[ad_1]

OKEx surpassed BitMEX within the Bitcoin futures quantity whereas exchanges face challenges in coping with excessive market.

The cryptocurrency market fell prey to the worldwide instability, which contributes to the catastrophic falling of Bitcoin, the most important cryptocurrency, from $9K degree to $3k degree. Ranging from 7 March, the asset confirmed strain on the resistance degree, and continued the downwards trending till at the moment, with out indicating any robust bounce again alerts but.

OKEx Dominates the Bitcoin Futures Market

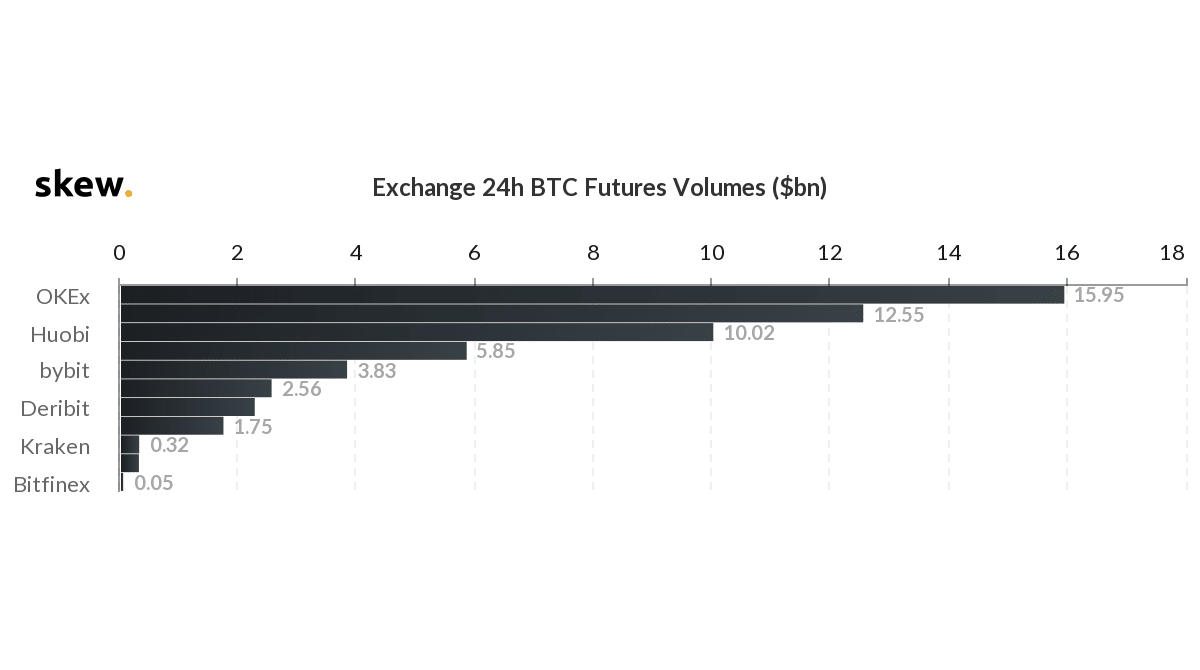

Regardless of the spot market is slowing down, Bitcoin’s derivatives market has been getting extra consideration, and the passion is sort of seen within the Bitcoin futures market. Concerning the Bitcoin futures, BitMEX has been lengthy dominated out there, however now OKEx, one other cryptocurrency big, continues to carefully observe BitMEx’s footprints and made a breakthrough within the Bitcoin futures buying and selling quantity. In keeping with SkewAnalystics, OKEx outperformed BitMEX when it comes to the 24h BTC Futures volumes, main the Futures quantity by reporting 15.95 billion, adopted by BitMEX at 12.55 billion. Not solely retail traders, however the circulate of institutional capital can also be large out there, which requires the crypto asset exchanges to have an expert and strong degree of infrastructure to assist the buying and selling calls for of the establishments, particularly through the excessive market.

