[ad_1]

Ethereum creator Vitalik Buterin shared his ideas relating to Bitcoin value mocements. He claims the Inventory to Circulate mannequin doesn’t work for Bitcoin or some other crypto asset.

Vitalik Buterin says that you simply shouldn’t make monetary choices solely after studying the information. The basic Inventory to Circulate (S2F) mannequin shouldn’t be working with Bitcoin. Main information bulletins, in addition to world disasters akin to coronavirus, don’t have an effect on the crypto market. Buterin says that there are 95% of the articles on the Internet claiming the improper issues:

Nah that stuff is a part of the 95%

— vitalik.eth (@VitalikButerin) February 27, 2020

He admits that it’s unhealthy that journalists, market whales, and crypto merchants are hoping to become profitable on coronavirus fears. As a substitute, they might cooperate to assist contaminated international locations and communities.

Since Monday, Worst Buying and selling Classes Started

Vitalik Buterin’s Bitcoin value opinion goes in opposition to the general constructive notions within the information. He stays impartial to the worth predictions as if he’s a Buddhist, admits he doesn’t know the long run. He says that a lot of the value prediction fashions he has seen available in the market removed from being correct. Curiously, a number of the crypto investigators from Telegram even declare that value prediction fashions, indicators, stats, and so on. are about nothing. In response to these theorists, crypto costs transfer because of influencers and secretive offers.

Vitalik didn’t say what market fashions he used to foretell the costs of cryptocurrencies. Nonetheless, he notes two articles by Billy Bambrough and Jeff Benson claiming the other issues about Bitcoin and coronavirus.

Inventory to Circulate Mannequin Is ‘Bullshit’, In response to Vitalik Buterin

Traditionally, the sort of value forecast was working properly. Now, it says that Bitcoin’s common value must be $8,600.

Buterin sees issues in different mild:

https://twitter.com/VitalikButerin/standing/1232870793534562304

Such a mannequin is utilizing many measures to foretell Bitcoin’s value and to search out its shortage indicator. Nonetheless, makes folks make controversial claims. The mannequin relies on the works by laptop scientist Nick Szabo, who was thought-about Satoshi Nakamoto in previous, and cryptocurrency investigator and writer Saifedean Ammous. This was described in particulars in an article by Hint Meyer from 2015:

“S2F is a measure of shortage. The facility-law relation between S2F and bitcoin value over time captures the underlying regularity of bitcoin’s complicated dynamic system of community results.”

Shares to Circulate Appears Like a On line casino, Not Math

This time the mannequin shouldn’t be as correct because it appeared, as a result of the costs of cryptocurrencies falling, not rising, throughout coronavirus outbreak. Greater than that, the Dow index, S&P 500 and the main shares fall similar to cryptos. Trump’s current declare that the coronavirus treatment is ‘very shut’, provides pessimism. As a result of when White Home spokesman Judd Deere claimed three days in the past that Donald Trump was referring to the Ebola treatment, not the coronavirus one, the markets went in a good deeper panic.

By the way in which, by making such estimates we fall into seduction of utilizing Inventory to Circulate to research value.

Different Specialists Share Buterin’s Ideas on S2F Bitcoin Value Predictions

Analyst Alex Kruger says that the Inventory to Circulate mannequin is similar nonsense just like the ‘Tether Manipulation’ paper. He claims that such investigations are based mostly on an unclear set of shady economical metrics and phrases. The market depends on a lot simpler, however hidden elements. Such ones periodically convey the ice castles of crypto merchants to a grand meltdown.

Charlie Morris from Byte Tree notes that PlanB’s concept of value dependence on mass adoption and community exercise is superb. Nevertheless it has a significant flaw: it doesn’t analysis the demand, solely the provision of the Bitcoin market.

That is certainly unusual that some specialists rush into predictions whereas they don’t have all of the details about how the crypto market works. Many journalists already uncovered secret trails, offers and cash move within the business. Some observers even declare cryptocurrencies solely entice criminals, because of excessive anonymity.

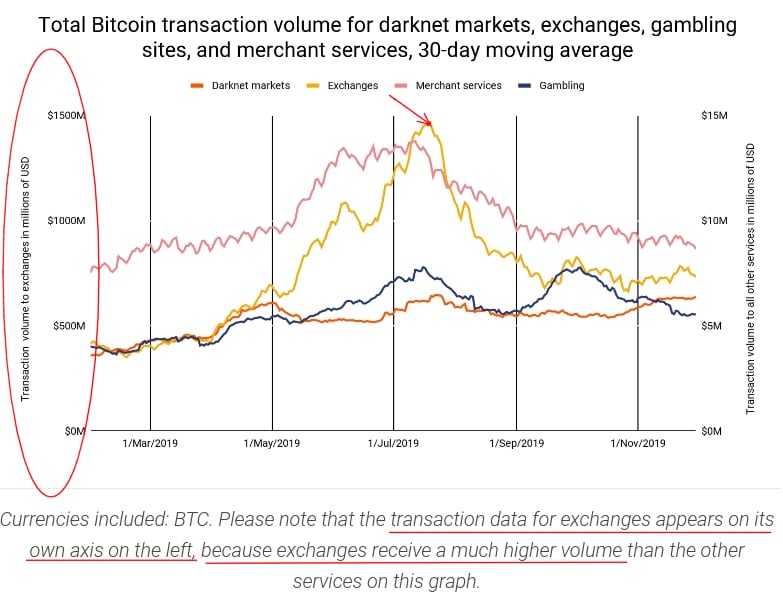

Once more, such a declare goes in opposition to dry statistics. In response to the report by Chainalysis launched in January 2020, exchanges, service provider providers, and playing web sites make many extra BTC transactions than darknet market customers.

Picture: Chainalysis

In the long run, Buterin might look like the prophet. As a result of Inventory to Circulate additionally predicts that the worth of Bitcoin should skyrocket to $100,000, in 1 to three years after the following Bitcoin Halving. The halving will happen within the first weeks of Might 2020. This estimate appears very unrealistic, however in case you really feel in any other case, please share your ideas within the feedback.

Jeff Fawkes is a seasoned funding skilled and a crypto analyst masking the blockchain house. He has a twin diploma in Enterprise Administration and Artistic Writing and is passionate in terms of how know-how impacts our society.

[ad_2]

Supply hyperlink