[ad_1]

The on-chain analytics agency Santiment has revealed that the altcoins have been displaying a latest divergence in community development.

Altcoins Are Observing Polarization When It Comes To Community Development

In a brand new post on X, Santiment has defined how the altcoins have been separating from one another following the massive Bitcoin spot ETF information final week. The indicator of curiosity right here is the “community development,” which retains monitor of the variety of new addresses becoming a member of any cryptocurrency’s community.

The brand new addresses are outlined as these coming on-line on the blockchain for the primary time (that’s, they’re making their very first transaction). New addresses would possibly pop up on any community for a lot of causes.

Some cryptocurrency customers prefer to make a brand new deal with each time they wish to take part in contemporary trades to take care of their privateness. Such customers would naturally contribute to development on this metric.

This new deal with kind wouldn’t be related for the extra complete community. One thing that may be very related (and is usually, in truth, the principle driver of community development), alternatively, is adoption.

New customers becoming a member of the blockchain would create their contemporary addresses, thus rising the community development indicator. Adoption is normally a optimistic growth for any asset, because it gives a extra strong basis for sustainable strikes to happen sooner or later.

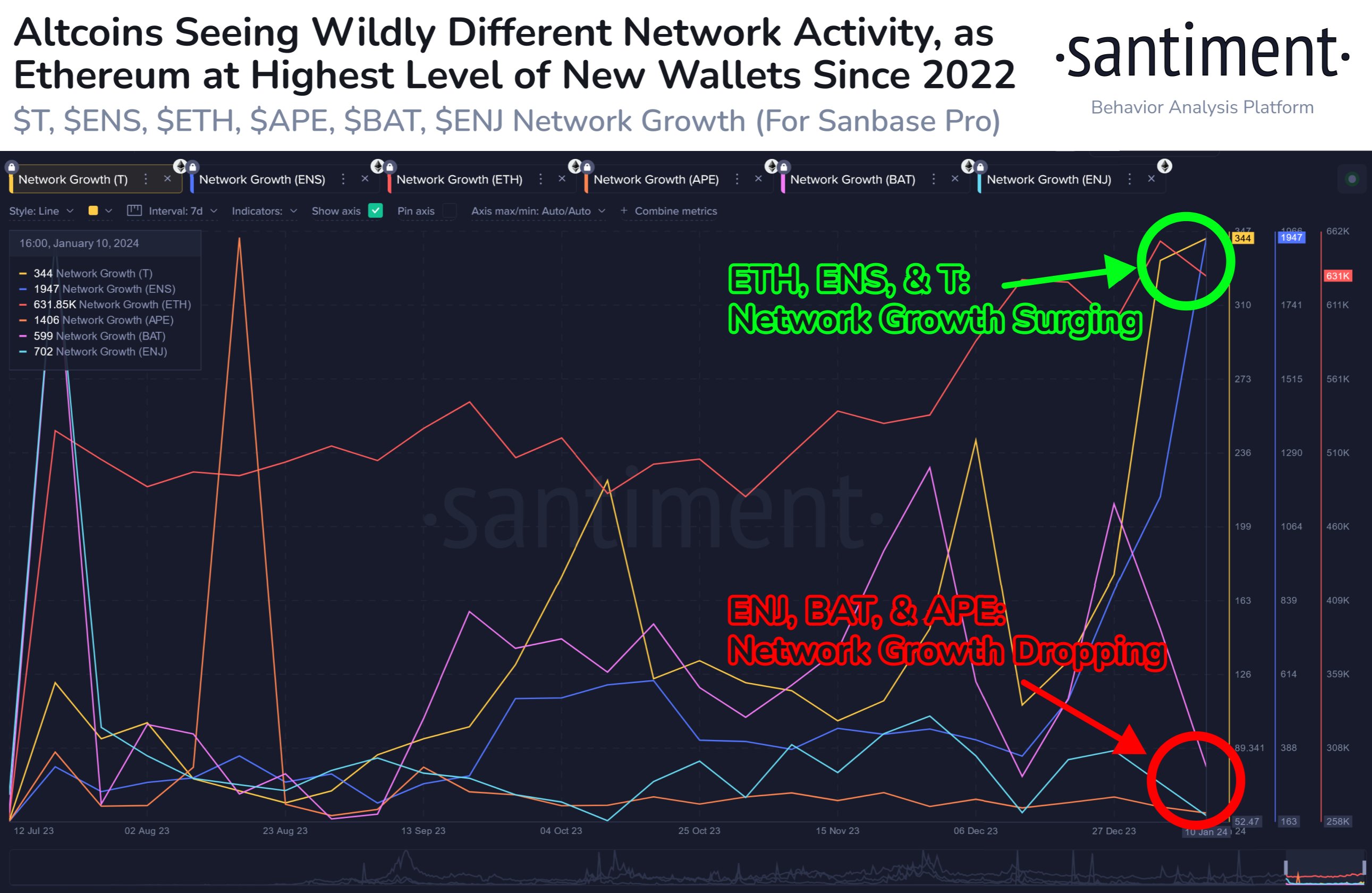

Now, right here is the chart shared by Santiment that exhibits the development within the community development for six totally different altcoins, showcasing the 2 totally different sides the alts have separated into just lately:

Appears like half of those cash have seen the metric shoot up, whereas the opposite half have noticed a decline | Supply: Santiment on X

As displayed within the above graph, Ethereum (ETH), Ethereum Title Service (ENS), and Threshold (T) have loved a surge of their respective community growths just lately.

The latter two property have seen the metric enhance by about 124% and 195%, respectively, that are a lot bigger than ETH’s rise of simply 6%. Nevertheless, this disparity is barely restricted to the indicator’s development, not its pure worth.

ENS and T are a lot smaller altcoins than ETH, the second largest cryptocurrency by market cap, in order that they observe fewer new addresses in absolute phrases.

To place issues into perspective, Ethereum is at the moment observing over 631,850 new addresses developing on the community, whereas the metric’s worth for the 2 smaller alts is simply 1,947 and 344, respectively.

On the opposite aspect of the spectrum are ApeCoin (APE), Fundamental Consideration Token (BAT), and Enjin Coin (ENJ), which have seen their community growths decline by 23%, 42%, and 32%, respectively.

Based on Santiment, altcoins have turn into polarized like this throughout the sector. This divergence has been forming for a while however has solely deepened following the Bitcoin spot ETF approvals.

The Alts observing extra adoption would naturally be higher set for long-term development than the opposite aspect, though whether or not they would stay as much as this potential stays to be seen.

ETH Worth

Whereas Bitcoin has struggled just lately, Ethereum has managed to shine a bit as its worth has been capable of break above the $2,500 degree.

ETH has gone by means of some rise within the final ten days or so | Supply: ETHUSD on TradingView

Featured picture from Traxer on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link