Picture: Skew

Exchanges Face Challenges within the Excessive Market

Just lately, Bitcoin value skilled a big plunge, and the market is beneath dramatic volatility. BitMEX introduced on their Twitter to return throughout a system breakdown for a brief interval due to the {hardware} situation on their cloud service, leading to a pause in buying and selling on the platform.

Between 02:16 and 02:40 UTC 13 March 2020 we grew to become conscious of a {hardware} situation with our cloud service supplier inflicting BitMEX requests to be delayed. Regular service resumed at 03:00 UTC. As a reminder, newest system updates could be discovered on our standing web page https://t.co/fVa1FAqSEW

— BitMEX (@BitMEXdotcom) March 13, 2020

As a result of this instability, some customers even complained by no means to commerce once more on BitMEX as a result of the platform’s market makers are buying and selling with the customers through the breakdown.

I’ll by no means commerce on Bitmex once more. Unstable, “system overload”, whereas its personal market makers are buying and selling towards the customers.

Additionally, I obtained massively rekt throughout this crash lol. pic.twitter.com/glvSLn8Mqb

— ☣️ WALL/FACER 🔑 (@Stock_to_Flow) March 13, 2020

Related points occurred on Binance, one of many world’s largest cryptocurrency buying and selling platforms, and CZ, the CEO of Binance, additionally introduced on Twitter relating to the newest upkeep each on their spot & futures buying and selling system.

Massacre day.

🔶spot depth push skilled some delays, mounted

🔶futures UI 500 errors for a couple of minutes, mounted

🔶some futures ADL and margin calls, no cyclic crashes.Total 5x system load than all earlier peaks. Holding up thus far, monitoring all methods.

— CZ Binance 🔶🔶🔶 (@cz_binance) March 12, 2020

It’s notable that CZ talked about the futures ADL (auto-deleveraging) which is a technique of counterparty liquidation when the insurance coverage fund stops working, that means the worthwhile customers must share a part of the income with the dropping customers. As Binance talked about, they’ve used half of their insurance coverage funds to cut back ADL, and they’ll inject new funds whether it is used up.

The #Binance Futures Insurance coverage Fund has used over $6,000,000+ up to now 24 hours lowering ADL’s.

Within the occasion that the insurance coverage fund continues to deplete, we’ll inject new funds and proceed defending our customers.

Signal as much as #BinanceFutures right here:

➡️ https://t.co/jkiHuCnnVe pic.twitter.com/ISzDtahFGx— Binance (@binance) March 13, 2020

Nevertheless, Jay Hao, CEO of OKEx, one other crypto change big, holds completely different opinions by highlighting “Previously 24 hours, OKEx has achieved: 0% clawback in all markets and all pairs, and 0% ADL in revenue trades.” From the information proven on OKEx web site, it appears the insurance coverage fund circulate on the platform is extra steady than Binance, implying OKEx hasn’t contributed the insurance coverage fund to offset the losses. To elucidate, Hao talked about it’s equally essential to guard customers’ funds and their income.

One other matter I wanna spotlight right here: platform danger administration. Previously 24 hours #OKEx have achieved:

– 0% clawback in all markets and all pairs

– 0% ADL in revenue tradesWe shield customers funds and their income, equally essential. pic.twitter.com/kxwWNe3fGl

— Jay Hao (@JayHao8) March 13, 2020

However, the CEO additionally mentioned OKEx’s buying and selling service is sort of steady with none upkeep through the excessive market besides the APP didn’t work for some time, and processed virtually 300ok orders/second. What’s extra, Hao highlighted their API labored correctly, and it ought to be nice information to the institutional merchants.

Having obtained a diploma in Intercultural Communication, Julia continued her research taking a Grasp’s diploma in Economics and Administration. Turning into captured by modern applied sciences, Julia turned obsessed with exploring rising techs believing of their means to rework all spheres of our life.

[ad_2]

Supply hyperlink