[ad_1]

Although cryptocurrency exchanges are sometimes thought-about to be a handy option to handle cryptocurrencies, this comfort normally comes at the price of privateness.

Cryptocurrency trade wallets are presently one of the well-liked methods to retailer Bitcoin and different cryptocurrencies. However there are critical drawbacks to utilizing them that usually go missed.

If privateness, safety, and self-sovereignty of your funds are vital to you, you would possibly need to rethink maintaining your Bitcoin in an trade pockets.

Not Your Keys, Not Your Crypto

Though it isn’t instantly obvious in lots of circumstances, making a cryptocurrency pockets additionally entails the creation of personal keys. These are primarily the keys that show possession over cryptocurrency funds, and permit them to be spent, staked, and in any other case used.

Nonetheless, the overwhelming majority of cryptocurrency exchanges don’t enable their customers to entry their non-public keys. It’s because exchanges truly generate addresses from a grasp seed, and allocate these addresses to its customers, utilizing an index system to maintain observe of how a lot was despatched to and from every handle to permit it to steadiness trades internally.

The annual Proof of Keys motion sees trade customers withdraw their Bitcoin funds to user-controlled wallets to make sure exchanges will not be working a fractional reserve. Photograph: Proof of Keys

Due to this, cryptocurrency trade customers are primarily topic to the quirks and whims of the trade and its house owners. If the trade goes offline for upkeep, the person can’t entry their funds. If the trade is hacked, the person can’t forcibly withdraw their funds. If the trade is in any other case rendered unavailable, the person’s funds additionally can’t be accessed.

This example was demonstrated by the current QuadrigaCX debacle, which noticed hundreds of customers lose their funds as a result of the trade CEO died all of a sudden – and he was the one individual with entry to the trade pockets non-public keys.

By withdrawing your funds out of your trade pockets to a cellular or desktop pockets that gives non-public key entry, you possibly can be certain that your cryptocurrencies stay accessible always.

Alternate Hacks are Frequent

Cryptocurrency trade hacks have risen as much as change into a recurring theme within the cryptocurrency business, as even a number of the largest and hottest exchanges have struggled to maintain their coffers secure from hackers.

In keeping with a current report by the CipherTrace, round $4.Four billion was stolen by means of fraud or hacks within the first three quarters of 2019. That is the equal of round 2% of all cryptocurrency being stolen all through 2019 – the majority of which was stolen from breached cryptocurrency trade accounts and direct assaults on trade sizzling wallets.

