submitted final Thursday, the corporate goals to supply present revenue and allow participation within the worth return of Grayscale Bitcoin Belief.

The submission of the coated name signifies a possible lower in volatility throughout the crypto markets sooner or later. Nonetheless, Sonnenshein clarified that the first driving pressure behind the coated name submitting was investor curiosity, not volatility. Sonnenshein stated:

“Having the ability to supply a coated name technique permits buyers to have passive lengthy GBTC publicity but in addition earn some extra revenue. I don’t assume it’s for us a lot a measure of volatility however as a substitute that we’ve heard from buyers that they wish to be passively lengthy of that asset class.”

Learn different market information on Coinspeaker.

subsequent

[ad_2]

Source link