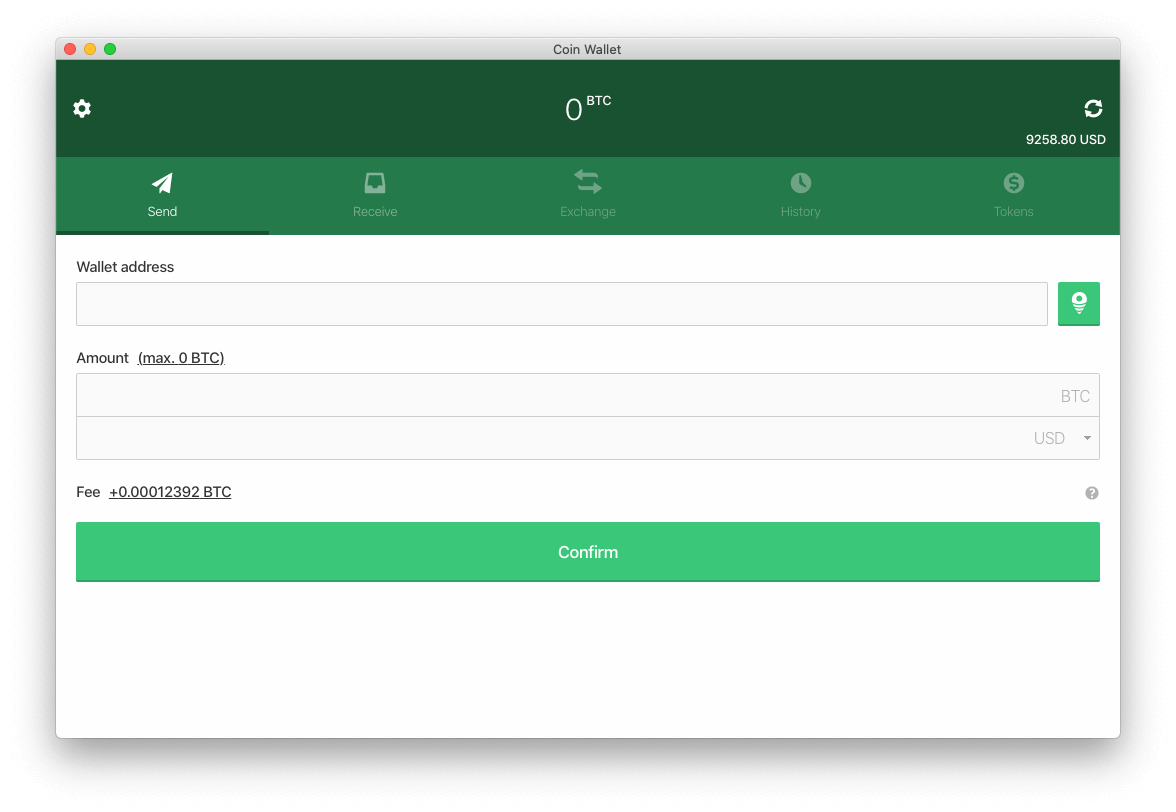

Coin.Area and several other different Bitcoin wallets assist you to simply derive your whole non-public keys out of your restoration phrase. Photograph: Coin.Area

This problem was confronted by a number of main cryptocurrency trade platforms in recent times. Binance, presently the most important cryptocurrency spot trade by buying and selling quantity, was hacked for over $40 million in Bitcoin in Might 2019. Likewise, CoinBene was hacked for $100 million in March 2019, whereas Bithumb was hacked for $31.5 million in June 2018 and $13 million in April 2019.

These centralized pockets suppliers make prime targets for hackers since they often maintain a considerable amount of cryptocurrency in a single pockets, and endure from lower than stellar safety. Since most cryptocurrency exchanges will not be insured in opposition to such assaults, affected clients can endure doubtlessly whole losses.

Take Again Your Privateness

Although cryptocurrency exchanges are sometimes thought-about to be a handy option to handle cryptocurrencies, this comfort normally comes at the price of privateness.

Not solely do the big majority of cryptocurrency trade implement stringent KYC necessities on their customers, doubtlessly requiring identification and handle verification to unlock sure options, however in addition they sacrifice a number of vital privateness options which can be out there in most cellular wallets.

Considered one of these is the flexibility to generate new addresses for every transaction. Widespread cellular wallets like Coin.Area and Electrum will mechanically generate a brand new handle each time a cost is obtained. This prevents a privateness problem generally known as handle reuse, whereby outdoors observers are capable of collect an rising quantity of knowledge on a person the extra occasions they reuse the identical handle.

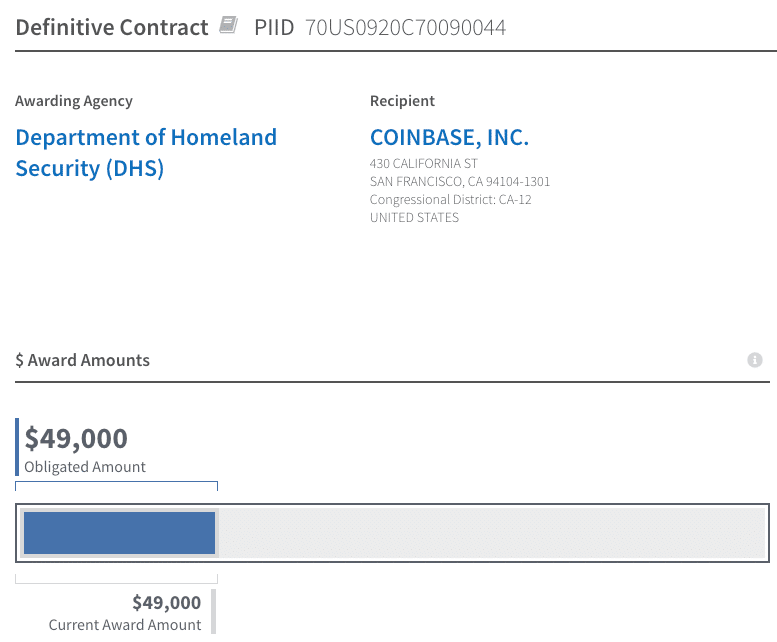

Photograph: USAspending.gov

Some trade platforms may also be actively working in opposition to the privateness beliefs most cryptocurrency customers search by sharing inner insights and blockchain analytics with exterior companies. This consists of Coinbase, a well-liked trade platform, and fiat on-ramp that not too long ago licensed its Coinbase Analytics software to the Division of Homeland safety’s Secret Service.

Fortuitously, taking again management of your Bitcoin privateness is so simple as switching to a pockets that mechanically prevents handle reuse and doesn’t embody third celebration monitoring – re-establishing the privateness, safety and self-sovereignty that centralized exchanges are likely to destroy.

[ad_2]

Source link